Answered step by step

Verified Expert Solution

Question

1 Approved Answer

le depreclaion method? The Home Depot financial statements and related material appear in Appendix A at the end of this textbook. Use these to answer

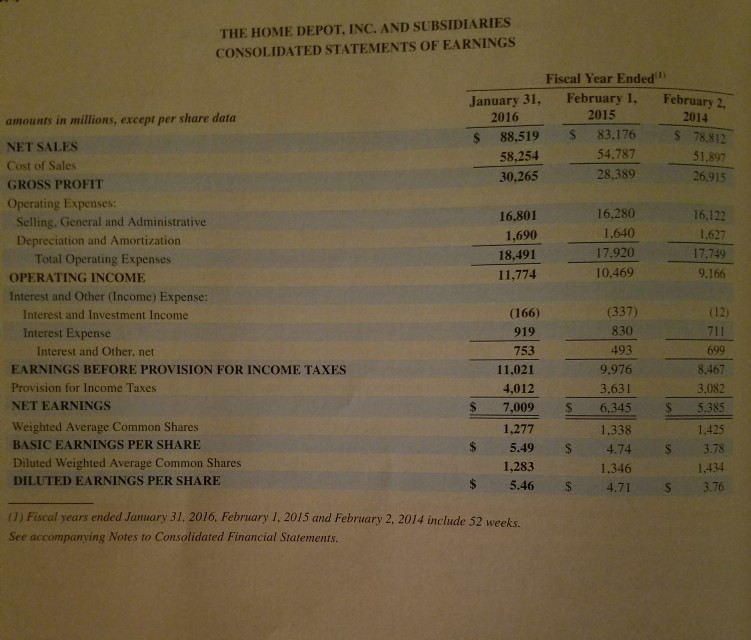

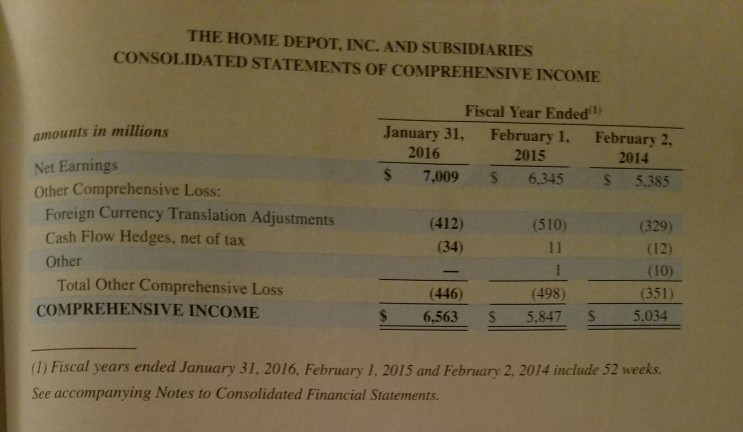

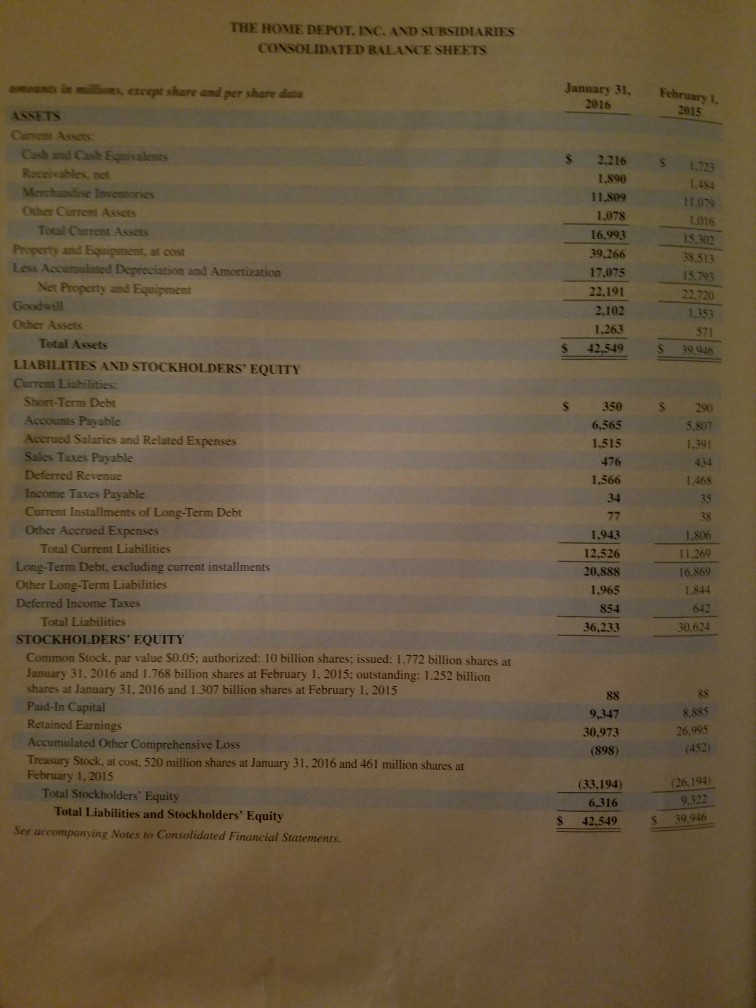

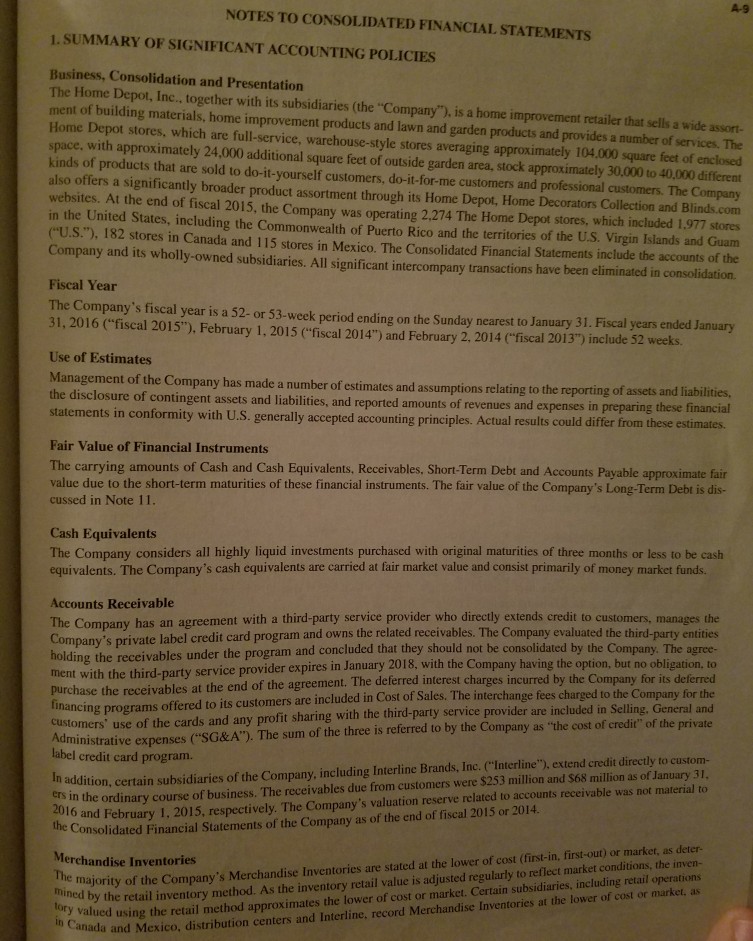

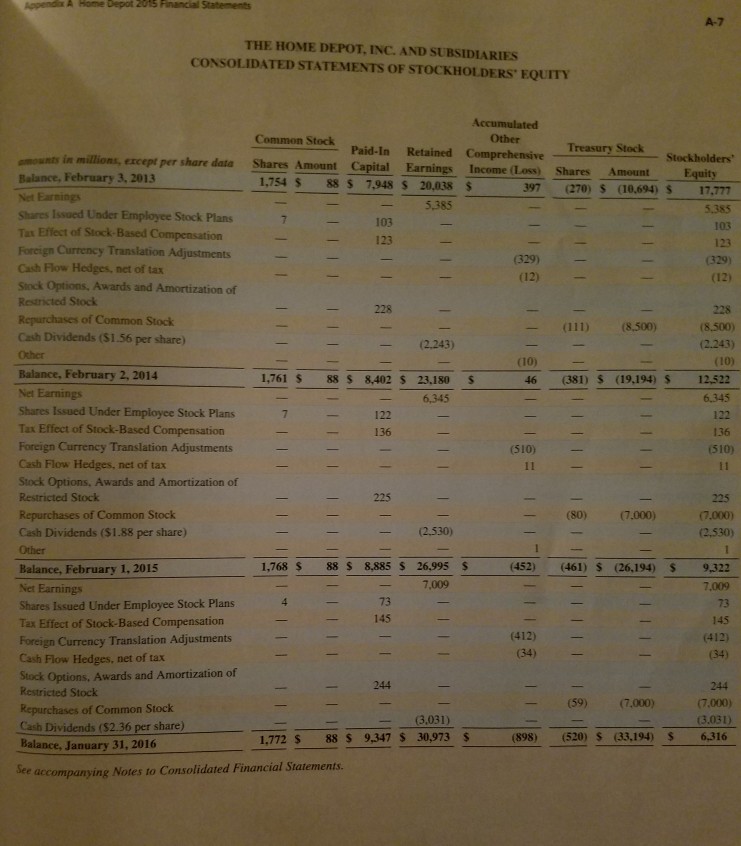

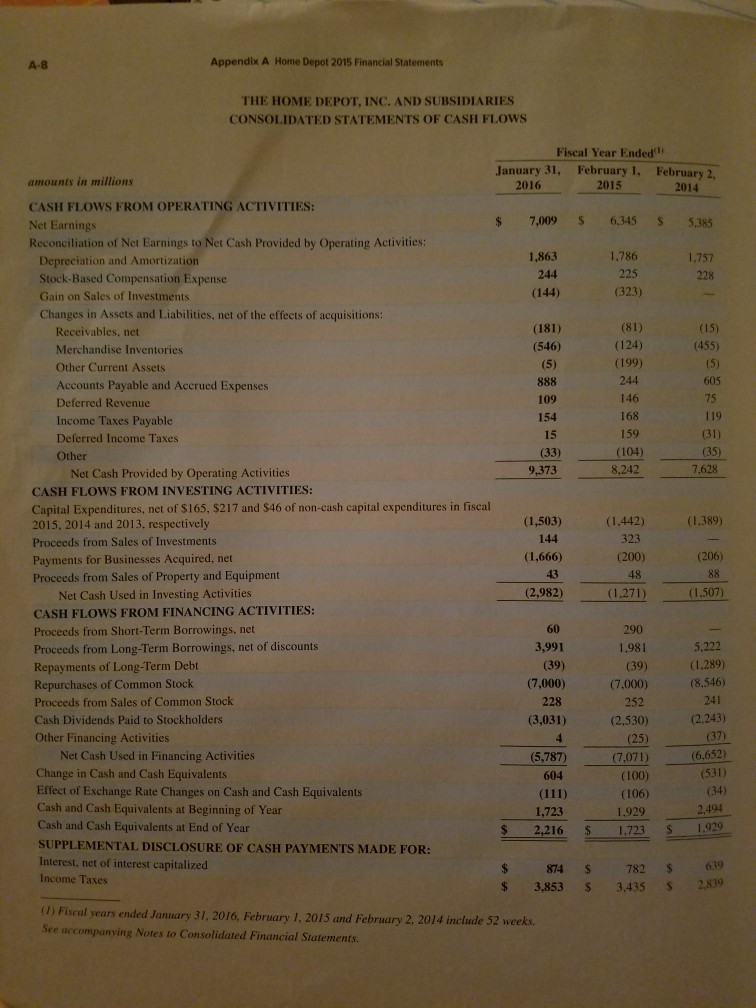

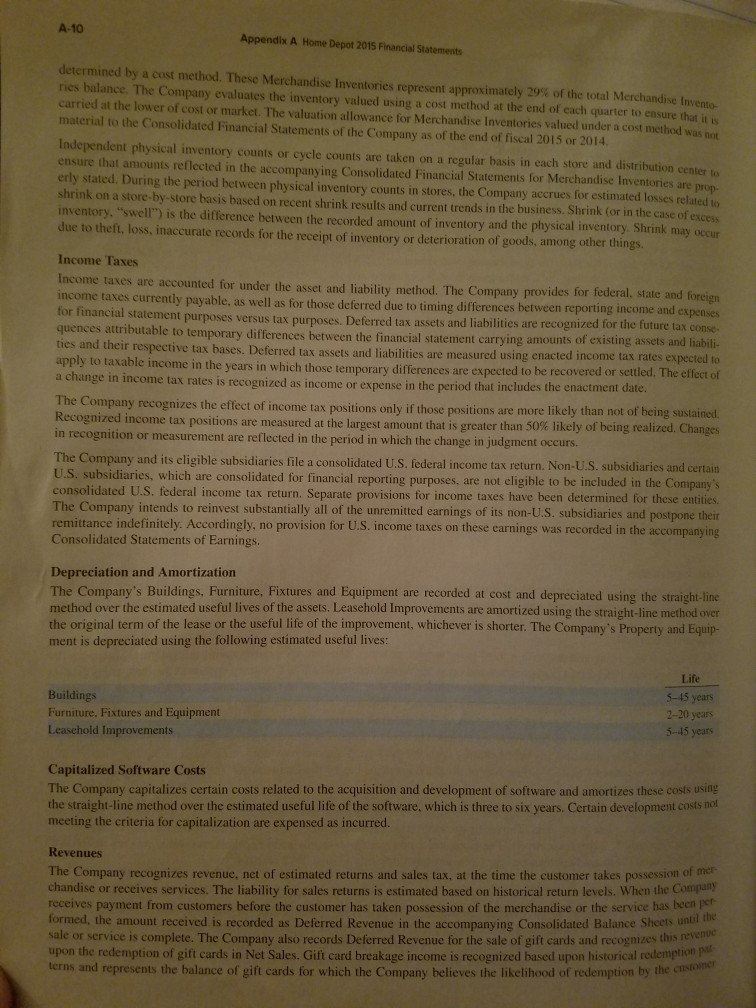

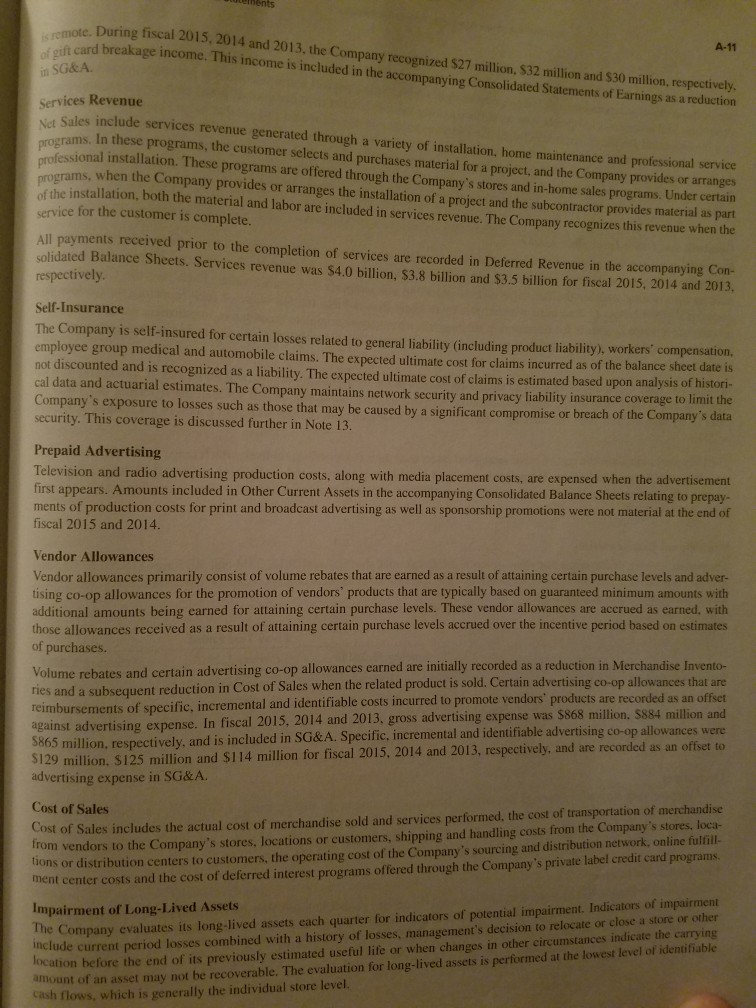

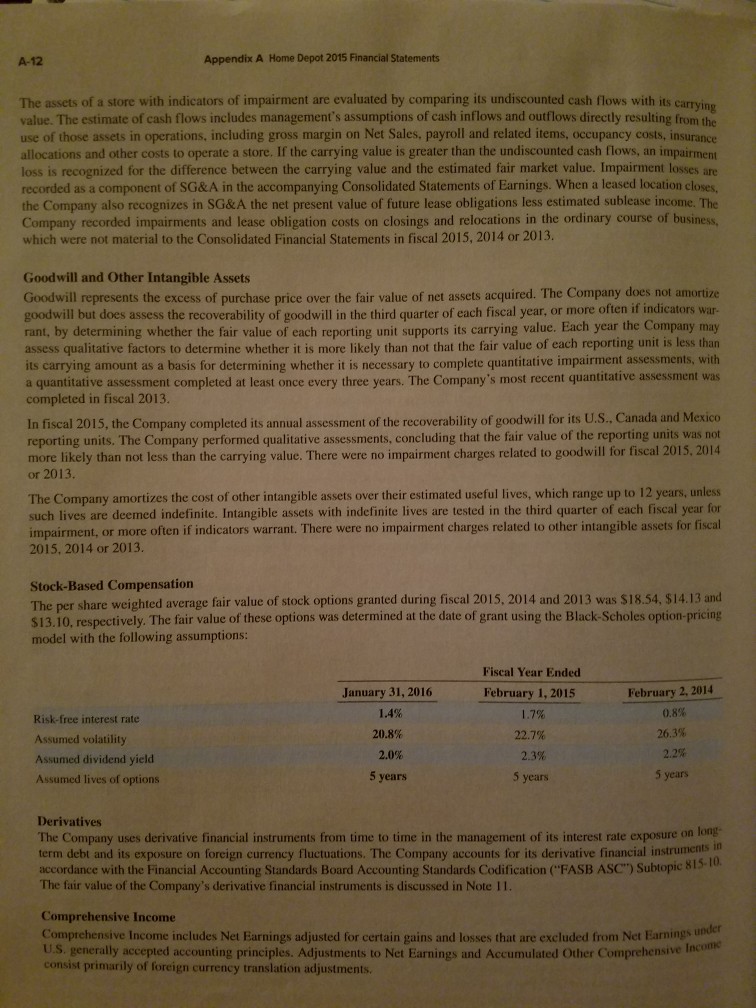

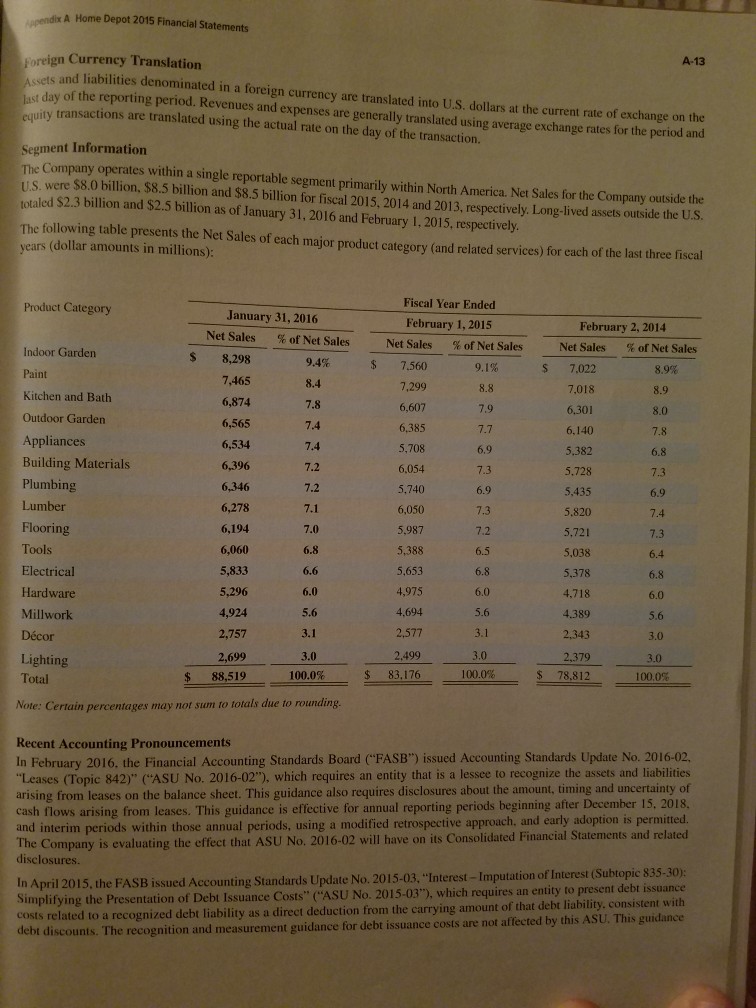

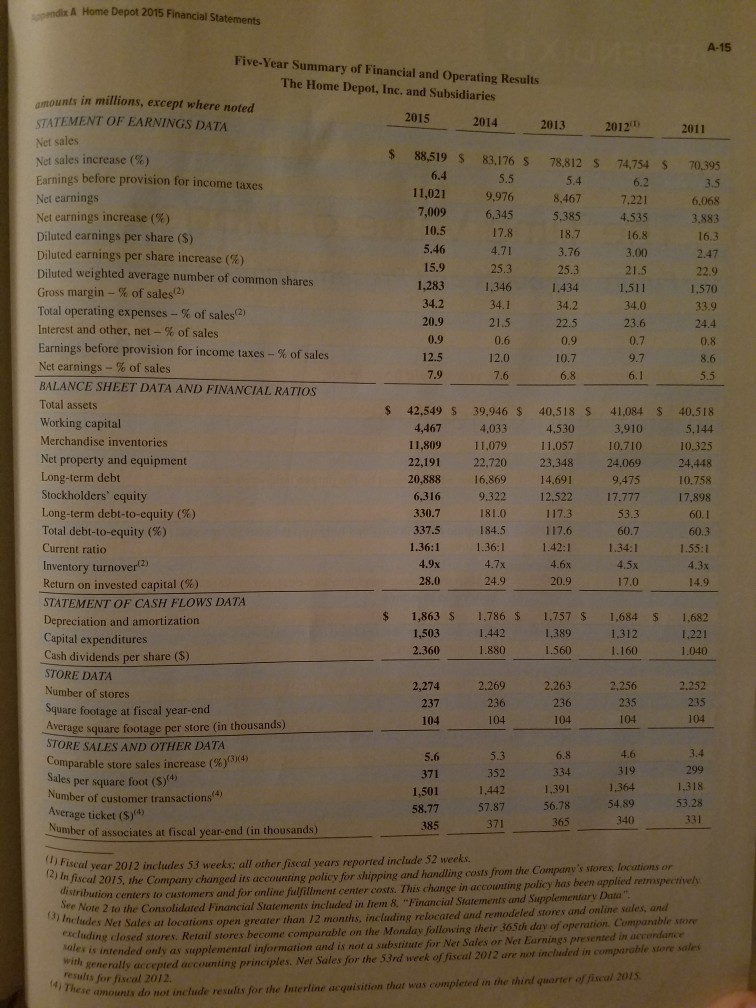

le depreclaion method? The Home Depot financial statements and related material appear in Appendix A at the end of this textbook. Use these to answer the following questions and indicate where in the fin ments you found the information. a. What depreciation method does Home Depot use for buildings, furniture, fixtures, and eq ment? What are the useful lives over which these assets are depreciated? policy regarding impairment of plant assets? Locate Home Depot's balance sheet and find the section entitled "Property and Equipment, at cost." As of January 31, 2016, determine the amount of the company's investment in property and equipment and the amount of depreciation taken to date on those assets. Are these assets, as a whole, near the beginning or end of their estimated useful lives? Explain your answer c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started