LCNRV is done.

need help with CLM

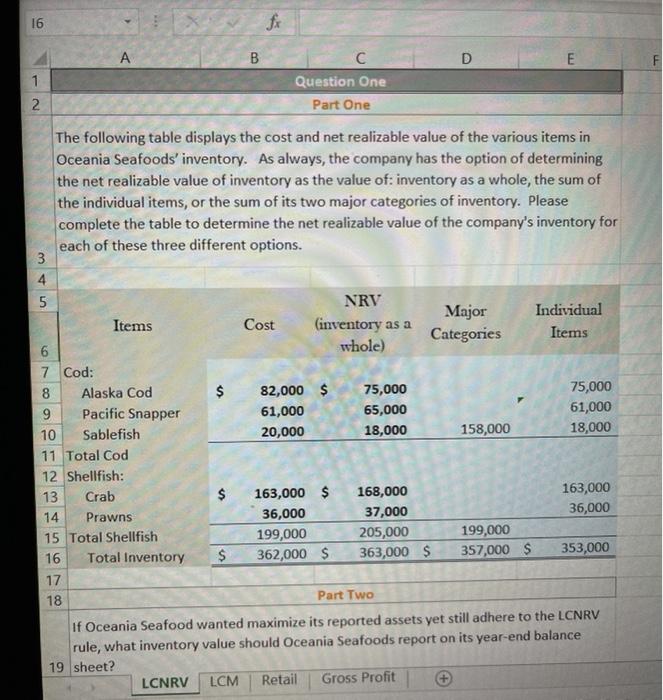

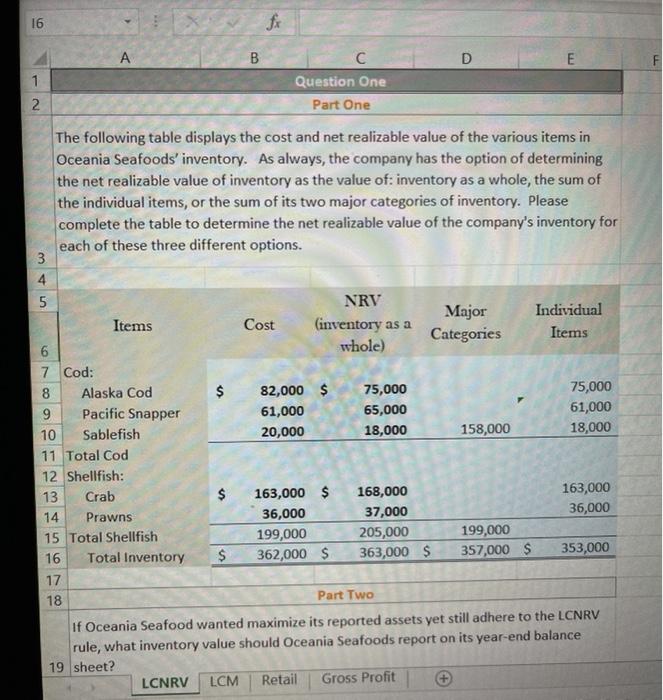

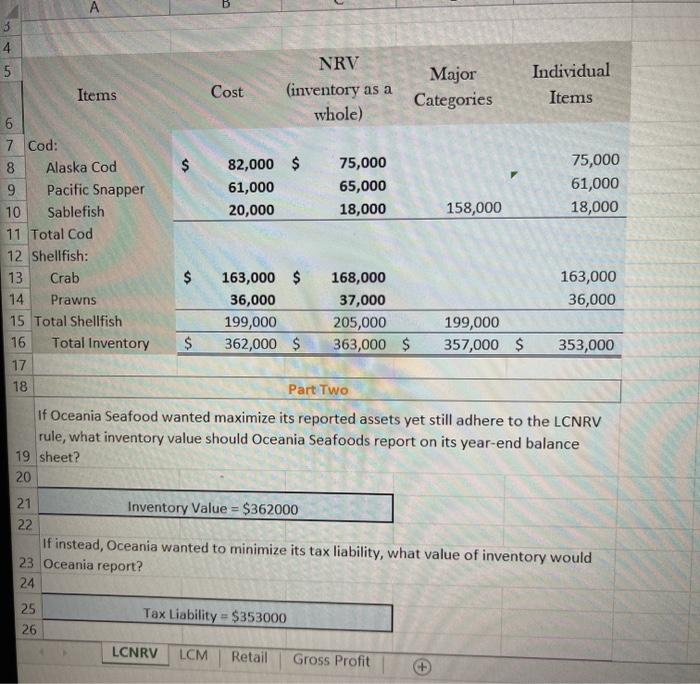

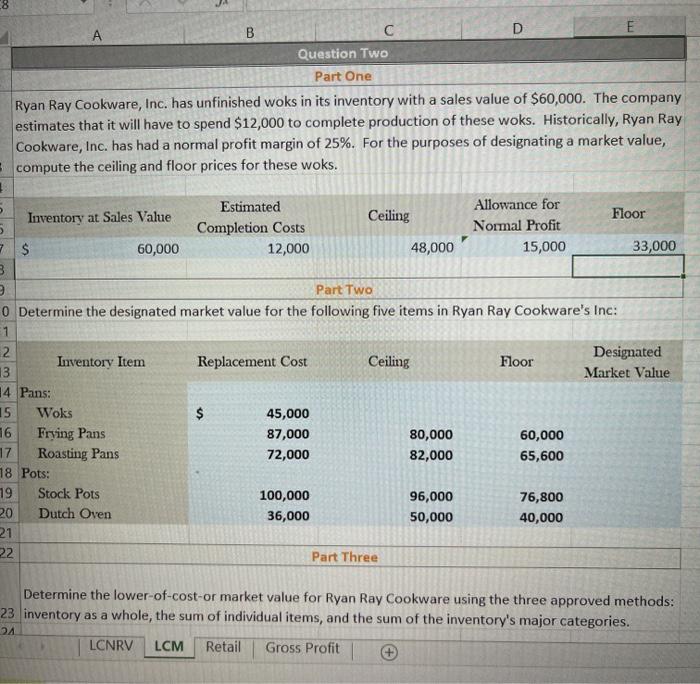

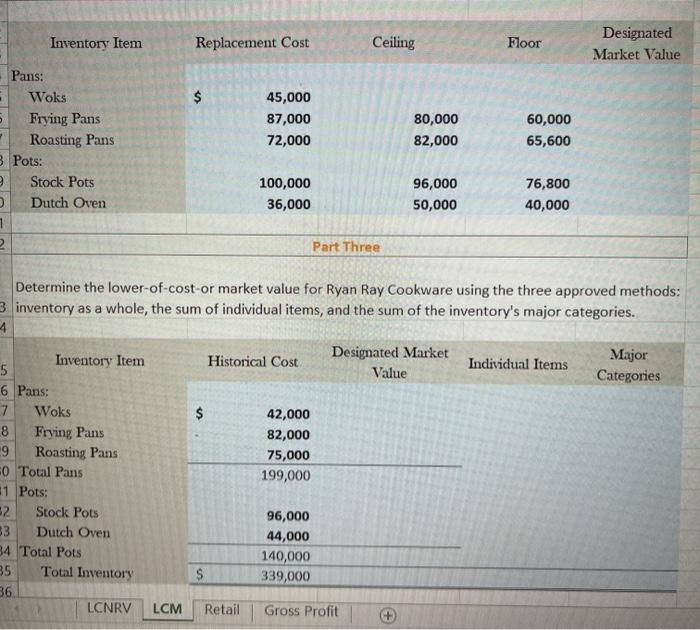

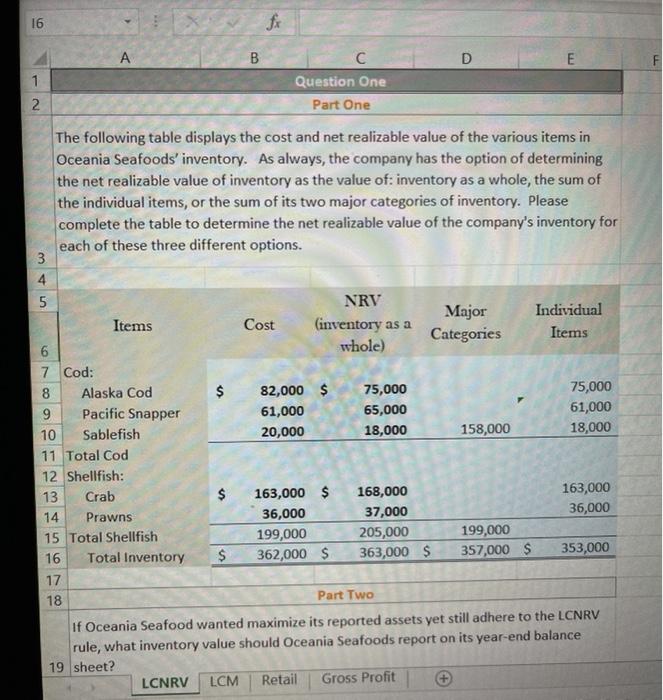

16 B C D E F 1 2 Question One Part One $ The following table displays the cost and net realizable value of the various items in Oceania Seafoods' inventory. As always, the company has the option of determining the net realizable value of inventory as the value of: inventory as a whole, the sum of the individual items, or the sum of its two major categories of inventory. Please complete the table to determine the net realizable value of the company's inventory for each of these three different options. 3 4 5 NRV Major Individual Items Cost (inventory as a Categories Items 6 whole) 7 Cod: 8 Alaska Cod 82,000 $ 75,000 75,000 9 Pacific Snapper 61,000 65,000 61,000 10 Sablefish 20,000 18,000 158,000 18,000 11 Total Cod 12 Shellfish: 13 Crab $ 163,000 $ 168,000 163,000 14 Prawns 36,000 37,000 36,000 15 Total Shellfish 199,000 205,000 199,000 16 Total Inventory $ 362,000 $ 363,000 $ 357,000 $ 353,000 17 18 Part Two If Oceania Seafood wanted maximize its reported assets yet still adhere to the LCNRV rule, what inventory value should Oceania Seafoods report on its year-end balance 19 sheet? LCNRV LCM Retail Gross Profit 1 A 3 4 5 NRV Major Individual Items Cost (inventory as a Categories Items 6 whole) 7 Cod: 8 Alaska Cod $ 82,000 $ 75,000 75,000 9 Pacific Snapper 61,000 65,000 61,000 10 Sablefish 20,000 18,000 158,000 18,000 11 Total Cod 12 Shellfish: 13 Crab $ 163,000 $ 168,000 163,000 14 Prawns 36,000 37,000 36,000 15 Total Shellfish 199,000 205,000 199,000 16 Total Inventory $ 362,000 $ 363,000 $ 357,000 $ 353,000 17 18 Part Two If Oceania Seafood wanted maximize its reported assets yet still adhere to the LCNRV rule, what inventory value should Oceania Seafoods report on its year-end balance 19 sheet? 20 21 Inventory Value = $362000 22 If instead, Oceania wanted to minimize its tax liability, what value of inventory would 23 Oceania report? 24 25 26 Tax Liability = $353000 LCNRV LCM Retail Gross Profit 7 B D E Question Two Part One Ryan Ray Cookware, Inc. has unfinished woks in its inventory with a sales value of $60,000. The company estimates that it will have to spend $12,000 to complete production of these woks. Historically, Ryan Ray Cookware, Inc. has had a normal profit margin of 25%. For the purposes of designating a market value, compute the ceiling and floor prices for these woks. 1 5 Estimated Allowance for Inventory at Sales Value Ceiling Floor Completion Costs Normal Profit $ 60,000 12,000 48,000 15,000 33,000 3 Part Two O Determine the designated market value for the following five items in Ryan Ray Cookware's Inc: 1 2 Inventory Item Replacement Cost Ceiling 13 Designated Floor Market Value 14 Pans: 15 Woks $ 45,000 16 Frying Pans 87,000 80,000 60,000 17 Roasting Pans 72,000 82,000 65,600 18 Pots: 19 Stock Pots 100,000 96,000 76,800 20 Dutch Oven 36,000 50,000 40,000 21 22 Part Three Determine the lower-of-cost-or market value for Ryan Ray Cookware using the three approved methods: 23 inventory as a whole, the sum of individual items, and the sum of the inventory's major categories. LCNRV LCM Retail Gross Profit Inventory Item Replacement Cost Ceiling Floor Designated Market Value . $ 45,000 87,000 72,000 80,000 82,000 60,000 65,600 Pans: Woks 5 Frying Pans Roasting Pans 3 Pots: Stock Pots Dutch Oven 1 2 100,000 36,000 96,000 50,000 76,800 40,000 Part Three Determine the lower-of-cost-or market value for Ryan Ray Cookware using the three approved methods: 3 inventory as a whole, the sum of individual items, and the sum of the inventory's major categories. 4 Designated Market Inventory Item Major Individual Items 5 Historical Cost Value Categories 6 Pans: 7 Woks $ 42,000 8 Frying Pans 82,000 9 Roasting Pans 75,000 0 Total Pans 199,000 1 Pots: 2 Stock Pots 96,000 53 Dutch Oven 44,000 34 Total Pots 140,000 35 Total Inventory S 339,000 36 LCNRV LCM Retail Gross Profit