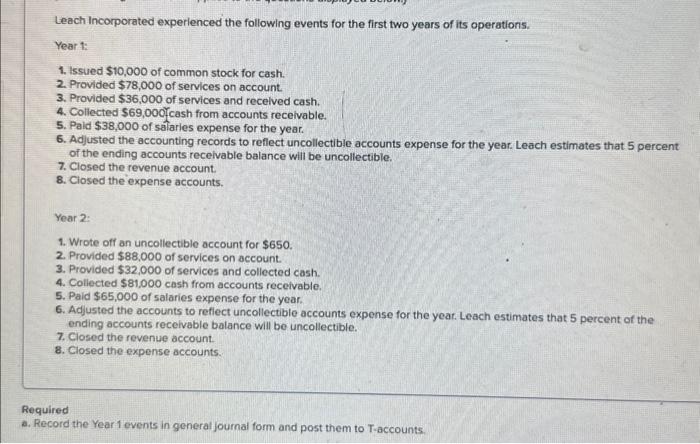

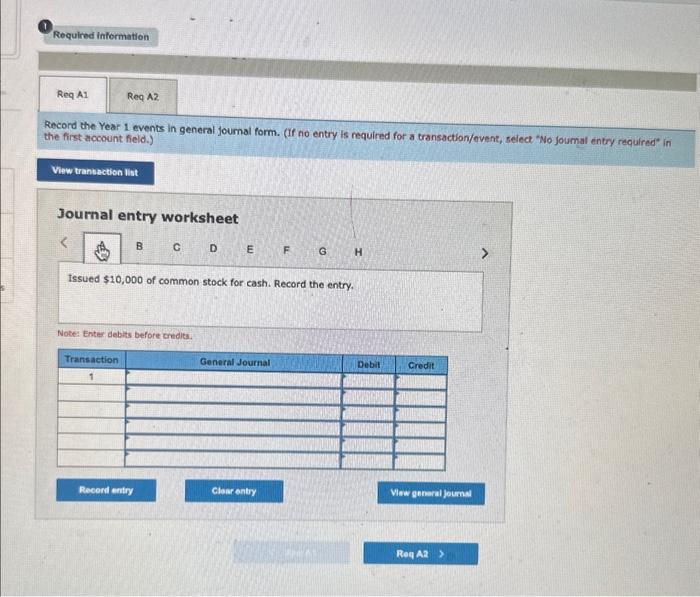

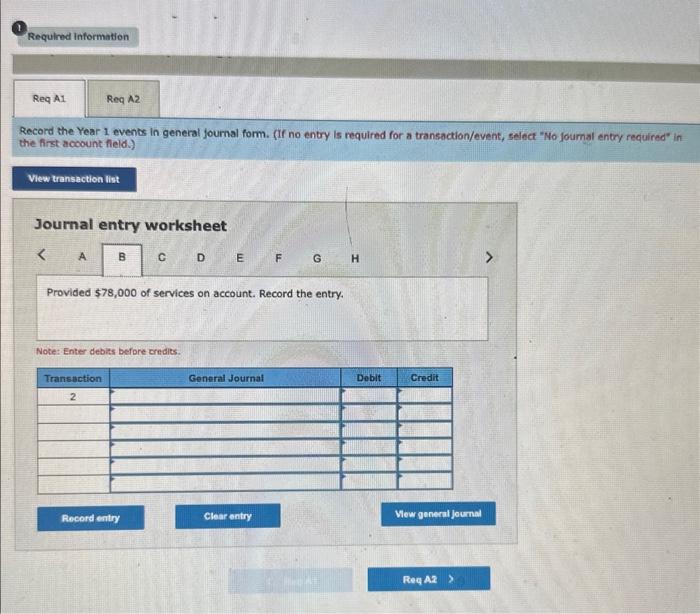

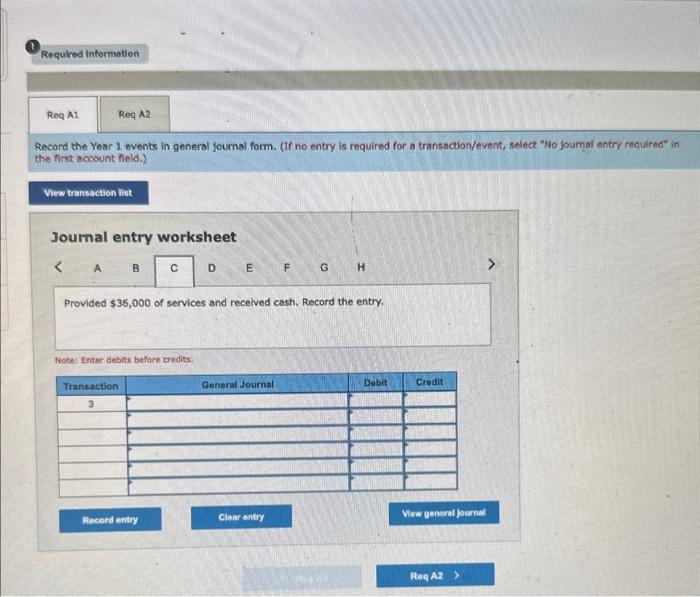

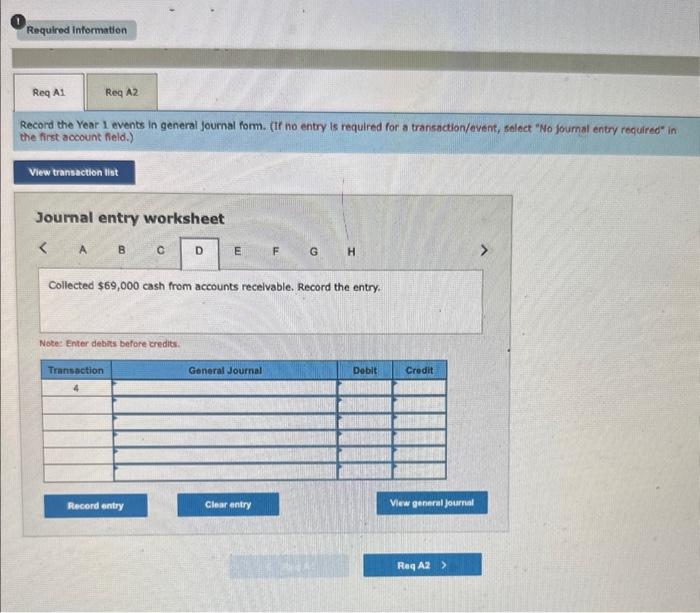

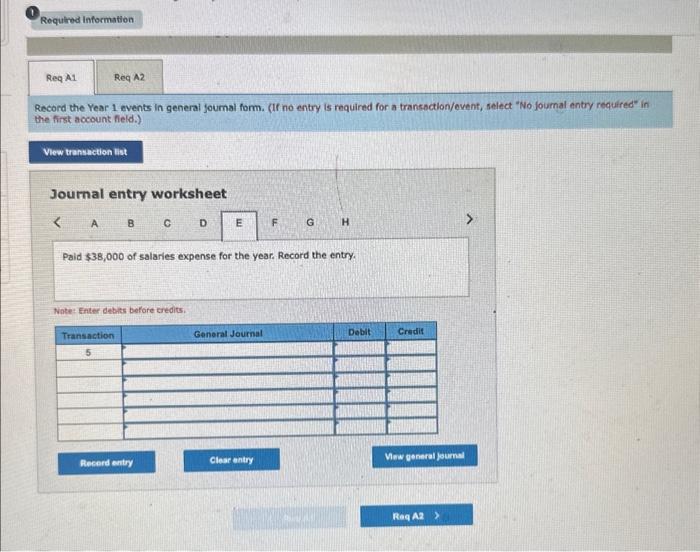

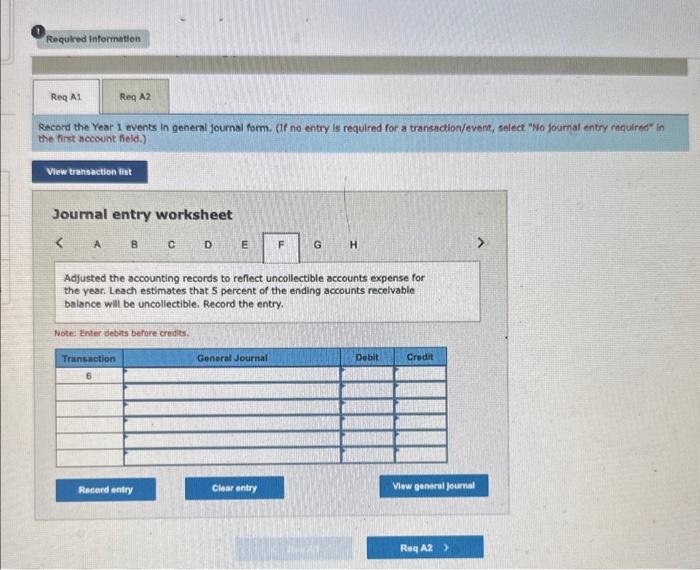

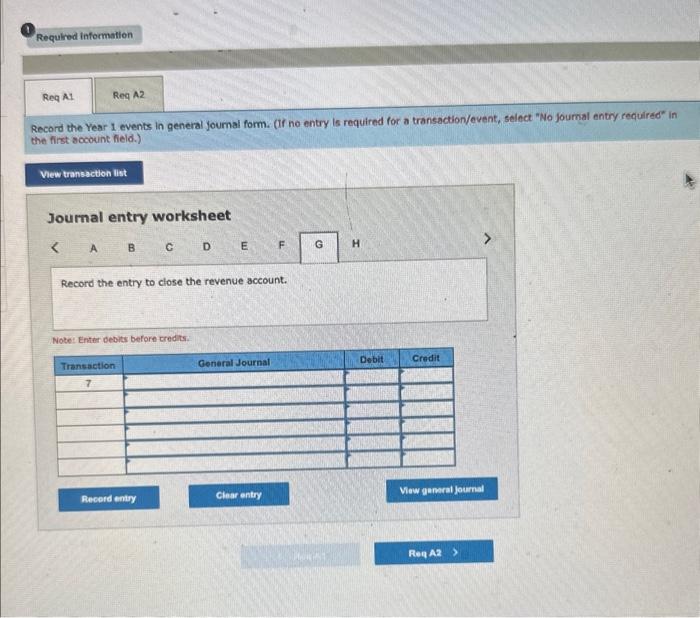

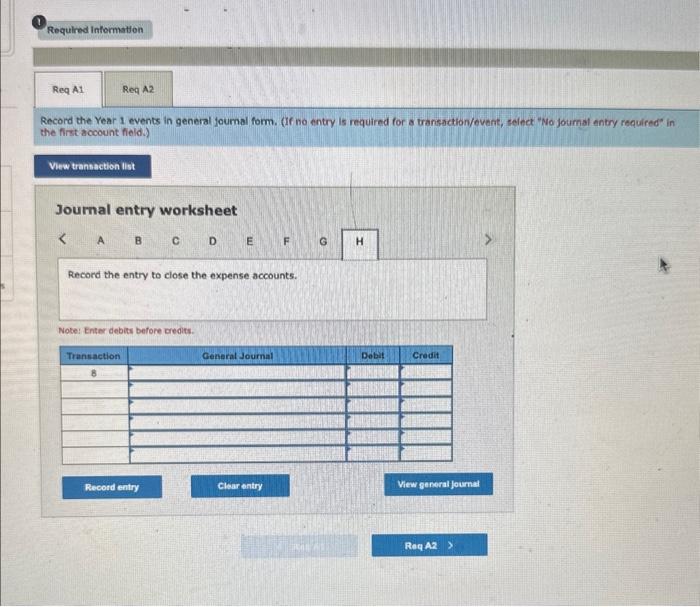

Leach Incorporated experienced the following events for the first two years of its operations. Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $78,000 of services on account. 3. Provided $36,000 of services and recelved cash. 4. Collected $69,000-cash from accounts recelvable. 5. Paid $38,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts recelvable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Year 2 : 1. Wrote off an uncollectible account for $650. 2. Provided $88,000 of services on account. 3. Provided $32,000 of services and collected cash. 4. Collected $81,000 cash from accounts receivable. 5. Paid $65,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Required a. Record the Year 1 events in general journal form and post them to T-accounts. Record the Year 1 events in general joumal form. (If no entry is required for a transaction/ovent, select "No joumal entry required" in the first account field.) Joumal entry worksheet Record the Year 1 events in general fournal form. (If no entry is required for a transaction/event, salect "No joumal entry required" in the first account field.) Journal entry worksheet EFGH Provided $78,000 of services on account. Record the entry. Note: Enter debits before credits. Record the Year 1 events in general fournal form. (If no entry is required for a transaction/event, select "No journal entry requlred" in the first account field.) Journal entry worksheet A Provided $36,000 of services and recelved cosh. Record the entry. Notei Enter debits before rredits. Record the Year 1 events in general Journal form. (if no entry is required for a transnction/event, salect "No joumal entry roquired" in the first aocount field.) Joumal entry worksheet Collected $69,000 cash from accounts recelvable. Record the entry. Noke: Enter debais before credits. Record the Year 1 events in general foumal form. (If no entry is required for a transaction/ovent, select "No joumal entry required" in the first account field.) Journal entry worksheet Note: Finter debits before eredits. Record the Year 1 events in general joumal fom. (Ir no entry is required for a transnction/event, select "No joumal entry required" in the first scoount feld.) Journal entry worksheet Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts recelvable balance will be uncollectible. Record the entry. Notes tinter debits before credils. Record the Year 1 events in general joumai form. (If no entry is required for a transaction/event, select "No joumal entry requircd" in the first scoount field.) Joumal entry worksheet B B Record the entry to close the revenue account. Note: Enter debits before credits. Record the Year 1 events in general foumal form. (If no entry is required for a transaction/ovent, select "No joumal entry required" in the first account field.) Joumal entry worksheet Note: Enter debits before credits