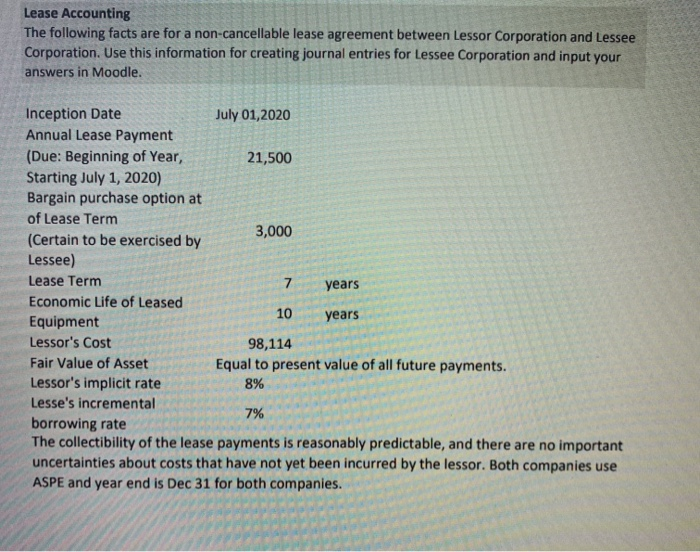

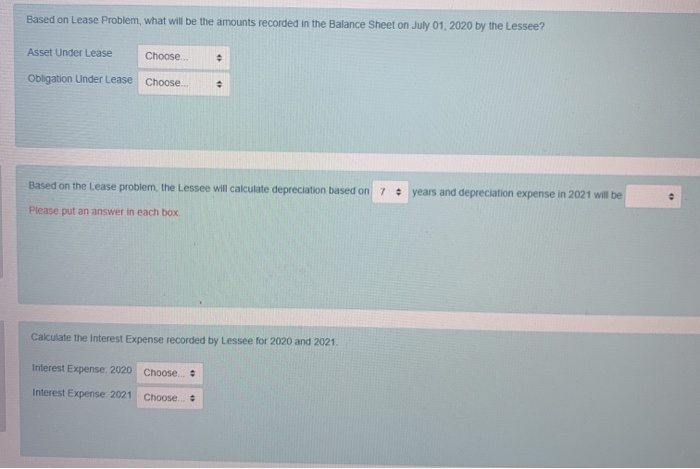

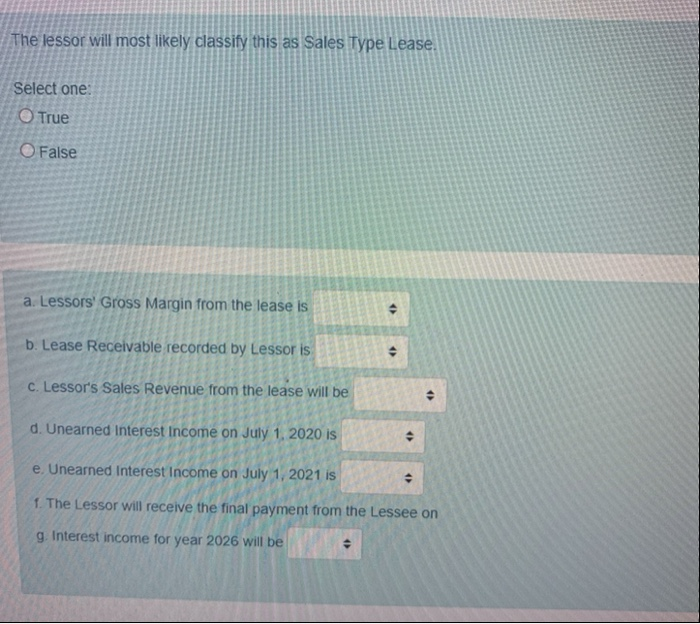

Lease Accounting The following facts are for a non-cancellable lease agreement between Lessor Corporation and Lessee Corporation. Use this information for creating journal entries for Lessee Corporation and input your answers in Moodle. Inception Date July 01,2020 Annual Lease Payment (Due: Beginning of Year, 21,500 Starting July 1, 2020) Bargain purchase option at of Lease Term 3,000 (Certain to be exercised by Lessee) Lease Term 7 years Economic Life of Leased 10 Equipment years Lessor's Cost 98,114 Fair Value of Asset Equal to present value of all future payments. Lessor's implicit rate 8% Lesse's incremental 7% borrowing rate The collectibility of the lease payments is reasonably predictable, and there are no important uncertainties about costs that have not yet been incurred by the lessor. Both companies use ASPE and year end is Dec 31 for both companies. Based on Lease Problem, what will be the amounts recorded in the Balance Sheet on July 01, 2020 by the Lessee? Asset Under Lease Choose Obligation Under Lease Choose Based on the Lease problem, the Lessee will calculate depreciation based on 7 years and depreciation expense in 2021 will be Please put an answer in each box Calculate the interest Expense recorded by Lessee for 2020 and 2021 Interest Expense: 2020 choose.. Interest Expense 2021 Choose... The lessor will most likely classify this as Sales Type Lease. Select one: True False a. Lessors' Gross Margin from the lease is b. Lease Receivable recorded by Lessor is . c. Lessor's Sales Revenue from the lease will be . d. Unearned Interest Income on July 1, 2020 is > e. Unearned Interest Income on July 1, 2021 is . 1. The Lessor will receive the final payment from the Lessee on g. Interest income for year 2026 will be Lease Accounting The following facts are for a non-cancellable lease agreement between Lessor Corporation and Lessee Corporation. Use this information for creating journal entries for Lessee Corporation and input your answers in Moodle. Inception Date July 01,2020 Annual Lease Payment (Due: Beginning of Year, 21,500 Starting July 1, 2020) Bargain purchase option at of Lease Term 3,000 (Certain to be exercised by Lessee) Lease Term 7 years Economic Life of Leased 10 Equipment years Lessor's Cost 98,114 Fair Value of Asset Equal to present value of all future payments. Lessor's implicit rate 8% Lesse's incremental 7% borrowing rate The collectibility of the lease payments is reasonably predictable, and there are no important uncertainties about costs that have not yet been incurred by the lessor. Both companies use ASPE and year end is Dec 31 for both companies. Based on Lease Problem, what will be the amounts recorded in the Balance Sheet on July 01, 2020 by the Lessee? Asset Under Lease Choose Obligation Under Lease Choose Based on the Lease problem, the Lessee will calculate depreciation based on 7 years and depreciation expense in 2021 will be Please put an answer in each box Calculate the interest Expense recorded by Lessee for 2020 and 2021 Interest Expense: 2020 choose.. Interest Expense 2021 Choose... The lessor will most likely classify this as Sales Type Lease. Select one: True False a. Lessors' Gross Margin from the lease is b. Lease Receivable recorded by Lessor is . c. Lessor's Sales Revenue from the lease will be . d. Unearned Interest Income on July 1, 2020 is > e. Unearned Interest Income on July 1, 2021 is . 1. The Lessor will receive the final payment from the Lessee on g. Interest income for year 2026 will be