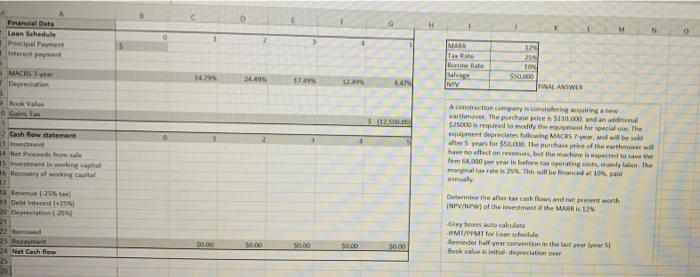

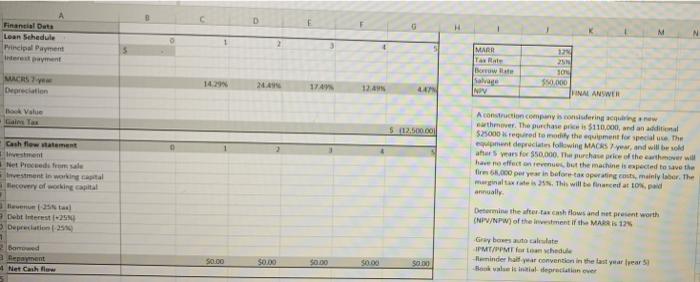

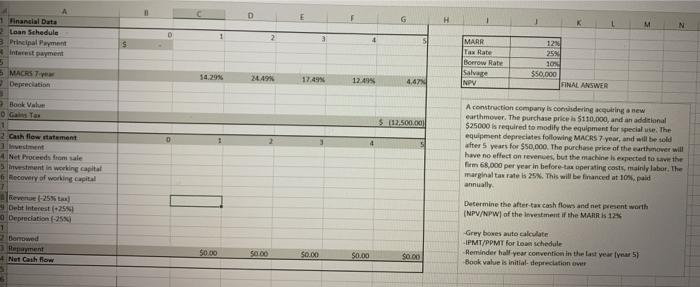

Lean Schedule MARI Texte 12 29 TON MACRS MAN 12. Savage NY JHNAL ANSWER Val $12.00 Cash flow statement A construction concerning warthmover the purchase price $110,000 dan anal $2.000 is a modify them for special. The en dentes flowing MACRS, and will be 5 years for 350.000 The murchase price of the water will neffectivenes, but the machine sto save the form 68.000 pyrainboererating collar. The mate. This will be financed 10 Bantining 16 Recovery of working 19 DSN Determine the auto cash flows and entworth NPV/W) of the investment the MARIS 12 Gwybos atakulete ME/PMT for de sche Seminderhalf corn in the lawyer Book was initial depreciation over 23 24 Net Cash flow 50.00 50.00 So.co G A Financial Data Lean Schedule Principal Payment 12 MARR Tax wat 14.29 SON 50.000 VINAL ANSWER Depreciation 17 LAN NIV Vahid Gain Tax $ 12,500.00 Cash flow watement estment Net Proceeds from sale vestment in working capital Becovery of working capital A construction company is considering gow thmover. The purchase price is $110,000, and an additional 525000 required to modify the ment for special use. The en deprecates following MACRS yw, and will be sold a pars for $50.000. The purchase price of the earthmover will have no effect on revenue, but the machine is expected to save the fire 61.000 per year in before tax operating costs, mainly be. The marginale. This will be finance ar to, pod annually Determine the trach flows and not present worth (NPV/NPW) of the entir the MARRIS 12% Benta Debt interest 25 Bormed Gray bees to calate IPMT/PPMT for whedule minder haar convention in the last year rear Belial depreciation over $0.00 $0.00 $0.00 Net Cashflow $0.00 D H A Financial Data Lean Schedule 3 Principal Payment N D 1 2 3 SO MARR Tax Rate Borrow Rate Salve NOV 12 25% 1 $50.000 FINAL ANSWER MACRS 7 Depreciation 14.29% 24.49% 17.49% 12.49% 4.47 Book Valur DGT $ 112,500.00 2 cash flow statement Investment Net Proceeds for sale vestment in working capital Recovery of working capital 7 Reverse 1-255 Debit interest(+25 Depreciation (-25 1 Benowed A construction company is considering acquiring a new earthmover. The purchase prices 5110,000, and an additional $25000 is required to modify the equipment for special use. The equipment depreciates following MACRS 7 year, and will be sold after 5 years for $50,000. The purchase price of the earthmover will have no effect on revenues, but the machine is expected to the firm 68.000 per year in before-tex operating costs, mainly labor, The marginal tax rate is 25. This will be financed at 10% paid annually Determine the after-tax cash flows and net present worth (NPV/NPW of the investment of the MARRIS 125 Grey bowes auto calculate IPMT/PPMT for Lo schedule Reminder hall your convention in the last year Book value is initial depreciation or $0.00 $0.00 Net Cash flow $0.00 $0.00