Answered step by step

Verified Expert Solution

Question

1 Approved Answer

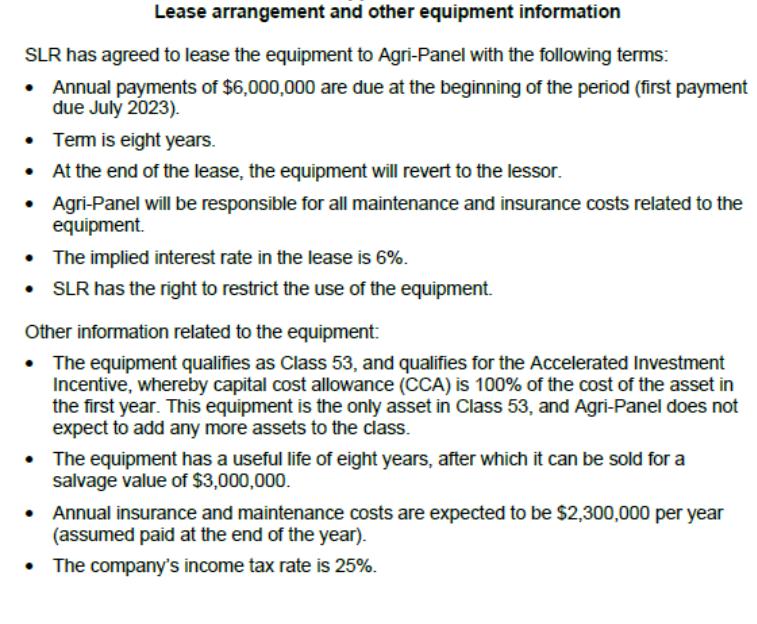

Lease arrangement and other equipment information SLR has agreed to lease the equipment to Agri-Panel with the following terms: Annual payments of $6,000,000 are

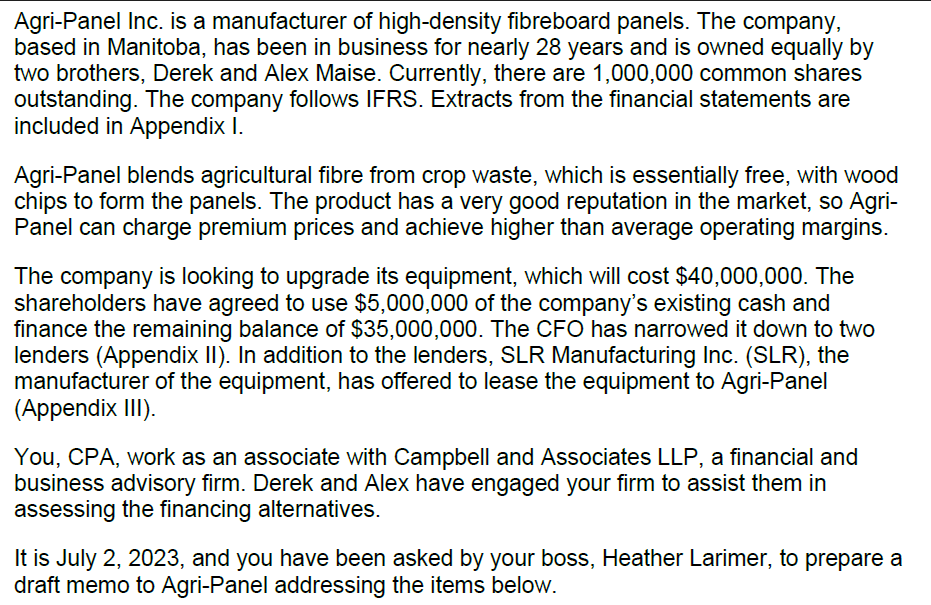

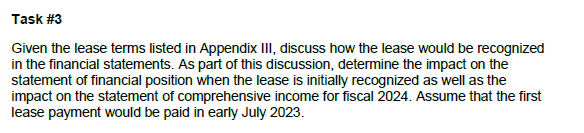

Lease arrangement and other equipment information SLR has agreed to lease the equipment to Agri-Panel with the following terms: Annual payments of $6,000,000 are due at the beginning of the period (first payment due July 2023). Term is eight years. At the end of the lease, the equipment will revert to the lessor. Agri-Panel will be responsible for all maintenance and insurance costs related to the equipment. The implied interest rate in the lease is 6%. SLR has the right to restrict the use of the equipment. Other information related to the equipment: The equipment qualifies as Class 53, and qualifies for the Accelerated Investment Incentive, whereby capital cost allowance (CCA) is 100% of the cost of the asset in the first year. This equipment is the only asset in Class 53, and Agri-Panel does not expect to add any more assets to the class. The equipment has a useful life of eight years, after which it can be sold for a salvage value of $3,000,000. Annual insurance and maintenance costs are expected to be $2,300,000 per year (assumed paid at the end of the year). The company's income tax rate is 25%. Agri-Panel Inc. is a manufacturer of high-density fibreboard panels. The company, based in Manitoba, has been in business for nearly 28 years and is owned equally by two brothers, Derek and Alex Maise. Currently, there are 1,000,000 common shares outstanding. The company follows IFRS. Extracts from the financial statements are included in Appendix I. Agri-Panel blends agricultural fibre from crop waste, which is essentially free, with wood chips to form the panels. The product has a very good reputation in the market, so Agri- Panel can charge premium prices and achieve higher than average operating margins. The company is looking to upgrade its equipment, which will cost $40,000,000. The shareholders have agreed to use $5,000,000 of the company's existing cash and finance the remaining balance of $35,000,000. The CFO has narrowed it down to two lenders (Appendix II). In addition to the lenders, SLR Manufacturing Inc. (SLR), the manufacturer of the equipment, has offered to lease the equipment to Agri-Panel (Appendix III). You, CPA, work as an associate with Campbell and Associates LLP, a financial and business advisory firm. Derek and Alex have engaged your firm to assist them in assessing the financing alternatives. It is July 2, 2023, and you have been asked by your boss, Heather Larimer, to prepare a draft memo to Agri-Panel addressing the items below. Task #3 Given the lease terms listed in Appendix III, discuss how the lease would be recognized in the financial statements. As part of this discussion, determine the impact on the statement of financial position when the lease is initially recognized as well as the impact on the statement of comprehensive income for fiscal 2024. Assume that the first lease payment would be paid in early July 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Memorandum Date July 2 2023 To Derek and Alex Maise Owners of AgriPanel Inc From Your Name CPA Associate at Campbell and Associates LLP Subject ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started