Question

Lear Corporation (LEA) QUESTIONS Calculate the DuPont decomposition Calculate the DuPont Decomposition for each of the three years for your company. The DuPont Decomposition is

Lear Corporation (LEA)

QUESTIONS

Calculate the DuPont decomposition

Calculate the DuPont Decomposition for each of the three years for your company. The DuPont Decomposition is composed of

ROE = NI/Equity = NI/Sales *Sales/Assets * Assets/Equity

Therefore, you should have a total of twelve calculations (four ratios for each of the three years).

Determine liquidity.

Determine the companys liquidity by calculating the current ratio, the quick ratio, and the cash ratio for each of the three years. This should be a total of nine calculations.

| NI/Equity | NI/Sales | Sales/Assets | Assets/Equity | Current Ratio | Quick Ratio | Cash Ratio | |

| 2014 | |||||||

| 2015 | |||||||

| 2016 |

"OTHER QUESTIONS"

Has the company drastically increased or decreased its use of debt?

Has the companys liquidity position changed over the three years?

Has ROE been rising or falling? If so, what has contributed to this change?

What trends do you see developing in the data?

Do you see any major changes in the financial status of the company over the time period?

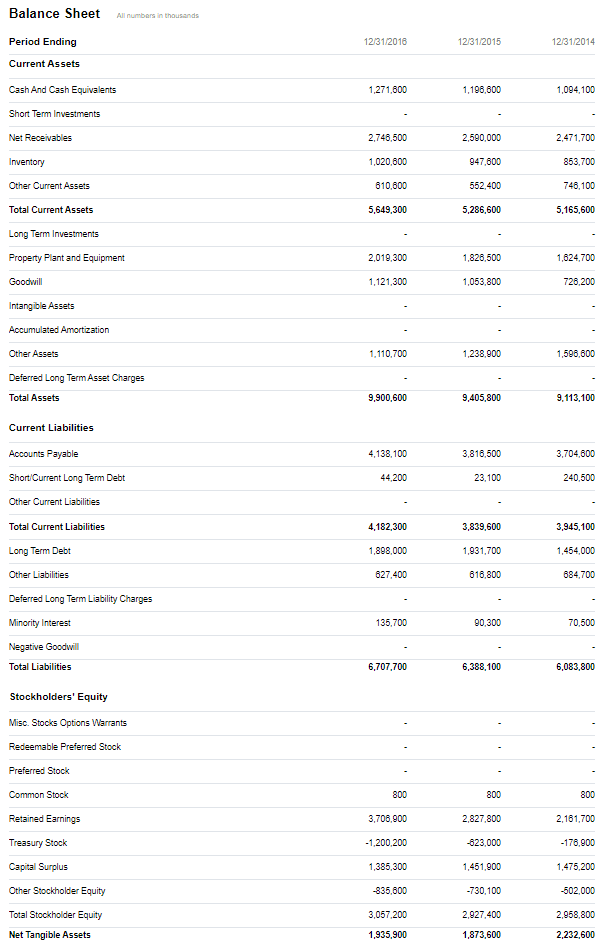

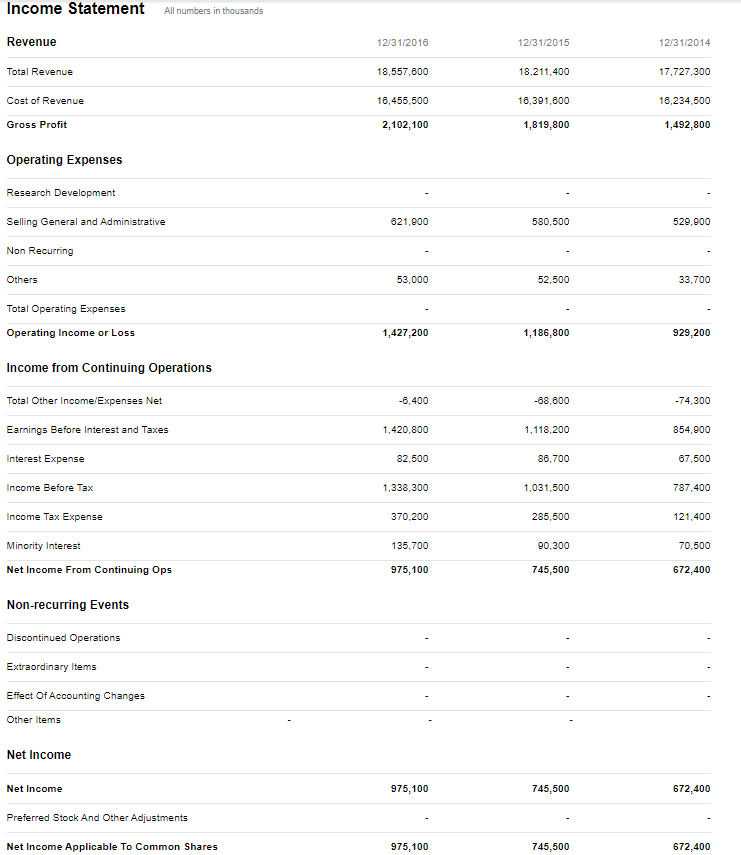

Balance Sheet Period Ending Current Assets 12/31/2016 12/31/2015 12/31/2014 Cash And Cash Equivalents 1271,600 1,196,600 1,094,100 Short Term Investments 2,746,500 1,020,800 610,800 5,649,300 2,590,000 947,600 552,400 5,286,600 2.471,700 853,700 748,100 5,165,600 Other Current Assets Total Current Assets Long Term Investments Property Flant and Equipment 2,019,300 1,826,500 1,624,700 1,121,300 1,053,800 728,200 Intangible Assets Other Assets 1.110,700 1,238,900 1,596,800 Deferred Long TermAsset Charges Total Assets 9,900,600 9,405,800 9,113,100 Current Liabilities Accounts Payable Short Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities 4,138,100 3,816,500 3,704,600 44,200 23,100 240,500 4,182,300 1,898,000 627,400 3,839,600 1,931,700 616,800 3,945,100 1,454,000 684,700 Deferred Long Term Liability Charges Minority Interest Negative Goodwill Total Liabilities 135,700 90,300 70,500 6,707,700 6,388,100 6,083,800 Stockholders' Equity Misc. Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Net Tangible Assets 3,706,900 1,200,200 1,385,300 835,600 3,057,200 1,935,900 2,827,800 823,000 1.451,900 -730,100 2,927,400 1,873,600 2,161,700 176,900 1,475,200 502,000 2,958,800 2,232,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started