Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lease accounting changes represent a significant paradigm shift in the accounting tandscape, introducing a more standardized approach to the recognition and reporting of lease transactions.

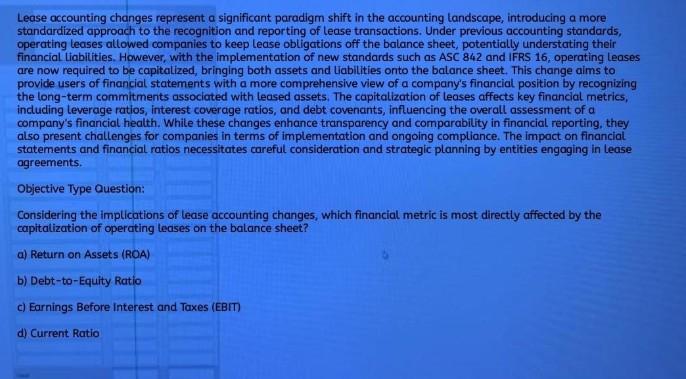

Lease accounting changes represent a significant paradigm shift in the accounting tandscape, introducing a more standardized approach to the recognition and reporting of lease transactions. Under previous accounting standards, operating leases allowed companies to keep lease obligations off the balance sheet, potentially understating their financial tiabilities. However, with the implementation of new standards such as ASC 842 and IFRS 16, operating leases are now required to be capitalized, bringing both assets and liabilities onto the balance sheet. This change aims to provide users of financial statements with a more comprehensive view of a company's financial position by recognizing the long-term commitments associated with leased assets. The capitatization of teases affects key financial metrics, including teverage ratios, interest coverage ratios, and debt covenants, influencing the overall assessment of a company's financial health. While these changes enhance transparency and comparability in financial reporting, they also present challenges for companies in terms of implementation and ongoing compliance. The impact on financial statements and financial ratios necessitates carefut consideration and strategic planning by entities engaging in tease agreements. Objective Type Question: Considering the implications of lease accounting changes, which financial metric is most directly affected by the capitalization of operating leases on the balance sheet? a) Return on Assets (ROA) b) Debt-to-Equity-Ratio c) Earnings Before interest and Taxes (EBIT) d) Current Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started