Answered step by step

Verified Expert Solution

Question

1 Approved Answer

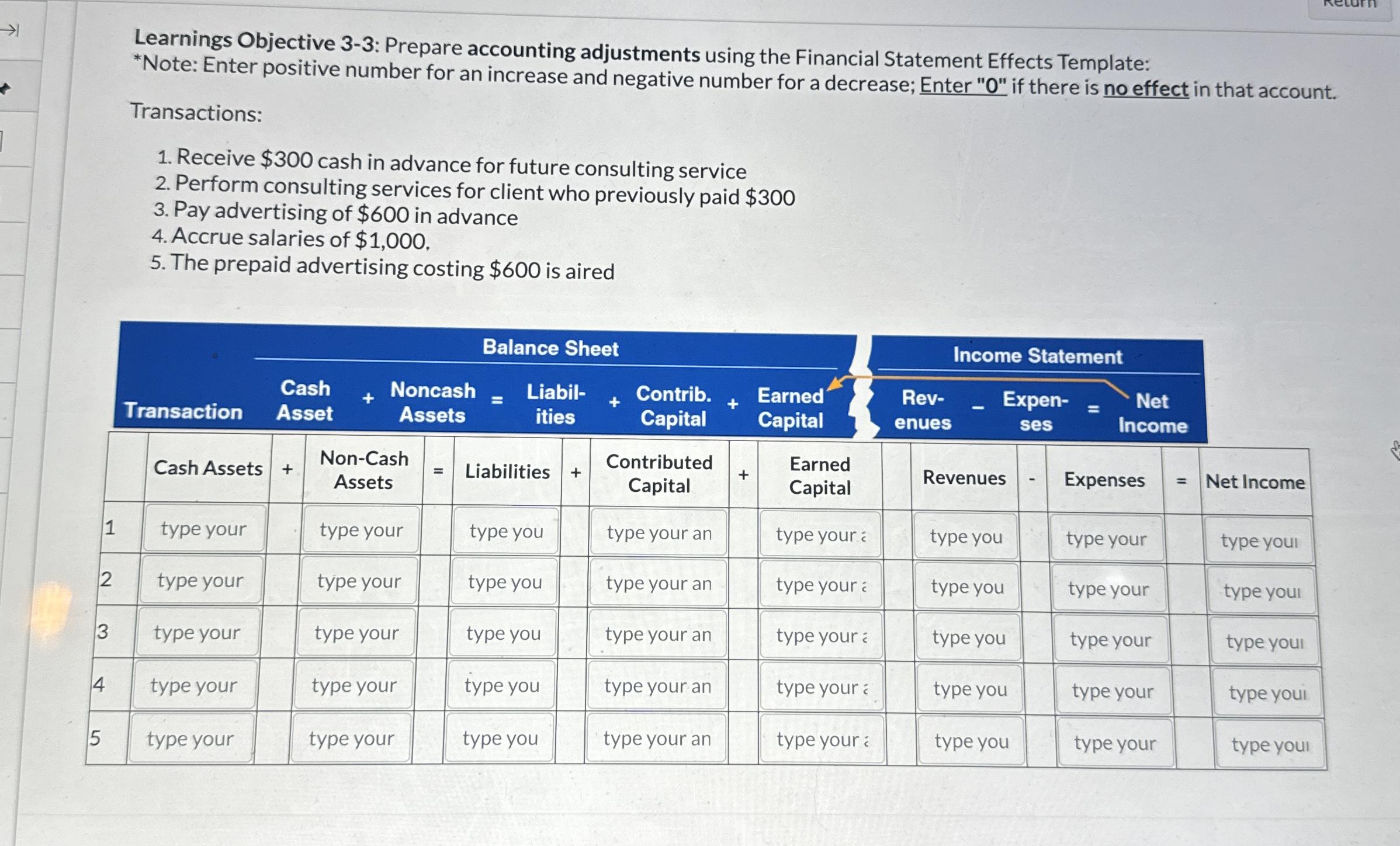

> Learnings Objective 3-3: Prepare accounting adjustments using the Financial Statement Effects Template: *Note: Enter positive number for an increase and negative number for

> Learnings Objective 3-3: Prepare accounting adjustments using the Financial Statement Effects Template: *Note: Enter positive number for an increase and negative number for a decrease; Enter "0" if there is no effect in that account. Transactions: 1. Receive $300 cash in advance for future consulting service 2. Perform consulting services for client who previously paid $300 3. Pay advertising of $600 in advance 4. Accrue salaries of $1,000. 5. The prepaid advertising costing $600 is aired Balance Sheet Income Statement Transaction Cash Asset + Noncash Assets = Liabil- ities + Contrib. Capital Capital Earned + Rev- enues Expen- = ses Net Income Cash Assets + Non-Cash Assets = Liabilities + Contributed Capital + Earned Capital Revenues Expenses = Net Income 1 type your type your type you type your an type your a type you type your type you! 2 type your type your type you type your an type your type you type your type you! 3 type your type your type you type your an type your type you type your type your 4 type your type your type you type your an type your type you type your type you! 5 type your type your type you type your an type your type you type your type your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started