Question

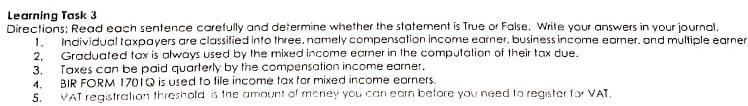

Learning Task 3 Directions: Read each sentence carefully and determine whether the statement is True or False. Write your answers in your journal. 1.

Learning Task 3 Directions: Read each sentence carefully and determine whether the statement is True or False. Write your answers in your journal. 1. Individual taxpayers are classified into three, namely compensation income earner, business income earner, and multiple earner 2, Graduated tax is always used by the mixed income earner in the computation of their tax due. Taxes can be paid quarterly by the compensation income earner. 3. 4. BIR FORM 1701Q is used to file income tax for mixed income earners. 5. VAT registration threshold is the amount of money you can earn before you need to register for VAT.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 False Only two types of income earners are there Business income earner and mult...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Algebra and Trigonometry

Authors: Ron Larson

10th edition

9781337514255, 1337271179, 133751425X, 978-1337271172

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App