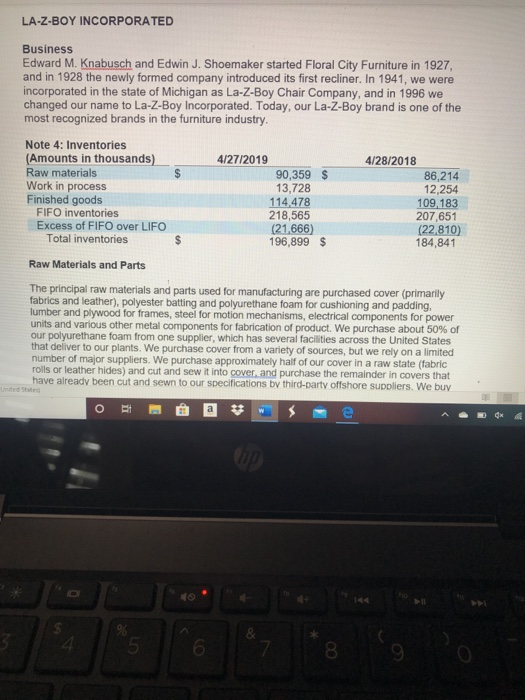

LA-Z-BOY INCORPORATED Business Edward M. Knabusch and Edwin J. Shoemaker started Floral City Furniture in 1927, and in 1928 the newly formed company introduced its first recliner. In 1941, we were incorporated in the state of Michigan as La-z-Boy Chair Company, and in 1996 we changed our name to La-z-Boy Incorporated. Today, our La-z-Boy brand is one of the most recognized brands in the furniture industry. Note 4: Inventories (Amounts in thousands) 4/27/2019 4/28/2018 Raw materials $ 90,359 $ 86,214 Work in process 13,728 12,254 Finished goods 114.478 109,183 FIFO inventories 218,565 207,651 Excess of FIFO over LIFO (21,666) (22,810) Total inventories 196,899 $ 184,841 Raw Materials and Parts The principal raw materials and parts used for manufacturing are purchased cover (primarily fabrics and leather), polyester batting and polyurethane foam for cushioning and padding, lumber and plywood for frames, steel for motion mechanisms, electrical components for power units and various other metal components for fabrication of product. We purchase about 50% of our polyurethane foam from one supplier, which has several facilities across the United States that deliver to our plants. We purchase cover from a variety of sources, but we rely on a limited number of major suppliers. We purchase approximately half of our cover in a raw state (fabric rolls or leather hides) and cut and sew it into cover and purchase the remainder in covers that have already been cut and sewn to our specifications by third-party offshore suppliers. We buy 5. 8 ACC122*N3 - Last Modified: 8m ago Design References Review View Layout Mailings Help Search rolls or leather hides) and cut and sew it into cover, and purchase the remainder in covers that have already been cut and sewn to our specifications by third-party offshore suppliers. We buy cut-and-sewn leather and fabric products from five primary suppliers. Of the products that we import, three suppliers that operate in China manufacture over 95% of the leather cut-and-sewn sets, and three suppliers that also operate in China manufacture approximately 90% of the fabric products. One of the five primary suppliers manufactures both leather cut-and-sewn sets and fabric products. We use these suppliers primarily for their product design capabilities, to leverage our buying power, and to control quality and product flow, in addition to their ability to handle the volume of product we require to operate our business. If any of these suppliers experience financial or other difficulties, we could experience temporary disruptions in our manufacturing process until we obtain alternate suppliers. Finished Goods Imports We import all of the casegoods (wood) furniture that we sell. In fiscal 2019, we purchased approximately 55% of this imported product from three suppliers. We use these suppliers primarily to leverage our buying power, to control quality and product flow, and because their capabilities align with our product design needs. In addition, these suppliers have the ability to handle the volume of product we require. If any of these suppliers experience financial or other difficulties, we could experience disruptions in our product flow until we obtain alternate suppliers, which could be lengthy due to the longer lead time required for sourced wood furniture from Asian manufacturers. United States O RI a # E ACC122 N3 - Last Modified: 8m ago Design Layout References Mailings Review View Help Search We use an all-import model for our casegoods furniture primarily to remain competitive for these products. The prices we paid for these imported products, including associated transportation costs, increased in fiscal 2019 compared with fiscal 2018, partially due to an increase in tariffs on certain product imported from China. We import approximately 25% of our casegoods product from China, and currently expect these product costs to increase more in fiscal 2020 than fiscal 2019 if the recent tariff increase to 25% remains in effect throughout fiscal 2020. We are actively working on moving sourcing of products out of China to reduce the tariff impact. Additionally, we are expecting higher ocean freight costs in fiscal 2020 compared with fiscal 2019. We may increase our selling prices to help offset the expected rise in transportation costs and may assess a material or duty surcharge on products imported from China when these increased prices or duties are in effect. Looking across our business, imported finished goods represented 8% of our consolidated sales in both fiscal 2019 and fiscal 2018. Inventory: For our Upholstery segment, we maintain raw materials and work-in-process inventory at our manufacturing locations. Finished goods inventory is maintained at our six regional distribution centers as well as our manufacturing locations. Our regional distribution centers allow us to streamline the warehousing and distribution processes for our La-z-Boy Furniture Galleries store network, including both company-owned stores and independently- owned stores. Our regional distribution centers also allow us to reduce the number of individual warehouses needed to supply our retail outlets and help us reduce inventory levels at our manufacturing and retail locations, For our Casegoods segment, we import wood furniture from Asian vendors, resulting in long lead times on these products. To address these long lead times and meet our customers' delivery requirements, we maintain higher levels of finished goods inventory in our domestic warehouses, as a percentage of sales, of our casegoods products than our upholstery products. Our company-owned La-z-Boy Furniture Galleries stores have finished goods inventory at the stores for display purposes. glish (United States) o a e View Design Layout References Mailings Review Help Search warenouses needed to supply our retail outlets and neip us reduce inventory levels at our manufacturing and retail locations. For our Casegoods segment, we import wood furniture from Asian vendors, resulting in long lead times on these products. To address these long lead times and meet our customers' delivery requirements, we maintain higher levels of finished goods inventory in our domestic warehouses, as a percentage of sales, of our casegoods products than our upholstery products. Our company-owned La-z-Boy Furniture Galleries stores have finished goods inventory at the stores for display purposes. Our Joybird business maintains raw materials, work-in-process, and finished goods inventory at their manufacturing location. Additional finished goods inventory for Joybird is stored in a warehouse or in-transit to the end consumer. Our inventory increased $12.1 million during fiscal 2019 compared with fiscal 2018 primarily as a result of the acquisitions we completed in fiscal 2019. We will continue to manage our inventory levels to ensure they are appropriate relative to our sales volume, while maintaining our focus on service to our customers. Use the attached information for La-Z-Boy and what we have learned in Chapters 2 and 3 to answer the following 5 questions worth 3 points each. 1. Indicate three materials that are included in La-Z-Boy's Raw Materials inventory A. steel for motion mechanisms B. polyester batting and polyurethane foam for cushioning and padding C. lumber and plywood for frames 2. La-z-Boy is a Michigan manufacturing company. Looking at the description of raw materials, what percentage of leather cut and sew products and then fabric products are produced in China? Leather cut and sew products: 95% Fabric products: 90% 3. There is no description of Work-in-Process inventory for La-z-Boy in the footnote, but we know the three costs that are included in work in process from our text. List them here: A. They import approximately 25% of our case goods product from China, and currently expect these product costs to increase more in fiscal 2020 B. They are actively working on moving sourcing of products out of China to reduce the tariff impact C. they are expecting higher ocean freight costs in fiscal 2020. 08 English (Unitectes to search o a e 4. La-Z-Boy has two classes of product in Finished Goods Inventory-Casegoods and Upholstery products. Which of these two classes comprise the majority of La-z-Boy finished goods inventory? Casegoods products comprise the majority of La-Z-Boy finished goods inventory. 5. Given the amounts for the three inventories accounts, do you think La-Z-Boy has a quick manufacturing process (short through-put time) or a long manufacturing process (long through-put time) in the U.S.? Explain why. I think La-Z-Boy has a quick manufacturing process in the U.S, because they use an all-import model for their casegoods furniture primarily to remain competitive for these products and their inventory increased $12.1 million during fiscal 2019 compared with fiscal 2018. LA-Z-BOY INCORPORATED Business Edward M. Knabusch and Edwin J. Shoemaker started Floral City Furniture in 1927, and in 1928 the newly formed company introduced its first recliner. In 1941, we were incorporated in the state of Michigan as La-z-Boy Chair Company, and in 1996 we changed our name to La-z-Boy Incorporated. Today, our La-z-Boy brand is one of the most recognized brands in the furniture industry. Note 4: Inventories (Amounts in thousands) 4/27/2019 4/28/2018 Raw materials $ 90,359 $ 86,214 Work in process 13,728 12,254 Finished goods 114.478 109,183 FIFO inventories 218,565 207,651 Excess of FIFO over LIFO (21,666) (22,810) Total inventories 196,899 $ 184,841 Raw Materials and Parts The principal raw materials and parts used for manufacturing are purchased cover (primarily fabrics and leather), polyester batting and polyurethane foam for cushioning and padding, lumber and plywood for frames, steel for motion mechanisms, electrical components for power units and various other metal components for fabrication of product. We purchase about 50% of our polyurethane foam from one supplier, which has several facilities across the United States that deliver to our plants. We purchase cover from a variety of sources, but we rely on a limited number of major suppliers. We purchase approximately half of our cover in a raw state (fabric rolls or leather hides) and cut and sew it into cover and purchase the remainder in covers that have already been cut and sewn to our specifications by third-party offshore suppliers. We buy 5. 8 ACC122*N3 - Last Modified: 8m ago Design References Review View Layout Mailings Help Search rolls or leather hides) and cut and sew it into cover, and purchase the remainder in covers that have already been cut and sewn to our specifications by third-party offshore suppliers. We buy cut-and-sewn leather and fabric products from five primary suppliers. Of the products that we import, three suppliers that operate in China manufacture over 95% of the leather cut-and-sewn sets, and three suppliers that also operate in China manufacture approximately 90% of the fabric products. One of the five primary suppliers manufactures both leather cut-and-sewn sets and fabric products. We use these suppliers primarily for their product design capabilities, to leverage our buying power, and to control quality and product flow, in addition to their ability to handle the volume of product we require to operate our business. If any of these suppliers experience financial or other difficulties, we could experience temporary disruptions in our manufacturing process until we obtain alternate suppliers. Finished Goods Imports We import all of the casegoods (wood) furniture that we sell. In fiscal 2019, we purchased approximately 55% of this imported product from three suppliers. We use these suppliers primarily to leverage our buying power, to control quality and product flow, and because their capabilities align with our product design needs. In addition, these suppliers have the ability to handle the volume of product we require. If any of these suppliers experience financial or other difficulties, we could experience disruptions in our product flow until we obtain alternate suppliers, which could be lengthy due to the longer lead time required for sourced wood furniture from Asian manufacturers. United States O RI a # E ACC122 N3 - Last Modified: 8m ago Design Layout References Mailings Review View Help Search We use an all-import model for our casegoods furniture primarily to remain competitive for these products. The prices we paid for these imported products, including associated transportation costs, increased in fiscal 2019 compared with fiscal 2018, partially due to an increase in tariffs on certain product imported from China. We import approximately 25% of our casegoods product from China, and currently expect these product costs to increase more in fiscal 2020 than fiscal 2019 if the recent tariff increase to 25% remains in effect throughout fiscal 2020. We are actively working on moving sourcing of products out of China to reduce the tariff impact. Additionally, we are expecting higher ocean freight costs in fiscal 2020 compared with fiscal 2019. We may increase our selling prices to help offset the expected rise in transportation costs and may assess a material or duty surcharge on products imported from China when these increased prices or duties are in effect. Looking across our business, imported finished goods represented 8% of our consolidated sales in both fiscal 2019 and fiscal 2018. Inventory: For our Upholstery segment, we maintain raw materials and work-in-process inventory at our manufacturing locations. Finished goods inventory is maintained at our six regional distribution centers as well as our manufacturing locations. Our regional distribution centers allow us to streamline the warehousing and distribution processes for our La-z-Boy Furniture Galleries store network, including both company-owned stores and independently- owned stores. Our regional distribution centers also allow us to reduce the number of individual warehouses needed to supply our retail outlets and help us reduce inventory levels at our manufacturing and retail locations, For our Casegoods segment, we import wood furniture from Asian vendors, resulting in long lead times on these products. To address these long lead times and meet our customers' delivery requirements, we maintain higher levels of finished goods inventory in our domestic warehouses, as a percentage of sales, of our casegoods products than our upholstery products. Our company-owned La-z-Boy Furniture Galleries stores have finished goods inventory at the stores for display purposes. glish (United States) o a e View Design Layout References Mailings Review Help Search warenouses needed to supply our retail outlets and neip us reduce inventory levels at our manufacturing and retail locations. For our Casegoods segment, we import wood furniture from Asian vendors, resulting in long lead times on these products. To address these long lead times and meet our customers' delivery requirements, we maintain higher levels of finished goods inventory in our domestic warehouses, as a percentage of sales, of our casegoods products than our upholstery products. Our company-owned La-z-Boy Furniture Galleries stores have finished goods inventory at the stores for display purposes. Our Joybird business maintains raw materials, work-in-process, and finished goods inventory at their manufacturing location. Additional finished goods inventory for Joybird is stored in a warehouse or in-transit to the end consumer. Our inventory increased $12.1 million during fiscal 2019 compared with fiscal 2018 primarily as a result of the acquisitions we completed in fiscal 2019. We will continue to manage our inventory levels to ensure they are appropriate relative to our sales volume, while maintaining our focus on service to our customers. Use the attached information for La-Z-Boy and what we have learned in Chapters 2 and 3 to answer the following 5 questions worth 3 points each. 1. Indicate three materials that are included in La-Z-Boy's Raw Materials inventory A. steel for motion mechanisms B. polyester batting and polyurethane foam for cushioning and padding C. lumber and plywood for frames 2. La-z-Boy is a Michigan manufacturing company. Looking at the description of raw materials, what percentage of leather cut and sew products and then fabric products are produced in China? Leather cut and sew products: 95% Fabric products: 90% 3. There is no description of Work-in-Process inventory for La-z-Boy in the footnote, but we know the three costs that are included in work in process from our text. List them here: A. They import approximately 25% of our case goods product from China, and currently expect these product costs to increase more in fiscal 2020 B. They are actively working on moving sourcing of products out of China to reduce the tariff impact C. they are expecting higher ocean freight costs in fiscal 2020. 08 English (Unitectes to search o a e 4. La-Z-Boy has two classes of product in Finished Goods Inventory-Casegoods and Upholstery products. Which of these two classes comprise the majority of La-z-Boy finished goods inventory? Casegoods products comprise the majority of La-Z-Boy finished goods inventory. 5. Given the amounts for the three inventories accounts, do you think La-Z-Boy has a quick manufacturing process (short through-put time) or a long manufacturing process (long through-put time) in the U.S.? Explain why. I think La-Z-Boy has a quick manufacturing process in the U.S, because they use an all-import model for their casegoods furniture primarily to remain competitive for these products and their inventory increased $12.1 million during fiscal 2019 compared with fiscal 2018