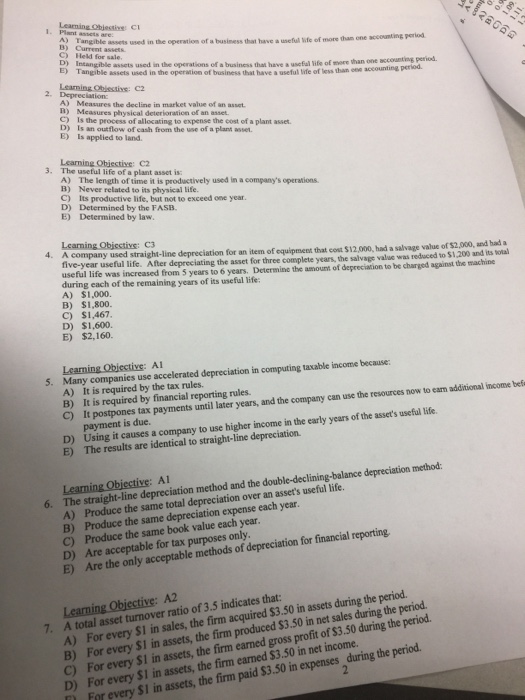

Learning Objessive ci Tangible assets used in the operation of a business that have a useful ife of more tham one B) Current assets C) Held for sale. accounting period D) Intangible assets used in the operations of a business thai have a useful ife of more than one E) Tangible assets used in the operation of business that have a useful tife of less than eee accounting than one accounting period Learming CObiessive: C2 period 2. Depreciation A) Meaures the decline in market value of an asst D) Measures physical deterioration of an asset. C) Is the process of allocating to expense the cost of a plant asset D) Is an outflow of cash from the use of a plant assent. E) Is applied to land. Learning Obiective: C2 3. The useful life of a plant asset is A) The length of time it is productively used in a company's operations B) Never related to its physical life. C) Its productive life, but not to exceed one year. D) Determined by the FASB E) Determined by law Lcarning Objcctivs: C3 A company used straight-line depreciation for an item of equipment that cost $12,000, had a salvage value of $2,000, and had a useful life. After depreciating the asset for three complete years, the salvage valuc was reduced to $1.200 and its tota useful life was increased from 5 years to 6 years. Determine the amount of depreciation to be charged against the machine during each of the remaining years of its useful life: A) $1,000. B) $1,800. C) $1,467 D) $1,600. E) $2,160. A1 Many companies use A) 5. It is required by the tax rules. It is required by financial reporting rules. It postpones tax payments until later years, and the payment is due. B) C) D) Using it causes a company to use higher income in the early years of the asset's useful life. E) The results are identical to straight-line depreciation A) Produce the same total depreciation over an asset's useful life. B) Produce the same depreciation expense each year. C) Produce the same book value each year. D) Are acceptable for tax purposes only E) Are the only acceptable methods of depreciation for financial reporting 6. The straight-line depreciation method and the double-declining-balance depreciation method: Learning Objective: A2 A total asset turnover ratio of 3.5 indicates that A) For every SI in sales, the firm acquired $3.50 in assets during the period. 7. B) F C) For every $1 in assets, the firm earned gross profit of $3.50 during the period. D) For every $1 in assets, the firm earned $3.50 in net income. or every SI in assets, the firm produced $3.50 in net sales during the period. For every $I in assets, the firm paid $3.50 in expenses during the period