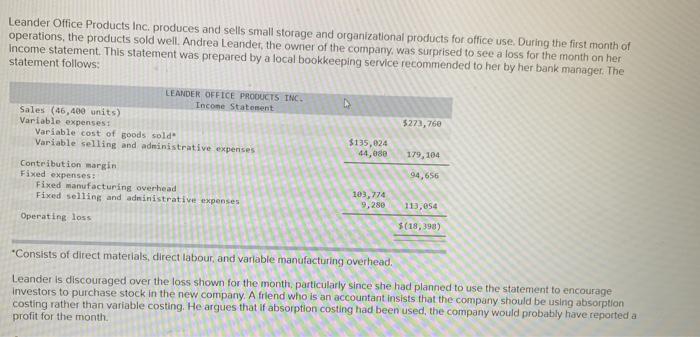

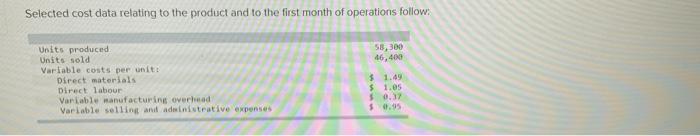

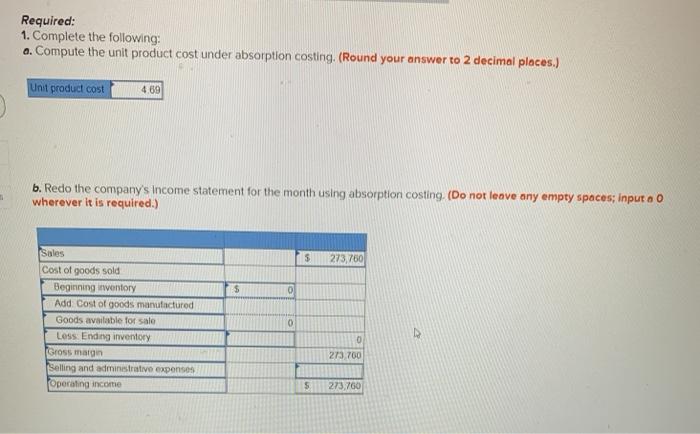

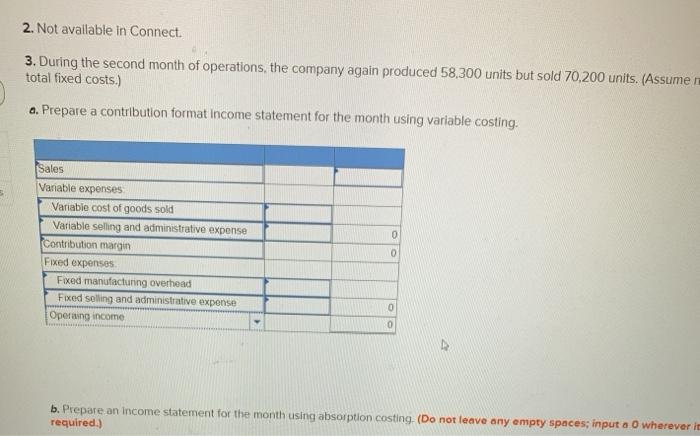

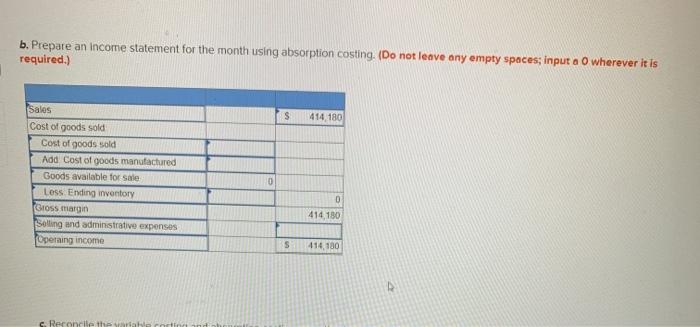

Leander Office Products Inc. produces and sells small storage and organizational products for office use. During the first month of operations, the products sold well. Andrea Leander, the owner of the company was surprised to see a loss for the month on her Income statement. This statement was prepared by a local bookkeeping service recommended to her by her bank manager. The statement follows: LEANDER OFFICE PRODUCTS INC. Income Statement Sales (46,400 units) 5273,76 Variable expenses Variable cost of goods sold $135,024 Variable selling and administrative expenses 44,080 179, 104 Contribution margin 94,656 Fixed expenses: Fixed manufacturing overhead 103,774 Fixed selling and administrative expenses 9,280 13,054 Operating loss $(18,398) Consists of direct materials, direct labour, and variable manufacturing overhead. Leander is discouraged over the loss shown for the month, particularly since she had planned to use the statement to encourage Investors to purchase stock in the new company. A friend who is an accountant insists that the company should be using absorption costing rather than variable costing. He argues that if absorption costing had been used, the company would probably have reported a profit for the month. Selected cost data relating to the product and to the first month of operations follow: 58,300 46,400 Units produced Units sold Variable costs per unit: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses $ 1.49 $ 1.05 $0. $5.95 Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. (Round your answer to 2 decimal places.) Unit product cost 4.89 b. Redo the company's Income statement for the month using absorption costing. (Do not leave any empty spaces; input o 0 wherever it is required.) 5 273,760 $ 0 Sales Cost of goods sold Beginning inventory Add Cost of goods manufactured Goods available for sale Less Ending inventory Grossmagn Selling and administrative expenses Operating income 0 0 273.700 5 273,760 2. Not available in Connect 3. During the second month of operations, the company again produced 58,300 units but sold 70,200 units. (Assume total fixed costs.) a. Prepare a contribution format income statement for the month using variable costing. 5 0 Sales Vanable expenses Variable cost of goods sold Variable selling and administrative expense Contribution margin Fixed expenses Fixed manufacturing overhoad Fixed selling and administrative expense Operaing income 0 0 0 b. Prepare an income statement for the month using absorption costing (Do not leave any empty spaces; input a O wherever i required.) b. Prepare an income statement for the month using absorption costing. (Do not leave any empty spaces; input a 0 wherever it is required.) 414 180 Sales Cost of goods sold Cost of goods sold Add Cost of goods manufactured Goods available for sale Loss Ending inventory Gross margin Selling and administrative expenses Operaing income 0 0 414180 S 414,100 c. Reconcile therah