Question

Assume today is November 1, 2022 and that all bonds pay interest semi-annually with a face value of $1,000. YTM= Current yield + Capital

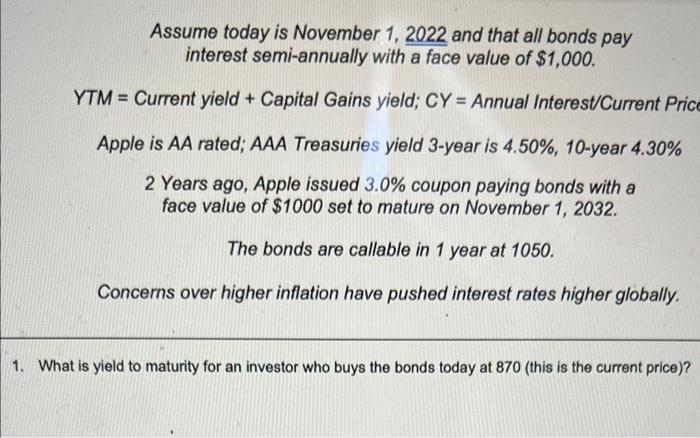

Assume today is November 1, 2022 and that all bonds pay interest semi-annually with a face value of $1,000. YTM= Current yield + Capital Gains yield; CY= Annual Interest/Current Price Apple is AA rated; AAA Treasuries yield 3-year is 4.50%, 10-year 4.30% 2 Years ago, Apple issued 3.0% coupon paying bonds with a face value of $1000 set to mature on November 1, 2032. The bonds are callable in 1 year at 1050. Concerns over higher inflation have pushed interest rates higher globally. 1. What is yield to maturity for an investor who buys the bonds today at 870 (this is the current price)?

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution To calculate the yield to maturity YTM for an investor who buys the bonds tod...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practicing Statistics Guided Investigations For The Second Course

Authors: Shonda Kuiper, Jeff Sklar

1st Edition

321586018, 978-0321586018

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App