Answered step by step

Verified Expert Solution

Question

1 Approved Answer

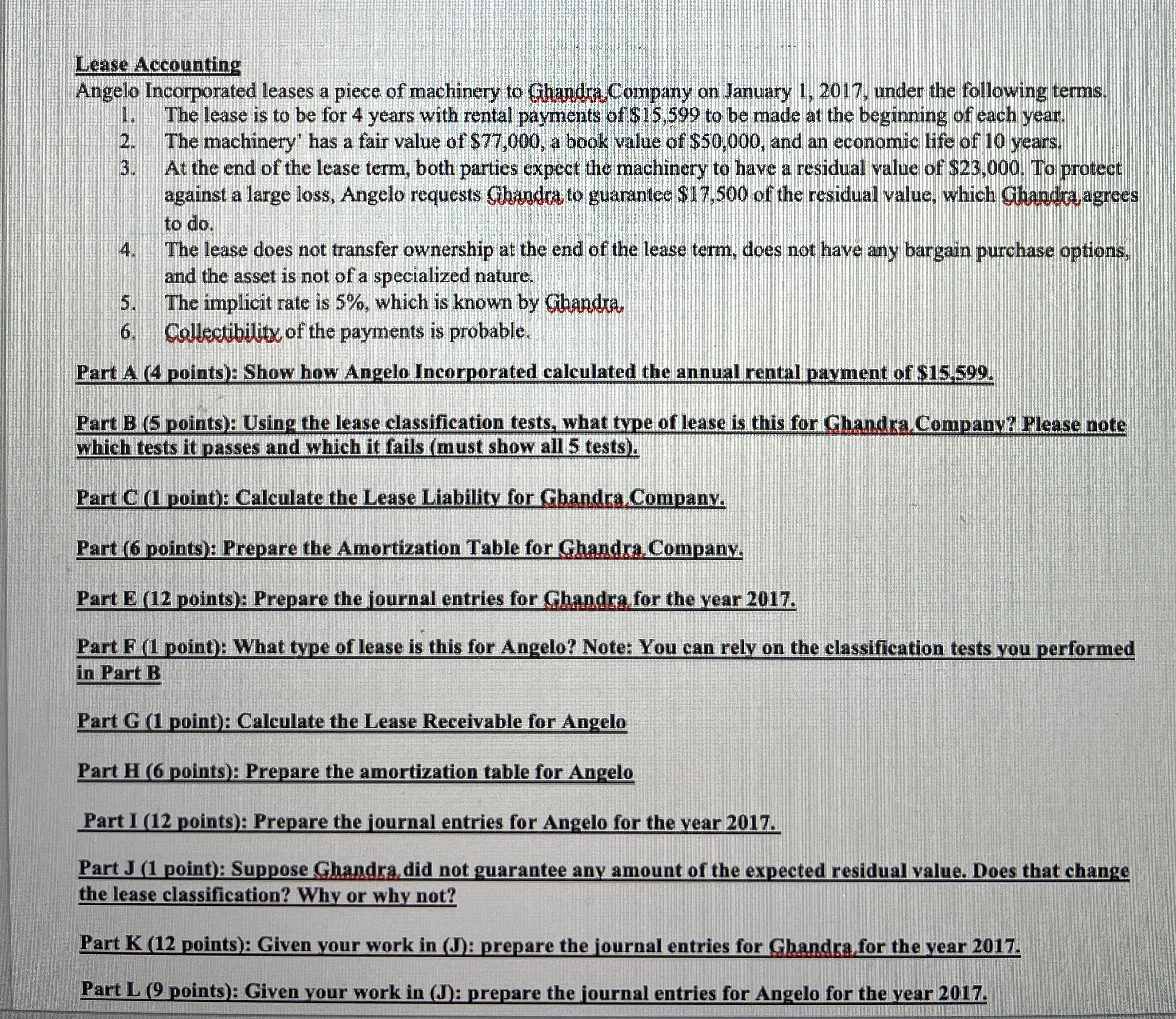

Lease Accounting Angelo Incorporated leases a piece of machinery to Ghandra, Company on January 1 , 2 0 1 7 , under the following terms.

Lease Accounting

Angelo Incorporated leases a piece of machinery to Ghandra, Company on January under the following terms.

The lease is to be for years with rental payments of $ to be made at the beginning of each year.

The machinery' has a fair value of $ a book value of $ and an economic life of years.

At the end of the lease term, both parties expect the machinery to have a residual value of $ To protect against a large loss, Angelo requests Gbandra, to guarantee $ of the residual value, which Ghandra, agrees to do

The lease does not transfer ownership at the end of the lease term, does not have any bargain purchase options, and the asset is not of a specialized nature.

The implicit rate is which is known by Ghandra,

Collectibility of the payments is probable.

Part A points: Show how Angelo Incorporated calculated the annual rental payment of $

Part B points: Using the lease classification tests, what type of lease is this for Ghandra. Company? Please note which tests it passes and which it fails must show all tests

Part C point: Calculate the Lease Liability for Ghandra. Company.

Part points: Prepare the Amortization Table for Goandra Company.

Part E points: Prepare the journal entries for Ghandra, for the year

Part F point: What type of lease is this for Angelo? Note: You can rely on the classification tests you performed in Part B

Part G point: Calculate the Lease Receivable for Angelo

Part H points: Prepare the amortization table for Angelo

Part I points: Prepare the journal entries for Angelo for the year

Part J point: Suppose Ghandra, did not guarantee any amount of the expected residual value. Does that change the lease classification? Why or why not?

Part K points: Given your work in J: prepare the journal entries for Ghandra, for the year

Part L points: Given your work in J: prepare the journal entries for Angelo for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started