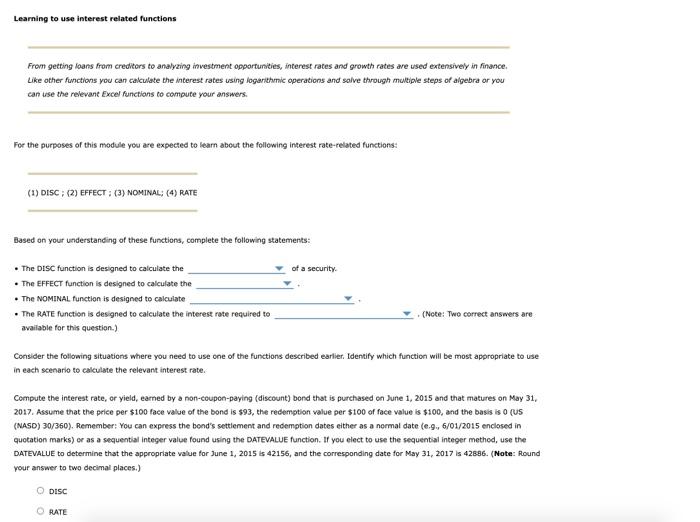

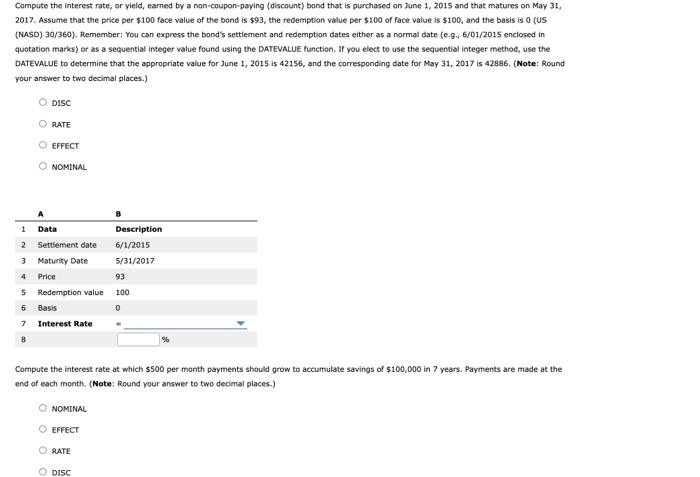

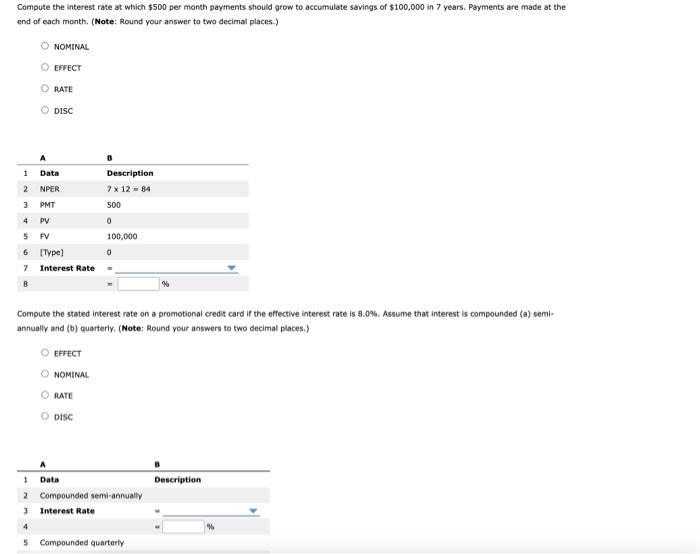

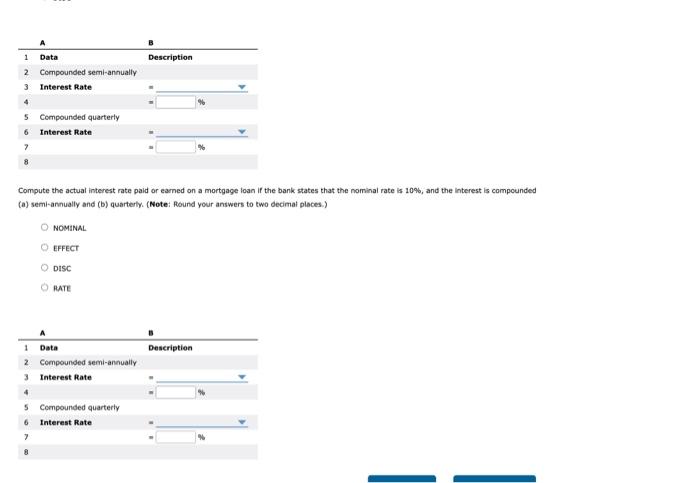

Learning to use interest related functions From getting loans from creditors to analyzing investment opportunities, interest rates and growth rates are used extensively in finance. Like other functions you can calculate the interest rates using logarithmic operations and solve through multiple steps of algebra or you can use the relevant Excel functions to compute your answers. For the purposes of this module you are expected to learn about the following interest rate-related functions: (1) DISC; (2) EFFECT; (3) NOMINAL; (4) RATE Based on your understanding of these functions, complete the following statements: The DISC function is designed to calculate the The EFFECT function is designed to calculate the The NOMINAL function is designed to calculate The RATE function is designed to calculate the interest rate required to available for this question.) of a security. (Note: Two correct answers are Consider the following situations where you need to use one of the functions described earlier. Identify which function will be most appropriate to use in each scenario to calculate the relevant interest rate. O DISC ORATE Compute the interest rate, or yield, earned by a non-coupon-paying (discount) bond that is purchased on June 1, 2015 and that matures on May 31, 2017. Assume that the price per $100 face value of the bond is $93, the redemption value per $100 of face value is $100, and the basis is 0 (US (NASD) 30/360). Remember: You can express the bond's settlement and redemption dates either as a normal date (e.g., 6/01/2015 enclosed in quotation marks) or as a sequential integer value found using the DATEVALUE function. If you elect to use the sequential integer method, use the DATEVALUE to determine that the appropriate value for June 1, 2015 is 42156, and the corresponding date for May 31, 2017 is 42886. (Note: Round your answer to two decimal places.) Compute the interest rate, or yield, earned by a non-coupon-paying (discount) bond that is purchased on June 1, 2015 and that matures on May 31, 2017. Assume that the price per $100 face value of the bond is $93, the redemption value per $100 of face value is $100, and the basis is 0 (US (NASD) 30/360). Remember: You can express the bond's settlement and redemption dates either as a normal date (e.g., 6/01/2015 enclosed in quotation marks) or as a sequential integer value found using the DATEVALUE function. If you elect to use the sequential integer method, use the DATEVALUE to determine that the appropriate value for June 1, 2015 is 42156, and the corresponding date for May 31, 2017 is 42886. (Note: Round your answer to two decimal places.) DISC RATE O EFFECT O NOMINAL A 1 2 Settlement date 3 Maturity Date Data 4 Price 5 Redemption value 6 Basis 7 Interest Rate 8 O NOMINAL EFFECT RATE 8 Compute the interest rate at which $500 per month payments should grow to accumulate savings of $100,000 in 7 years. Payments are made at the end of each month. (Note: Round your answer to two decimal places.) O DISC Description 6/1/2015 5/31/2017 93 100 0 Compute the interest rate at which $500 per month payments should grow to accumulate savings of $100,000 in 7 years. Payments are made at the end of each month. (Note: Round your answer to two decimal places.) O NOMINAL EFFECT RATE O DISC A 1 Data 2 NPER 3 PMT 4 PV 5 FV 6 [Type] 7 Interest Rate B NOMINAL Description 7 x 12 = 84 500 0 100,000 Compute the stated interest rate on a promotional credit card if the effective interest rate is 8.0%. Assume that interest is compounded (a) semi- annually and (b) quarterly. (Note: Round your answers to two decimal places.) O EFFECT ORATE O DISC 0 1 Data 2 Compounded semi-annually 3 Interest Rate 4 5 Compounded quarterly Description 1 Data 2 3 Interest Rate 4 7 8 5 6 Interest Rate A 3 4 Compounded semi-annually 5 Compounded quarterly Compute the actual interest rate paid or earned on a mortgage loan if the bank states that the nominal rate is 10%, and the interest is compounded (a) semi-annually and (b) quarterly. (Note: Round your answers to two decimal places.) 6 7 1 Data 2 Compounded semi-annually Interest Rate O NOMINAL O EFFECT O DISC RATE Description Compounded quarterly Interest Rate Description Learning to use interest related functions From getting loans from creditors to analyzing investment opportunities, interest rates and growth rates are used extensively in finance. Like other functions you can calculate the interest rates using logarithmic operations and solve through multiple steps of algebra or you can use the relevant Excel functions to compute your answers. For the purposes of this module you are expected to learn about the following interest rate-related functions: (1) DISC; (2) EFFECT; (3) NOMINAL; (4) RATE Based on your understanding of these functions, complete the following statements: The DISC function is designed to calculate the The EFFECT function is designed to calculate the The NOMINAL function is designed to calculate The RATE function is designed to calculate the interest rate required to available for this question.) of a security. (Note: Two correct answers are Consider the following situations where you need to use one of the functions described earlier. Identify which function will be most appropriate to use in each scenario to calculate the relevant interest rate. O DISC ORATE Compute the interest rate, or yield, earned by a non-coupon-paying (discount) bond that is purchased on June 1, 2015 and that matures on May 31, 2017. Assume that the price per $100 face value of the bond is $93, the redemption value per $100 of face value is $100, and the basis is 0 (US (NASD) 30/360). Remember: You can express the bond's settlement and redemption dates either as a normal date (e.g., 6/01/2015 enclosed in quotation marks) or as a sequential integer value found using the DATEVALUE function. If you elect to use the sequential integer method, use the DATEVALUE to determine that the appropriate value for June 1, 2015 is 42156, and the corresponding date for May 31, 2017 is 42886. (Note: Round your answer to two decimal places.) Compute the interest rate, or yield, earned by a non-coupon-paying (discount) bond that is purchased on June 1, 2015 and that matures on May 31, 2017. Assume that the price per $100 face value of the bond is $93, the redemption value per $100 of face value is $100, and the basis is 0 (US (NASD) 30/360). Remember: You can express the bond's settlement and redemption dates either as a normal date (e.g., 6/01/2015 enclosed in quotation marks) or as a sequential integer value found using the DATEVALUE function. If you elect to use the sequential integer method, use the DATEVALUE to determine that the appropriate value for June 1, 2015 is 42156, and the corresponding date for May 31, 2017 is 42886. (Note: Round your answer to two decimal places.) DISC RATE O EFFECT O NOMINAL A 1 2 Settlement date 3 Maturity Date Data 4 Price 5 Redemption value 6 Basis 7 Interest Rate 8 O NOMINAL EFFECT RATE 8 Compute the interest rate at which $500 per month payments should grow to accumulate savings of $100,000 in 7 years. Payments are made at the end of each month. (Note: Round your answer to two decimal places.) O DISC Description 6/1/2015 5/31/2017 93 100 0 Compute the interest rate at which $500 per month payments should grow to accumulate savings of $100,000 in 7 years. Payments are made at the end of each month. (Note: Round your answer to two decimal places.) O NOMINAL EFFECT RATE O DISC A 1 Data 2 NPER 3 PMT 4 PV 5 FV 6 [Type] 7 Interest Rate B NOMINAL Description 7 x 12 = 84 500 0 100,000 Compute the stated interest rate on a promotional credit card if the effective interest rate is 8.0%. Assume that interest is compounded (a) semi- annually and (b) quarterly. (Note: Round your answers to two decimal places.) O EFFECT ORATE O DISC 0 1 Data 2 Compounded semi-annually 3 Interest Rate 4 5 Compounded quarterly Description 1 Data 2 3 Interest Rate 4 7 8 5 6 Interest Rate A 3 4 Compounded semi-annually 5 Compounded quarterly Compute the actual interest rate paid or earned on a mortgage loan if the bank states that the nominal rate is 10%, and the interest is compounded (a) semi-annually and (b) quarterly. (Note: Round your answers to two decimal places.) 6 7 1 Data 2 Compounded semi-annually Interest Rate O NOMINAL O EFFECT O DISC RATE Description Compounded quarterly Interest Rate Description