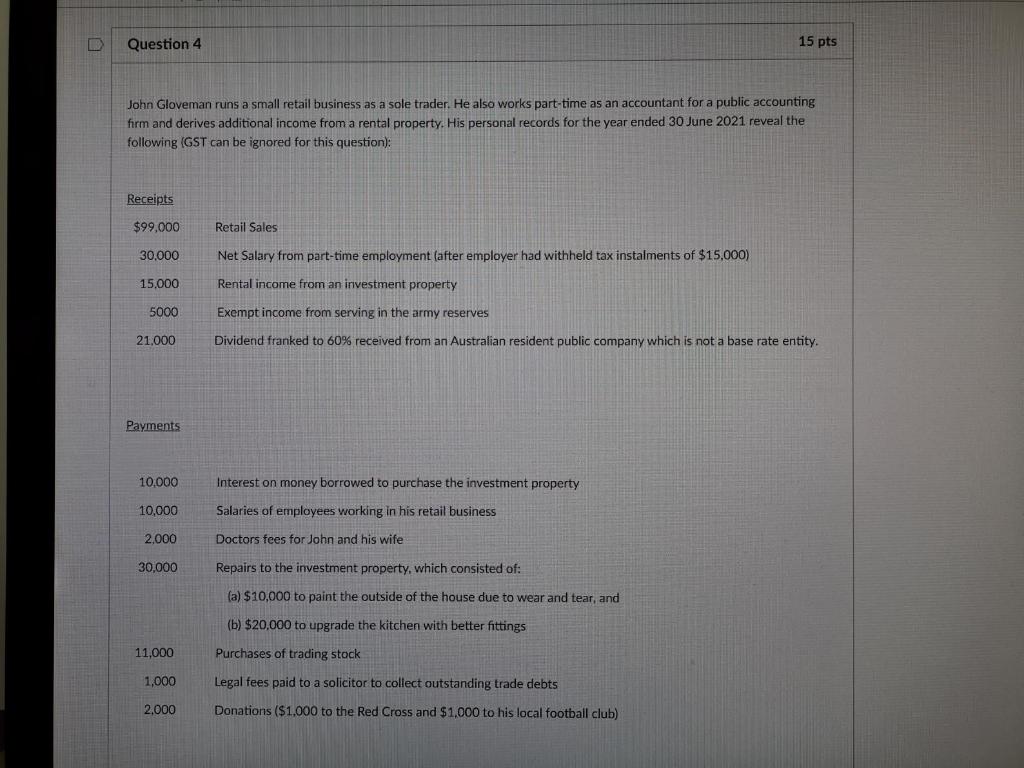

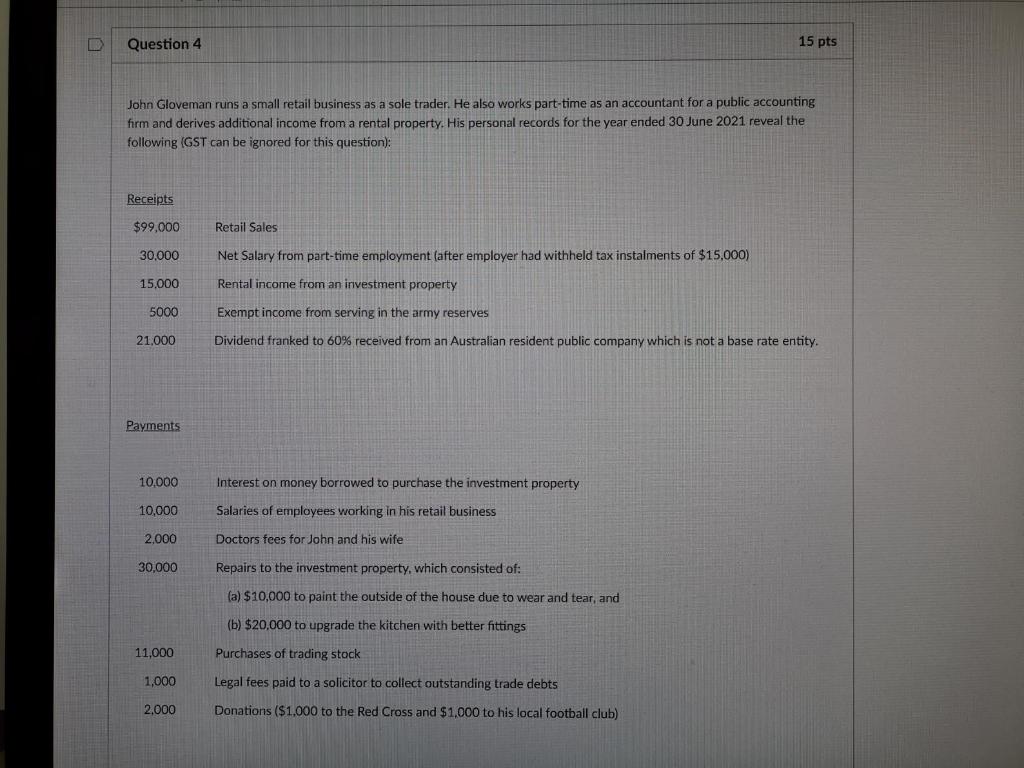

LE Question 4 15 pts John Gloveman runs a small retail business as a sole trader. He also works part-time as an accountant for a public accounting firm and derives additional income from a rental property. His personal records for the year ended 30 June 2021 reveal the following (GST can be ignored for this question): Receipts $99.000 Retail Sales 30,000 Net Salary from part-time employment (after employer had withheld tax instalments of $15.000) 15,000 Rental income from an investment property 5000 Exempt income from serving in the army reserves 21.000 Dividend franked to 60% received from an Australian resident public company which is not a base rate entity. Payments 10,000 Interest on money borrowed to purchase the investment property 10,000 Salaries of employees working in his retail business 2.000 Doctors fees for John and his wife 30,000 Repairs to the investment property, which consisted of: (a) $10,000 to paint the outside of the house due to wear and tear, and (b) $20,000 to upgrade the kitchen with better fittings 11,000 Purchases of trading stock 1,000 Legal fees paid to a solicitor to collect outstanding trade debts 2.000 Donations ($1,000 to the Red Cross and $1,000 to his local football club) LE Question 4 15 pts John Gloveman runs a small retail business as a sole trader. He also works part-time as an accountant for a public accounting firm and derives additional income from a rental property. His personal records for the year ended 30 June 2021 reveal the following (GST can be ignored for this question): Receipts $99.000 Retail Sales 30,000 Net Salary from part-time employment (after employer had withheld tax instalments of $15.000) 15,000 Rental income from an investment property 5000 Exempt income from serving in the army reserves 21.000 Dividend franked to 60% received from an Australian resident public company which is not a base rate entity. Payments 10,000 Interest on money borrowed to purchase the investment property 10,000 Salaries of employees working in his retail business 2.000 Doctors fees for John and his wife 30,000 Repairs to the investment property, which consisted of: (a) $10,000 to paint the outside of the house due to wear and tear, and (b) $20,000 to upgrade the kitchen with better fittings 11,000 Purchases of trading stock 1,000 Legal fees paid to a solicitor to collect outstanding trade debts 2.000 Donations ($1,000 to the Red Cross and $1,000 to his local football club)