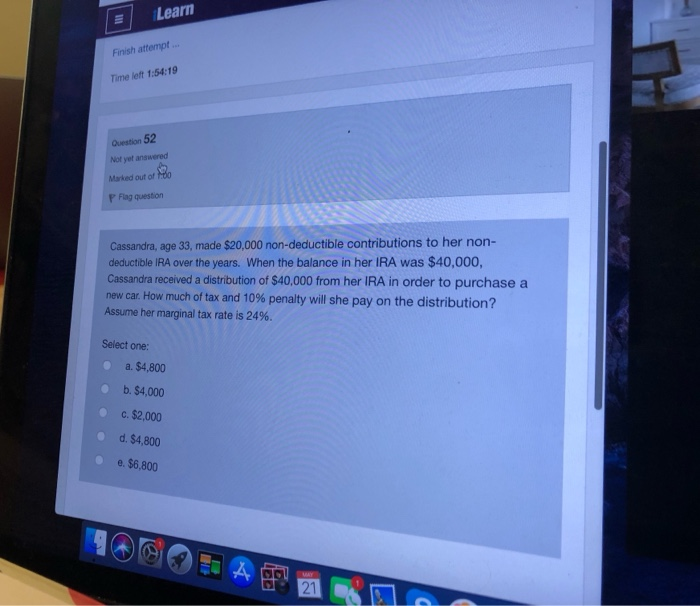

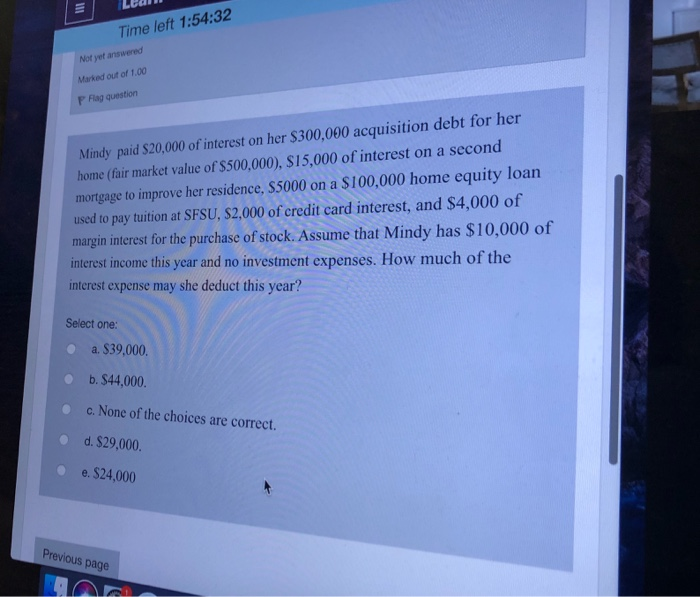

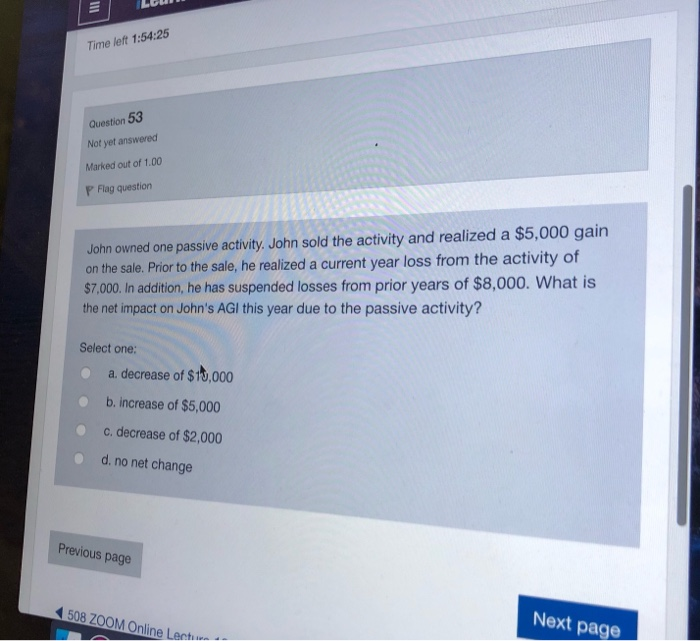

Learn Finish attempt Time left 1:54:19 Question 52 Not yet answered Marked out of to P Flag question Cassandra, age 33, made $20,000 non-deductible contributions to her non- deductible IRA over the years. When the balance in her IRA was $40,000, Cassandra received a distribution of $40,000 from her IRA in order to purchase a new car. How much of tax and 10% penalty will she pay on the distribution? Assume her marginal tax rate is 24%. Select one: a. $4,800 b. $4,000 c. $2,000 d. $4,800 e. $6,800 216 Time left 1:54:32 Nor yet answered Marked out of 1.00 P Flag question Mindy paid $20,000 of interest on her $300,000 acquisition debt for her home (fair market value of $500,000), $15,000 of interest on a second mortgage to improve her residence, $5000 on a $100,000 home equity loan used to pay tuition at SFSU, S2,000 of credit card interest, and $4,000 of margin interest for the purchase of stock. Assume that Mindy has $10,000 of interest income this year and no investment expenses. How much of the interest expense may she deduct this year? Select one: a. $39.000. b. $44,000. c. None of the choices are correct. d. $29,000 e. $24,000 Previous page E Time left 1:54:25 Question 53 Not yet answered Marked out of 1.00 P Flag question John owned one passive activity. John sold the activity and realized a $5,000 gain on the sale. Prior to the sale, he realized a current year loss from the activity of $7,000. In addition, he has suspended losses from prior years of $8,000. What is the net impact on John's AG this year due to the passive activity? Select one: a. decrease of $15,000 b. increase of $5,000 c. decrease of $2,000 d. no net change Previous page 508 ZOOM Online Leat- Next page Learn Finish attempt Time left 1:54:19 Question 52 Not yet answered Marked out of to P Flag question Cassandra, age 33, made $20,000 non-deductible contributions to her non- deductible IRA over the years. When the balance in her IRA was $40,000, Cassandra received a distribution of $40,000 from her IRA in order to purchase a new car. How much of tax and 10% penalty will she pay on the distribution? Assume her marginal tax rate is 24%. Select one: a. $4,800 b. $4,000 c. $2,000 d. $4,800 e. $6,800 216 Time left 1:54:32 Nor yet answered Marked out of 1.00 P Flag question Mindy paid $20,000 of interest on her $300,000 acquisition debt for her home (fair market value of $500,000), $15,000 of interest on a second mortgage to improve her residence, $5000 on a $100,000 home equity loan used to pay tuition at SFSU, S2,000 of credit card interest, and $4,000 of margin interest for the purchase of stock. Assume that Mindy has $10,000 of interest income this year and no investment expenses. How much of the interest expense may she deduct this year? Select one: a. $39.000. b. $44,000. c. None of the choices are correct. d. $29,000 e. $24,000 Previous page E Time left 1:54:25 Question 53 Not yet answered Marked out of 1.00 P Flag question John owned one passive activity. John sold the activity and realized a $5,000 gain on the sale. Prior to the sale, he realized a current year loss from the activity of $7,000. In addition, he has suspended losses from prior years of $8,000. What is the net impact on John's AG this year due to the passive activity? Select one: a. decrease of $15,000 b. increase of $5,000 c. decrease of $2,000 d. no net change Previous page 508 ZOOM Online Leat- Next page