Answered step by step

Verified Expert Solution

Question

1 Approved Answer

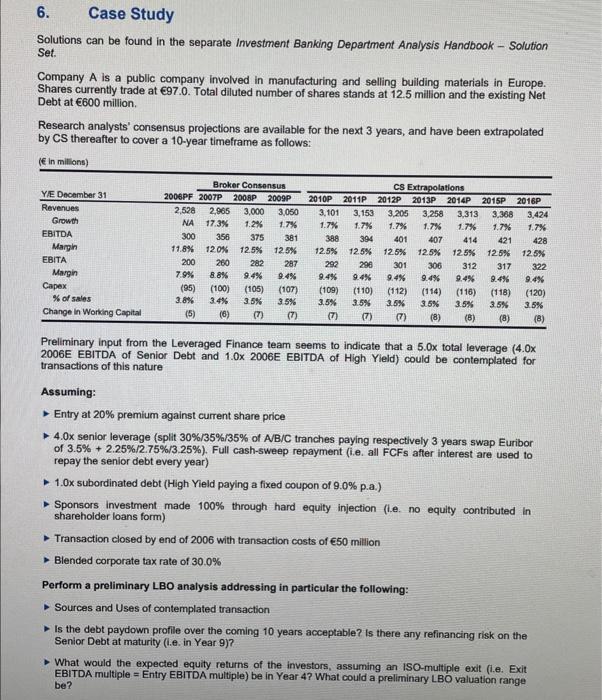

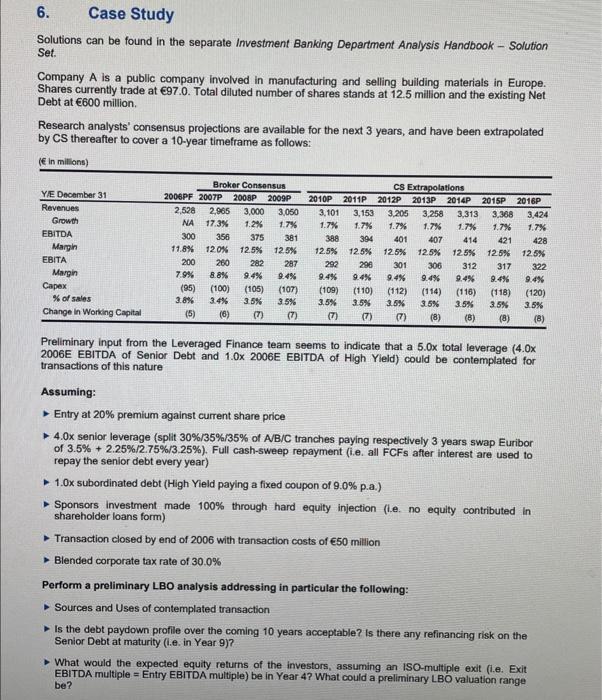

LBO modelling 6. Case Study Solutions can be found in the separate Investment Banking Department Analysis Handbook - Solution Set. Company A is a public

LBO modelling

6. Case Study Solutions can be found in the separate Investment Banking Department Analysis Handbook - Solution Set. Company A is a public company involved in manufacturing and selling building materials in Europe. Shares currently trade at 97.0. Total diluted number of shares stands at 12.5 million and the existing Net Debt at 600 million. Research analysts' consensus projections are available for the next 3 years, and have been extrapolated by CS thereafter to cover a 10-year timeframe as follows: ( in millions) Broker Consensus CS Extrapolations YIE December 31 2006PF 2007P 2008P 2009P 2010P 2011P2012P 2013P 2014P 2015P 2016P Revenues 2,528 2.965 3,000 3,050 3.101 3,153 3.205 3,258 3,313 3.368 3,424 Growth NA 17.3% 1.2% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% EBITDA 300 356 375 388 394 401 407 414 421 428 Margin 11.8% 120% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 125% 12.5% 125% EBITA 200 260 282 287 292 298 301 306 322 Margin 7.9% 8.8% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% Capex (95) (100) (105) (107) (110) (112) (114) (116) (118) (120) % of sales 3.8% 3.4% 3.5% 3.5% 3.5% 3.6% 3.5% 3.5% 3.5% 3.5% Change in Working Capital (5) (6) (7) (7) (7) (7) (7) (8) (8) (8) (8) 1.7% 381 312 317 (109) 3.5% Preliminary input from the Leveraged Finance team seems to indicate that a 5.0x total leverage (4.0x 2006E EBITDA of Senior Debt and 1.0x 2006E EBITDA of High Yield) could be contemplated for transactions of this nature Assuming: Entry at 20% premium against current share price 4.0x senior leverage (split 30%/35%/35% of A/B/C tranches paying respectively 3 years swap Euribor of 3.5% +2.25%/2.75%/3.25%). Full cash-sweep repayment (ie, all FCFs after interest are used to repay the senior debt every year) 1.0x subordinated debt (High Yield paying a fixed coupon of 9.0% p.a.) Sponsors investment made 100% through hard equity injection (ie no equity contributed in shareholder loans form) Transaction closed by end of 2006 with transaction costs of 50 million Blended corporate tax rate of 30.0% Perform a preliminary LBO analysis addressing in particular the following: Sources and Uses of contemplated transaction Is the debt paydown profile over the coming 10 years acceptable? Is there any refinancing risk on the Senior Debt at maturity (I.e. in Year 9)? What would the expected equity returns of the investors, assuming an ISO-multiple exit (i.e. Exit EBITDA multiple = Entry EBITDA multiple) be in Year 4? What could a preliminary LBO valuation range be? 6. Case Study Solutions can be found in the separate Investment Banking Department Analysis Handbook - Solution Set. Company A is a public company involved in manufacturing and selling building materials in Europe. Shares currently trade at 97.0. Total diluted number of shares stands at 12.5 million and the existing Net Debt at 600 million. Research analysts' consensus projections are available for the next 3 years, and have been extrapolated by CS thereafter to cover a 10-year timeframe as follows: ( in millions) Broker Consensus CS Extrapolations YIE December 31 2006PF 2007P 2008P 2009P 2010P 2011P2012P 2013P 2014P 2015P 2016P Revenues 2,528 2.965 3,000 3,050 3.101 3,153 3.205 3,258 3,313 3.368 3,424 Growth NA 17.3% 1.2% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% 1.7% EBITDA 300 356 375 388 394 401 407 414 421 428 Margin 11.8% 120% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 125% 12.5% 125% EBITA 200 260 282 287 292 298 301 306 322 Margin 7.9% 8.8% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% 9.4% Capex (95) (100) (105) (107) (110) (112) (114) (116) (118) (120) % of sales 3.8% 3.4% 3.5% 3.5% 3.5% 3.6% 3.5% 3.5% 3.5% 3.5% Change in Working Capital (5) (6) (7) (7) (7) (7) (7) (8) (8) (8) (8) 1.7% 381 312 317 (109) 3.5% Preliminary input from the Leveraged Finance team seems to indicate that a 5.0x total leverage (4.0x 2006E EBITDA of Senior Debt and 1.0x 2006E EBITDA of High Yield) could be contemplated for transactions of this nature Assuming: Entry at 20% premium against current share price 4.0x senior leverage (split 30%/35%/35% of A/B/C tranches paying respectively 3 years swap Euribor of 3.5% +2.25%/2.75%/3.25%). Full cash-sweep repayment (ie, all FCFs after interest are used to repay the senior debt every year) 1.0x subordinated debt (High Yield paying a fixed coupon of 9.0% p.a.) Sponsors investment made 100% through hard equity injection (ie no equity contributed in shareholder loans form) Transaction closed by end of 2006 with transaction costs of 50 million Blended corporate tax rate of 30.0% Perform a preliminary LBO analysis addressing in particular the following: Sources and Uses of contemplated transaction Is the debt paydown profile over the coming 10 years acceptable? Is there any refinancing risk on the Senior Debt at maturity (I.e. in Year 9)? What would the expected equity returns of the investors, assuming an ISO-multiple exit (i.e. Exit EBITDA multiple = Entry EBITDA multiple) be in Year 4? What could a preliminary LBO valuation range be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started