Question

Leah Bergmann was in the mood to celebrate. Her third year running Leahs Fungly Christmas Sweaters (a sole proprietorship selling Christmas sweaters online) had been

Leah Bergmann was in the mood to celebrate. Her third year running Leahs Fungly Christmas Sweaters (a sole proprietorship selling Christmas sweaters online) had been an extraordinary success. There were certainly speed bumps along the way. Many of her friends and family thought that ugly Christmas sweaters were just a fad. Making matters worse, Leah knew that most of her sales would occur in a very short timeframe. Thus she would need to spend many months making sweaters, and then hope they sold during the holiday season. Yet Leah persevered, and for that reason, she knew that reviewing the past year would be extra satisfying

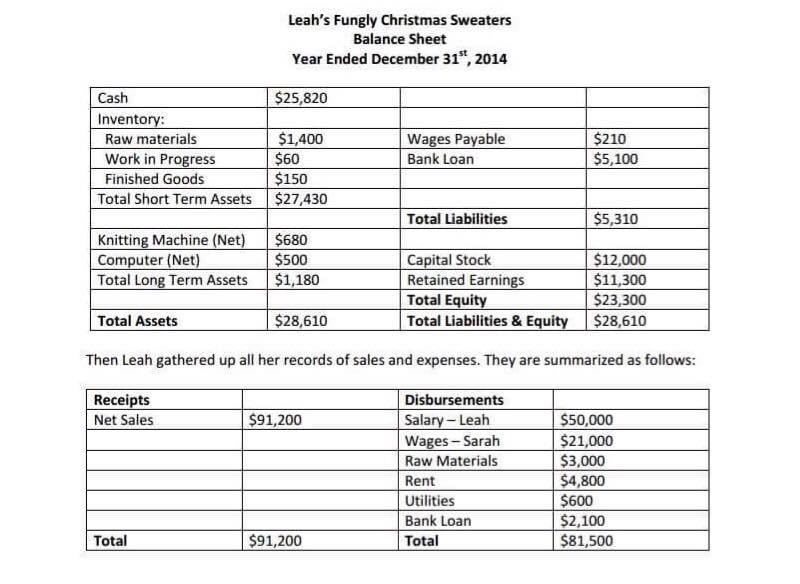

She started by looking at the previous years balance sheet:

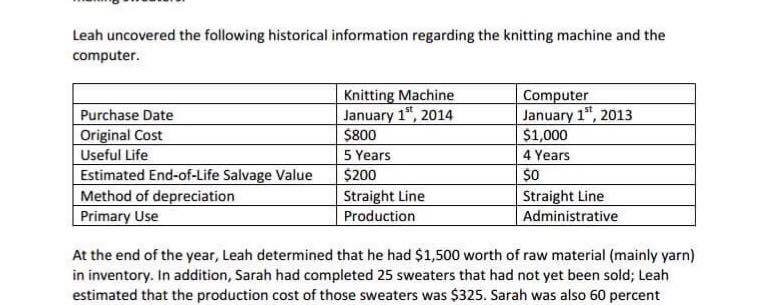

The business was run entirely out of one small room, for which rent was $400 per month. Leah estimated that 40% of the space was used for administrative tasks, the rest for sweater-making. Rent was always paid at the end of every month, as was the utility bill. In the early days Leah had made all the sweaters herself. But demand was so high that she had to hire Sarah Coatsworth in 2014 to make additional sweaters. To keep costs variable, Sarah was paid $10 per sweater. Meanwhile, Leah paid herself a salary of $50,000. As would be expected, she performed numerous administrative tasks required to run the business, and spent roughly 60% of her time making sweaters. Leah uncovered the following historical information regarding the knitting machine and the computer.

At the end of the year, Leah determined that he had $1,500 worth of raw material (mainly yarn) in inventory. In addition, Sarah had completed 25 sweaters that had not yet been sold; Leah estimated that the production cost of those sweaters was $325. Sarah was also 60 percent through 5 others. She was still due compensation for all of this work. Regarding the bank loan, Leah calculated that she was charged $240 worth of interest on the year. The rest of her payments to the bank went towards reducing the loan balance.

Questions (a) What is the 2015 wage debit to the work in progress inventory account? (2 marks)

(b) What is the Cost of Goods Sold expense for 2015? (2 marks)

(c) Create a 2015 income statement for Leahs Fungly Sweaters. (6 marks)

(d) Create a Balance Sheet as of December 31, 2015 for Leahs Fungly Sweaters. (6 marks)

Leah's Fungly Christmas sweaters Balance Sheet Year Ended December 31 2014 Cash $25,820 Inventory: S210 Wages Payable Raw materials $1.400 S60 Bank Loan RS5100 Work in Progress $150 Finished Goods Total Short Term Assets S27.430 Total Liabilities $5,310 Knitting Machine (Net) S680 TS12.000 Capital Stock $500 Computer (Net) Total Long Term Assets S1 180 $1,300 Retained Earnings $23,300 Total Equity Total Assets $28,610 Total Liabilities & Equity $28,610 Then Leah gathered up all her records of sales and expenses. They are summarized as follows: Receipts Disbursements salary-Leah $50,000 $91,200 Net Sales Wages-Sarah $21,000 Raw Materials $3,000 $4.800 Rent Utilities S600 Bank Loan $2,100 1,500 Total $91,200 Total Leah's Fungly Christmas sweaters Balance Sheet Year Ended December 31 2014 Cash $25,820 Inventory: S210 Wages Payable Raw materials $1.400 S60 Bank Loan RS5100 Work in Progress $150 Finished Goods Total Short Term Assets S27.430 Total Liabilities $5,310 Knitting Machine (Net) S680 TS12.000 Capital Stock $500 Computer (Net) Total Long Term Assets S1 180 $1,300 Retained Earnings $23,300 Total Equity Total Assets $28,610 Total Liabilities & Equity $28,610 Then Leah gathered up all her records of sales and expenses. They are summarized as follows: Receipts Disbursements salary-Leah $50,000 $91,200 Net Sales Wages-Sarah $21,000 Raw Materials $3,000 $4.800 Rent Utilities S600 Bank Loan $2,100 1,500 Total $91,200 TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started