Question

Le pain quotidien is a Belgian chain of bakeries which has recently opened a few stores in the United States. Sophie is the manager of

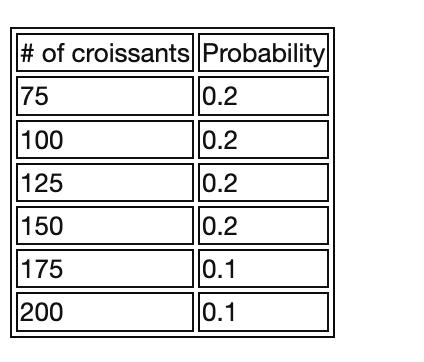

Le pain quotidien is a Belgian chain of bakeries which has recently opened a few stores in the United States. Sophie is the manager of the 5th avenue location in New York. The bakery sells croissants that are made fresh every day. Each croissant is sold for $1.2 and costs 20 cents to make. Because Sophie insists on selling only fresh products, any croissant left unsold at the end of the day is given to a charity which pays only 2 cents per croissant. Suppose that if they are no more croissants, all customers who wanted to buy a croissant buy a packaged caramel wafer instead (suppose that there are always plenty of brioches). The wafers are not perishable, they are sold for $1.5 and they cost 60 cents each to purchase them from the supplier. Based on past sales, Sophie has determined that the demand for croissants on any given day can only take the following values with the following probabilities:

a. What are the costs of underage and overage in this problem? In the blanks below, enter the values in dollars, numbers only:

Cu:

Co:

b. ( How many croissants they make in order to maximize their expected profit?

Q* =

c. ( If they make that quantity, what will be their expected profit? Include the profits made from selling wafers. Round your answer to two decimals. Enter the value in the field below

$Blank 4

d. Imagine that Sophie could obtain a perfect demand forecast. That is, she would know in advance what exactly would be her demand for each day. What is the maximum amount she would be willing to pay for such forecast? Round your answers to two decimals.

# of croissants Probability 75 0.2 100 0.2 125 0.2 150 0.2 175 0.1 200 0.1

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Croissants Probability Cummulative Probability 75 02 02 100 02 04 125 02 06 150 02 08 175 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started