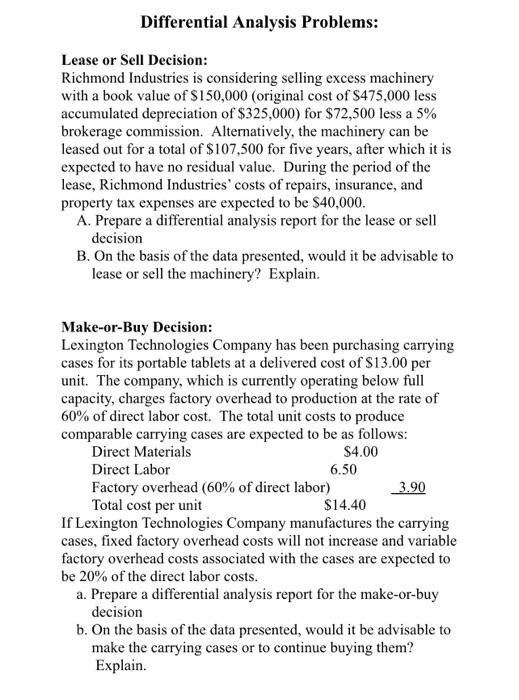

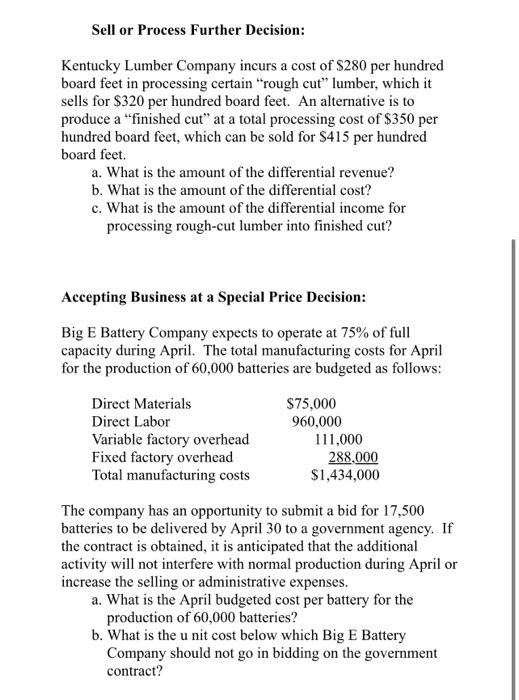

Lease or Sell Decision: Richmond Industries is considering selling excess machinery with a book value of $150,000 (original cost of $475,000 less accumulated depreciation of $325,000 ) for $72,500 less a 5% brokerage commission. Alternatively, the machinery can be leased out for a total of $107,500 for five years, after which it is expected to have no residual value. During the period of the lease, Richmond Industries' costs of repairs, insurance, and property tax expenses are expected to be $40,000. A. Prepare a differential analysis report for the lease or sell decision B. On the basis of the data presented, would it be advisable to lease or sell the machinery? Explain. Make-or-Buy Decision: Lexington Technologies Company has been purchasing carrying cases for its portable tablets at a delivered cost of $13.00 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 60% of direct labor cost. The total unit costs to produce comparable carrying cases are expected to be as follows: \begin{tabular}{lcr} Direct Materials & $4.00 & \\ Direct Labor & 6.50 & \\ Factory overhead (60% of direct labor) & 3.90 \\ Total cost per unit & $14.40 & \end{tabular} If Lexington Technologies Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 20% of the direct labor costs. a. Prepare a differential analysis report for the make-or-buy decision b. On the basis of the data presented, would it be advisable to make the carrying cases or to continue buying them? Explain. Sell or Process Further Decision: Kentucky Lumber Company incurs a cost of $280 per hundred board feet in processing certain "rough cut" lumber, which it sells for $320 per hundred board feet. An alternative is to produce a "finished cut" at a total processing cost of $350 per hundred board feet, which can be sold for $415 per hundred board feet. a. What is the amount of the differential revenue? b. What is the amount of the differential cost? c. What is the amount of the differential income for processing rough-cut lumber into finished cut? Accepting Business at a Special Price Decision: Big E Battery Company expects to operate at 75% of full capacity during April. The total manufacturing costs for April for the production of 60,000 batteries are budgeted as follows: The company has an opportunity to submit a bid for 17,500 batteries to be delivered by April 30 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during April or increase the selling or administrative expenses. a. What is the April budgeted cost per battery for the production of 60,000 batteries? b. What is the unit cost below which Big E Battery Company should not go in bidding on the government contract