Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate Monthly payment of leasing car and financing the car: a) Which option would be economically better for Henry? Which option would be economically

- 1. Calculate Monthly payment of leasing car and financing the car: a) Which option would be economically better for Henry?

- Which option would be economically better if the residual value was $15,500 for the lease option?

2. If the residual value for the lease option is $15,500 and the finance interest rate can be changed, what finance interest rate compounded semi-annually can make leasing and financing economically equivalent?

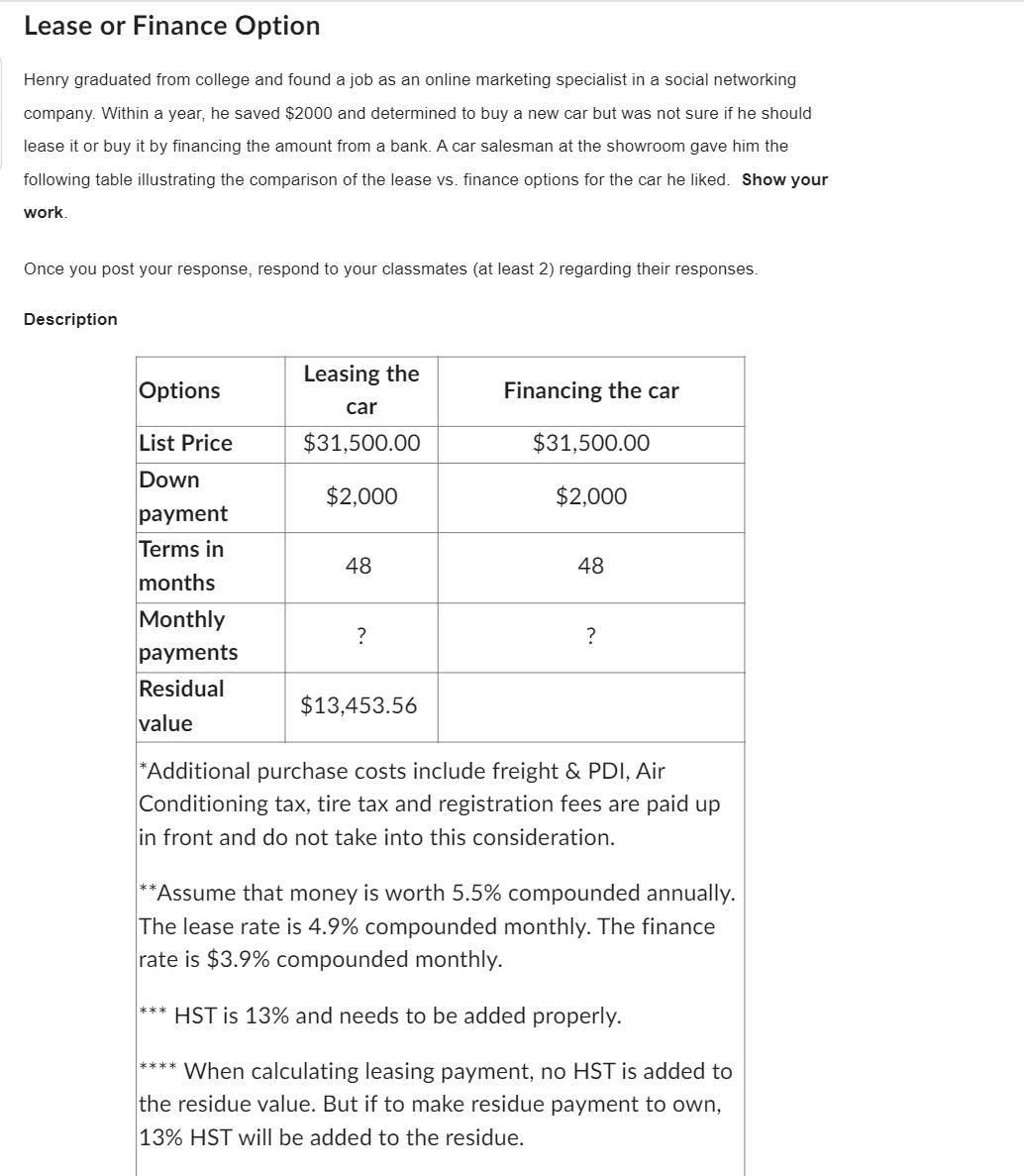

Lease or Finance Option Henry graduated from college and found a job as an online marketing specialist in a social networking company. Within a year, he saved $2000 and determined to buy a new car but was not sure if he should lease it or buy it by financing the amount from a bank. A car salesman at the showroom gave him the following table illustrating the comparison of the lease vs. finance options for the car he liked. Show your work. Once you post your response, respond to your classmates (at least 2) regarding their responses. Description Leasing the Options Financing the car car List Price $31,500.00 $31,500.00 Down $2,000 $2,000 payment Terms in 48 48 months Monthly ? ? payments Residual $13,453.56 value *Additional purchase costs include freight & PDI, Air Conditioning tax, tire tax and registration fees are paid up in front and do not take into this consideration. *Assume that money is worth 5.5% compounded annually. The lease rate is 4.9% compounded monthly. The finance rate is $3.9% compounded monthly. *** HST is 13% and needs to be added properly. **** When calculating leasing payment, no HST is added to the residue value. But if to make residue payment to own, 13% HST will be added to the residue.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started