Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lease [24 marks] On August 1, 2023, Holly Co. leased a laser cutting machine to Ivy Co. under an 8-year lease. Both companies use

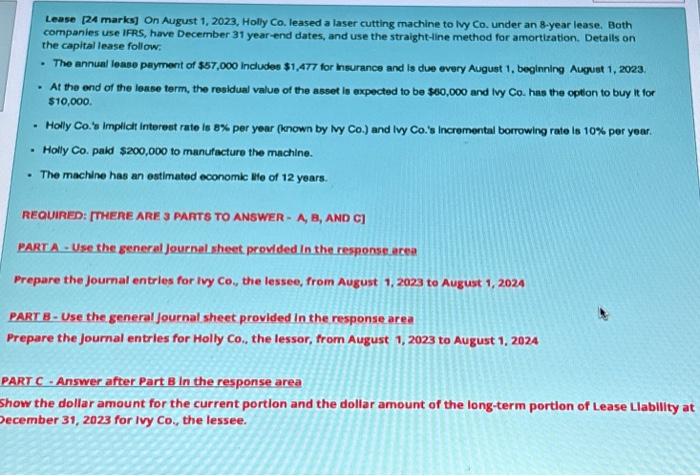

Lease [24 marks] On August 1, 2023, Holly Co. leased a laser cutting machine to Ivy Co. under an 8-year lease. Both companies use IFRS, have December 31 year-end dates, and use the straight-line method for amortization. Details on the capital lease follow The annual lease payment of $57,000 Includes $1,477 for Insurance and is due every August 1, beginning August 1, 2023. At the end of the lease term, the residual value of the asset is expected to be $60,000 and Ivy Co. has the option to buy it for $10,000. Holly Co.'s Implicit interest rate is 8% per year (known by ivy Co.) and Ivy Co.'s Incremental borrowing rate is 10% per year. Holly Co. paid $200,000 to manufacture the machine. The machine has an estimated economic life of 12 years. REQUIRED: THERE ARE 3 PARTS TO ANSWER-A, B, AND C] PART A-Use the general Journal sheet provided in the response area Prepare the journal entries for Ivy Co., the lessee, from August 1, 2023 to August 1, 2024 PART B-Use the general journal sheet provided in the response area Prepare the journal entries for Holly Co., the lessor, from August 1, 2023 to August 1, 2024 PART C-Answer after Part B In the response area Show the dollar amount for the current portion and the dollar amount of the long-term portion of Lease Llability at December 31, 2023 for Ivy Co., the lessee.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started