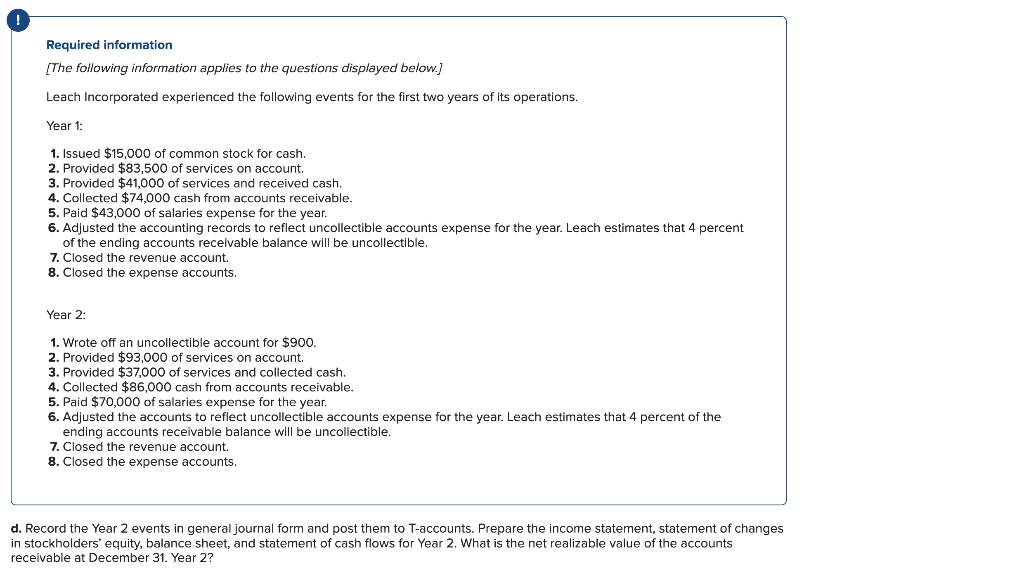

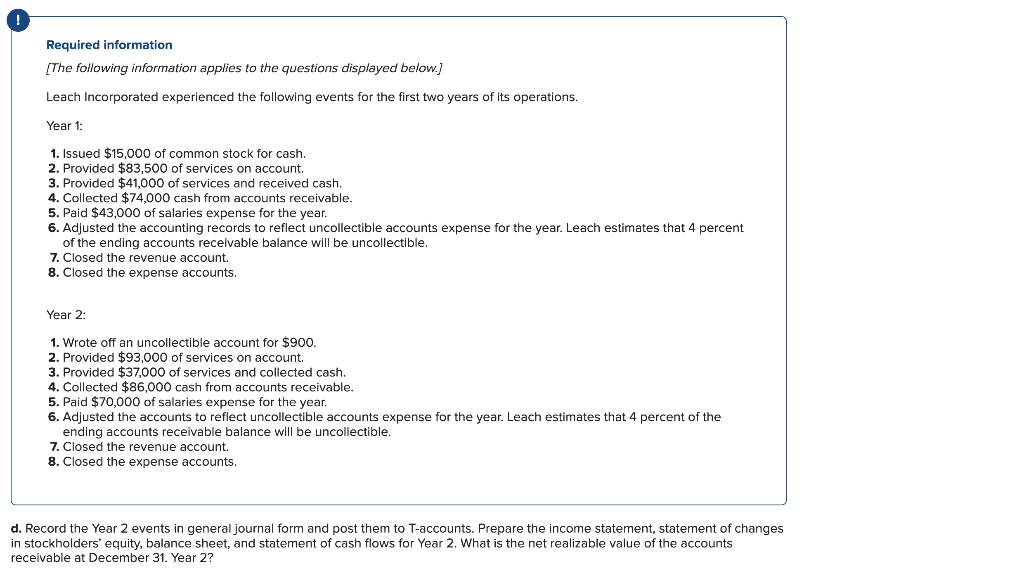

Leach Incorporated experienced the following events for the first two years of its operations.

Year 1:

- Issued $15,000 of common stock for cash.

- Provided $83,500 of services on account.

- Provided $41,000 of services and received cash.

- Collected $74,000 cash from accounts receivable.

- Paid $43,000 of salaries expense for the year.

- Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 4 percent of the ending accounts receivable balance will be uncollectible.

- Closed the revenue account.

- Closed the expense accounts.

Year 2:

- Wrote off an uncollectible account for $900.

- Provided $93,000 of services on account.

- Provided $37,000 of services and collected cash.

- Collected $86,000 cash from accounts receivable.

- Paid $70,000 of salaries expense for the year.

- Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 4 percent of the ending accounts receivable balance will be uncollectible.

- Closed the revenue account.

- Closed the expense accounts.

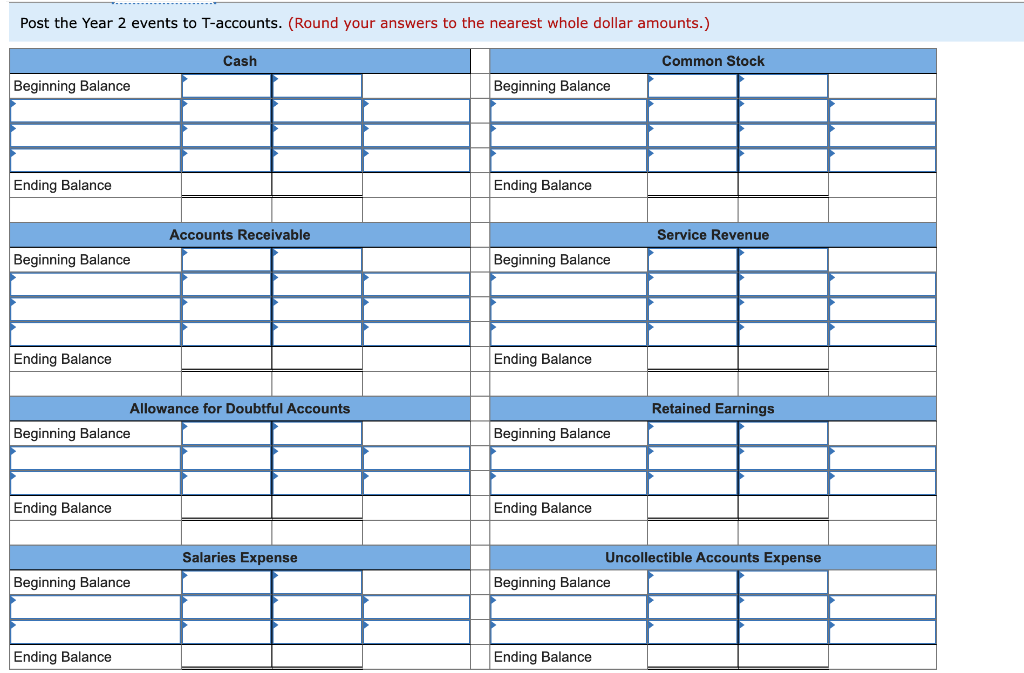

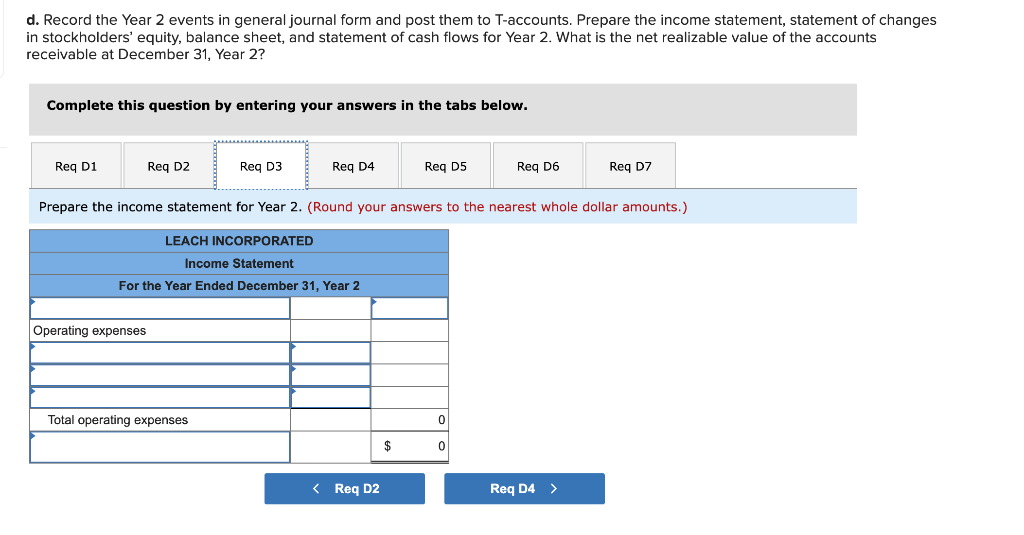

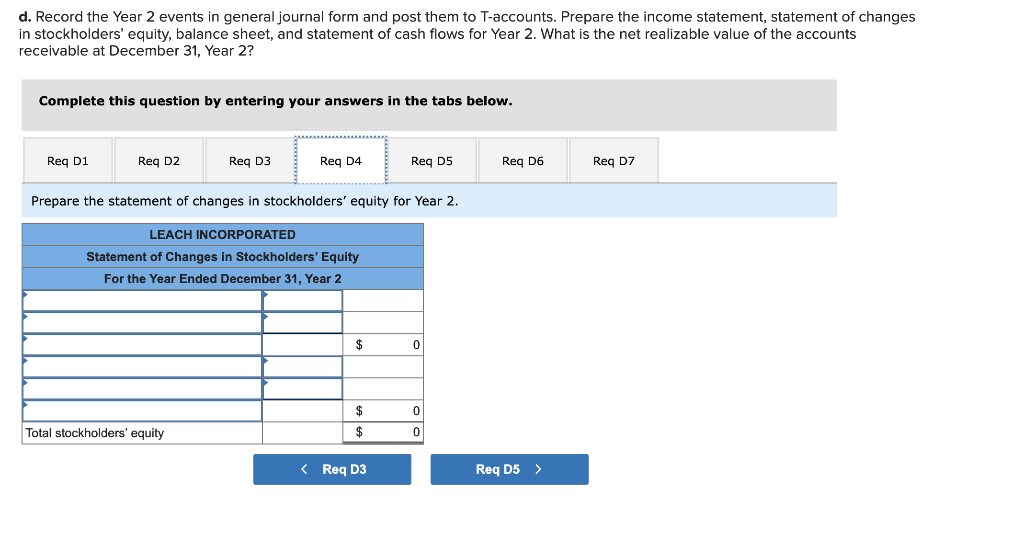

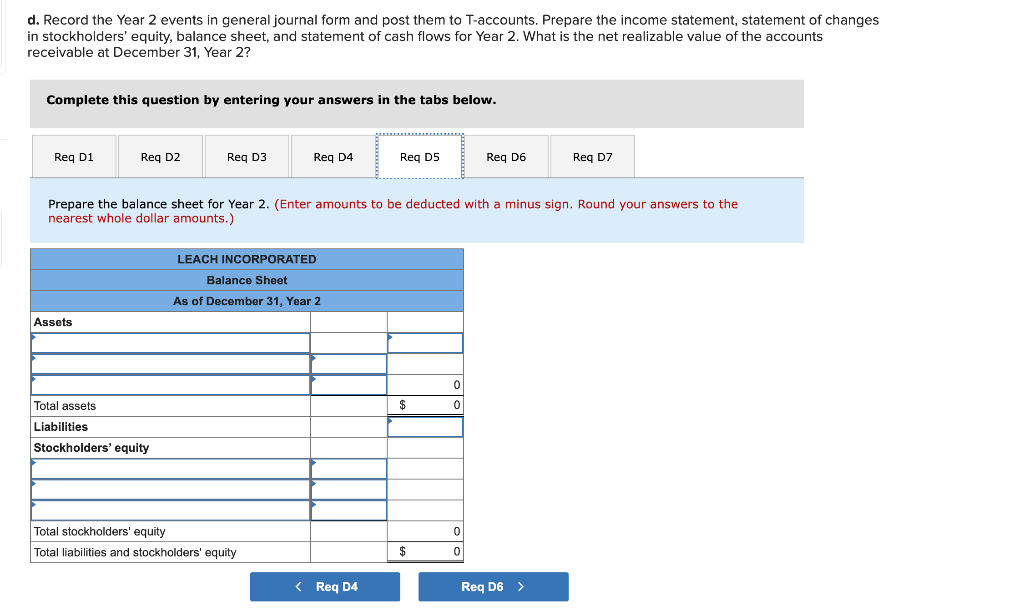

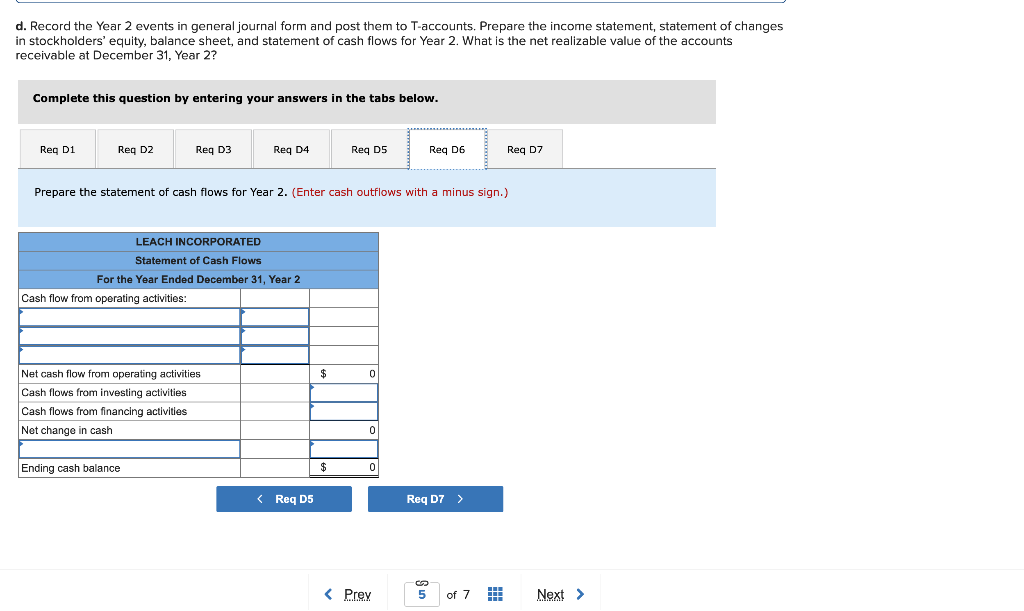

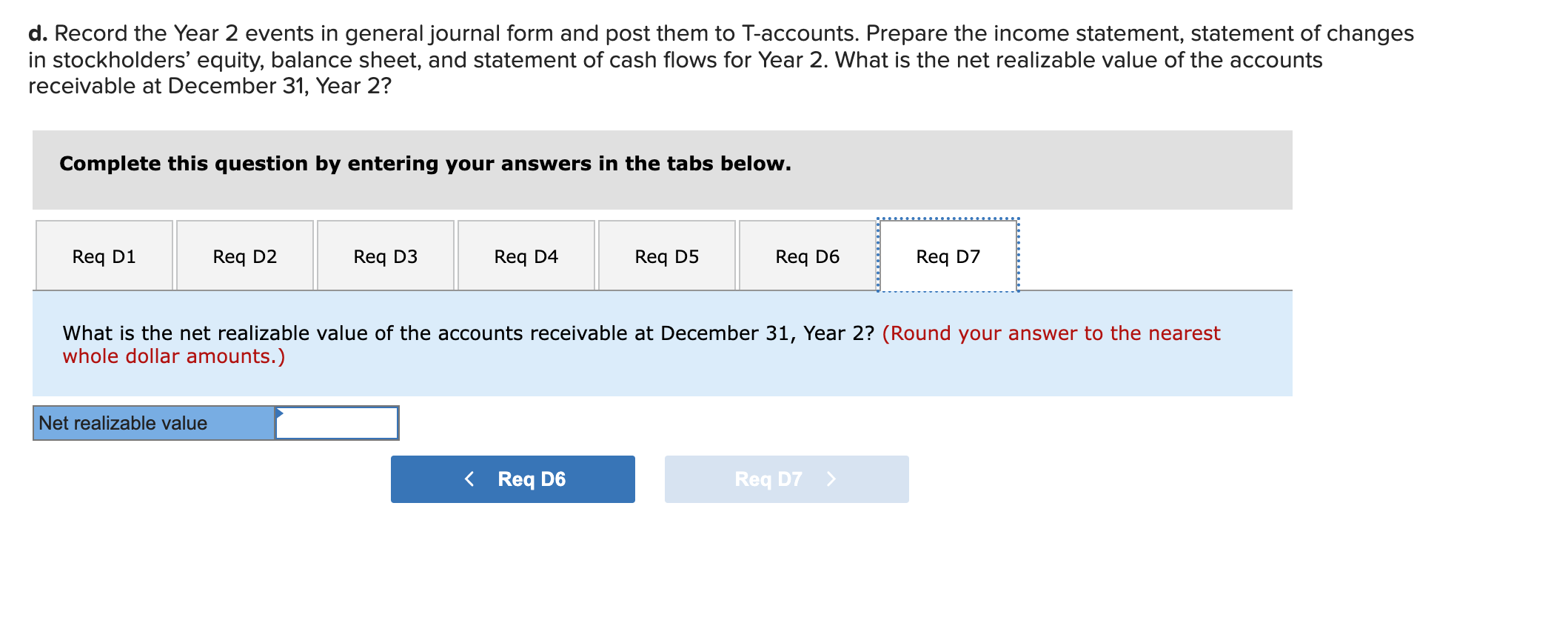

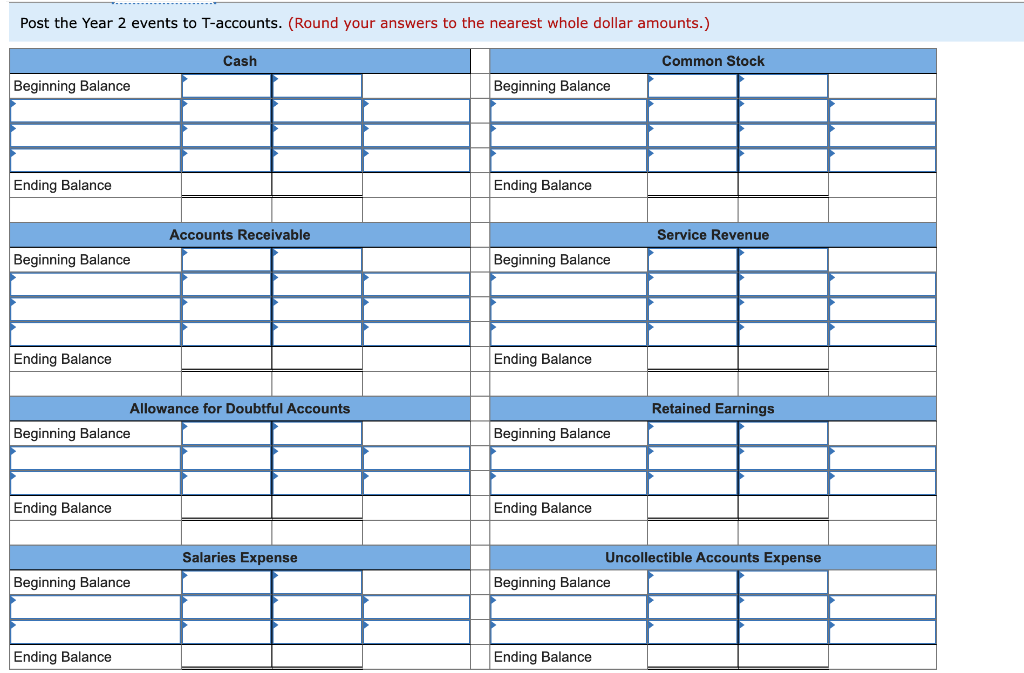

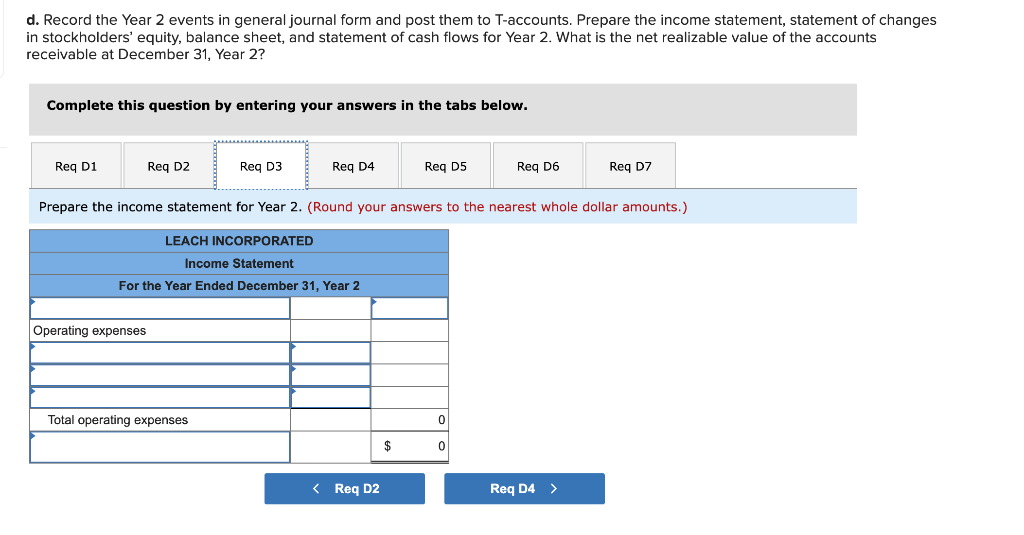

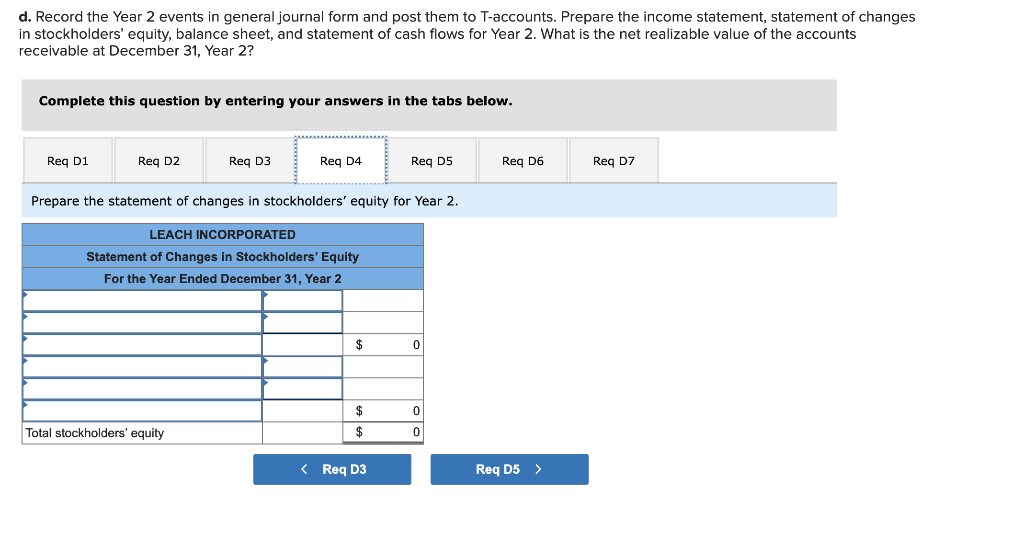

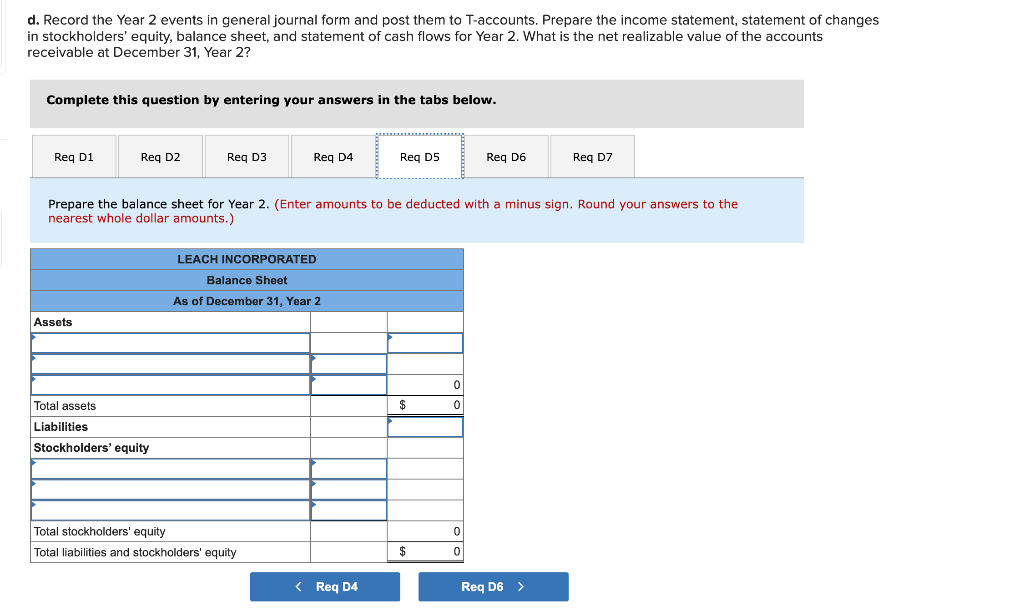

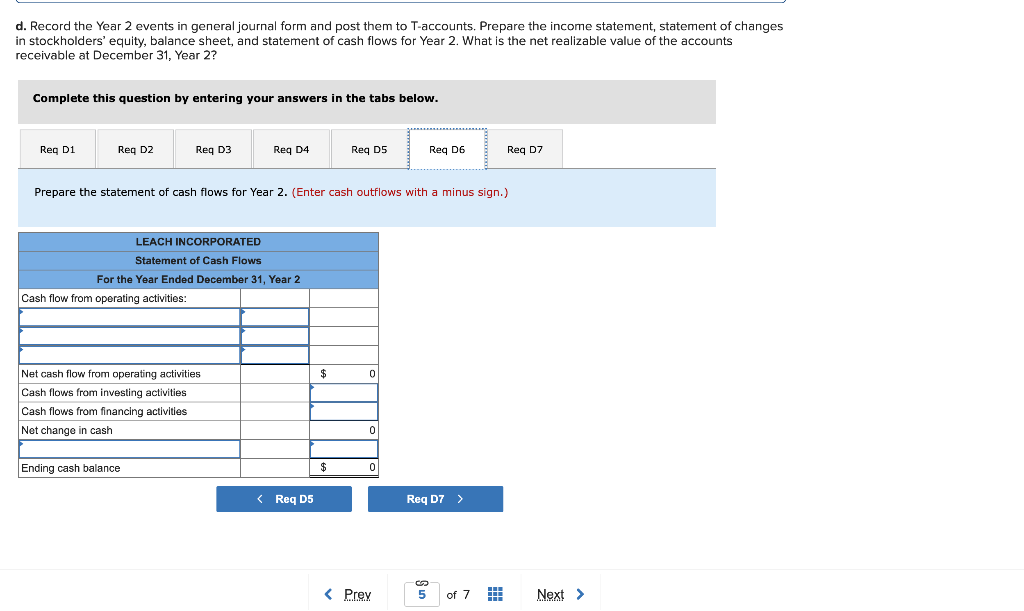

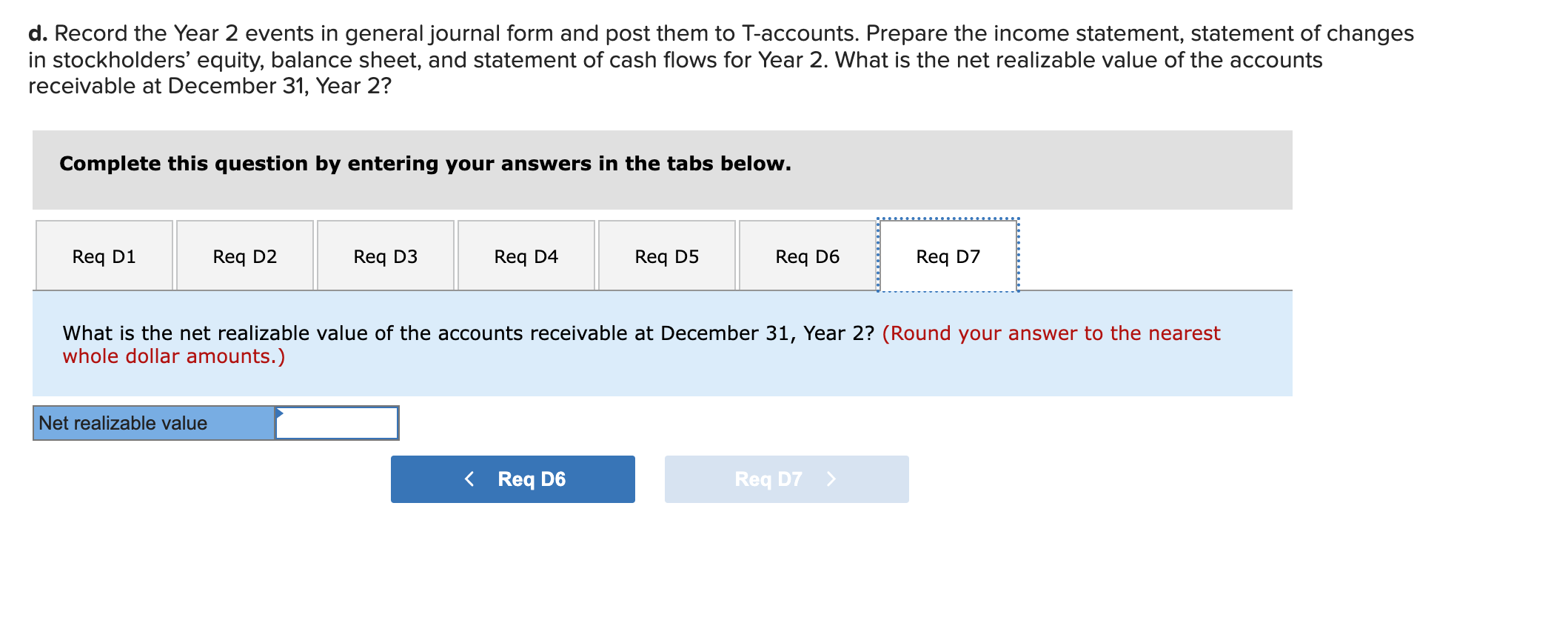

! Required information (The following information applies to the questions displayed below.) Leach Incorporated experienced the following events for the first two years of its operations. Year 1 1. Issued $15,000 of common stock for cash. 2. Provided $83,500 of services on account. 3. Provided $41,000 of services and received cash. 4. Collected $74,000 cash from accounts receivable. 5. Paid $43,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 4 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Year 2: 1. Wrote off an uncollectible account for $900. 2. Provided $93,000 of services on account. 3. Provided $37,000 of services and collected cash. 4. Collected $86,000 cash from accounts receivable. 5. Paid $70,000 of salaries expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 4 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. d. Record the Year 2 events in general journal form and post them to T-accounts. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. What is the net realizable value of the accounts receivable at December 31. Year 2? Post the Year 2 events to T-accounts. (Round your answers to the nearest whole dollar amounts.) Cash Common Stock Beginning Balance Beginning Balance Ending Balance Ending Balance Accounts Receivable Service Revenue Beginning Balance Beginning Balance Ending Balance Ending Balance Retained Earnings Allowance for Doubtful Accounts Beginning Balance Beginning Balance Ending Balance Ending Balance Salaries Expense Uncollectible Accounts Expense Beginning Balance Beginning Balance Ending Balance Ending Balance d. Record the Year 2 events in general journal form and post them to T-accounts. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. What is the net realizable value of the accounts receivable at December 31, Year 2? Complete this question by entering your answers in the tabs below. Req D1 Req D2 Req D3 Req D4 Req D5 Req D6 Reg D7 Prepare the income statement for Year 2. (Round your answers to the nearest whole dollar amounts.) LEACH INCORPORATED Income Statement For the Year Ended December 31, Year 2 Operating expenses Total operating expenses 0 $ 0 d. Record the Year 2 events in general journal form and post them to T-accounts. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. What is the net realizable value of the accounts receivable at December 31, Year 2? Complete this question by entering your answers in the tabs below. Req D1 Reg D2 Req D3 Req D4 Req D5 Reg D6 Req D7 Prepare the statement of changes in stockholders' equity for Year 2. LEACH INCORPORATED Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 2 $ 0 $ 0 Total stockholders' equity $ 0 d. Record the Year 2 events in general journal form and post them to T-accounts. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. What is the net realizable value of the accounts receivable at December 31, Year 2? Complete this question by entering your answers in the tabs below. Reg D1 Reg D2 Req D3 Reg D4 Reg D5 Reg D6 Reg D7 Prepare the balance sheet for Year 2. (Enter amounts to be deducted with a minus sign. Round your answers to the nearest whole dollar amounts.) LEACH INCORPORATED Balance Sheet As of December 31, Year 2 Assets 0 $ 0 Total assets Liabilities Stockholders' equity Total stockholders' equity Total liabilities and stockholders' equity $ d. Record the Year 2 events in general journal form and post them to T-accounts, Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. What is the net realizable value of the accounts receivable at December 31, Year 2? Complete this question by entering your answers in the tabs below. Reg D1 Reg D2 Req D3 Req D4 Reg D5 Req D6 Reg D7 Prepare the statement of cash flows for Year 2. (Enter cash outflows with a minus sign.) LEACH INCORPORATED Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flow from operating activities: $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash 0 Ending cash balance $ 0 d. Record the Year 2 events in general journal form and post them to T-accounts. Prepare the income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 2. What is the net realizable value of the accounts receivable at December 31, Year 2? Complete this question by entering your answers in the tabs below. Req D1 Req D2 Req D3 Reg D4 Req D5 Reg D6 Req D7 What is the net realizable value of the accounts receivable at December 31, Year 2? (Round your answer to the nearest whole dollar amounts.) Net realizable value