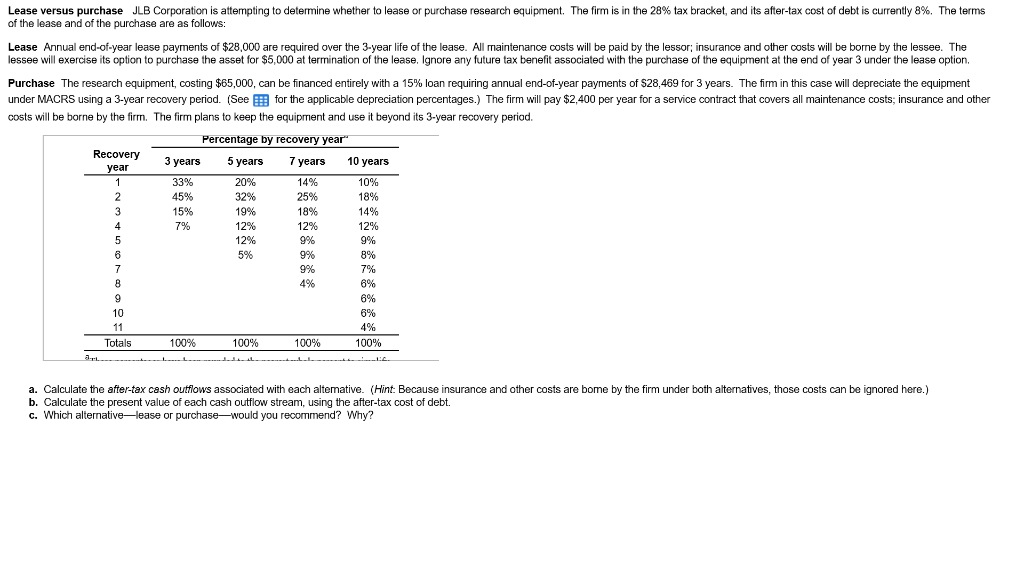

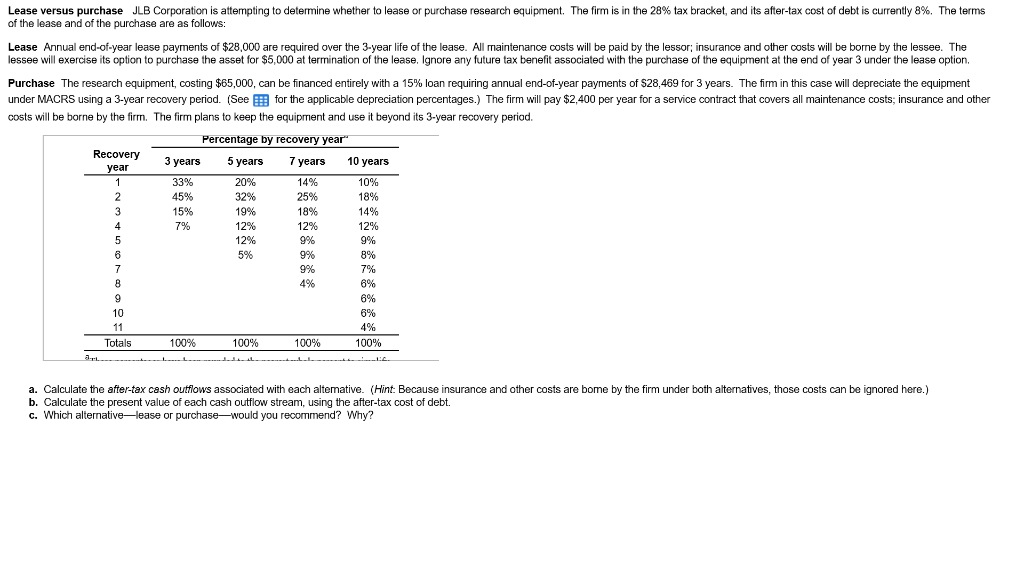

Lease versus purchase JLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 28% tax bracket and its after-tax cost of debt is currently 8%. The terms of the lease and of the purchase are as follows: Lease Annual end-of-year lease payments of $28,000 are required over the 3-year life of the lease. All maintenanoe costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Ignore any future tax benefit associated with the purchase of the equipment at the end of year 3 under the lease option Purchase The research equipment costing $65,000 can be financed entirely with a 15% loan requiring annual end-0 year payments of S28.469 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-year recovery period. Seefor he applicable depreciation percentages. The firm will pay $2400 per year for a ser ce contract that covers all maintenance costs Insurance and other costs will be borne by the firm. The firm plans to keep the equipment and use it beyond its 3-year recovery periad. entage by recovery yea Recovery3 years 5 years 7 years 14% 25% 18% 12% 10 years 10% 18% 14% 12% 9% year 45% 15% 32% 19% 12% 12% 5% 4 9% 49% 6% 6% 6% 10 Totals 100% 100% 100% 100% a. Calculate the after-tax cash outflows associated with each altemative. (Hint: Because insurance and other costs are bome by the firm under both alternatives, those costs can be ignored here.) b. Calculate the present value of each cash outflow stream, using the after-tax cost of debt. c. Which alternative lease or purchase-would you recommend? Why? Lease versus purchase JLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 28% tax bracket and its after-tax cost of debt is currently 8%. The terms of the lease and of the purchase are as follows: Lease Annual end-of-year lease payments of $28,000 are required over the 3-year life of the lease. All maintenanoe costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Ignore any future tax benefit associated with the purchase of the equipment at the end of year 3 under the lease option Purchase The research equipment costing $65,000 can be financed entirely with a 15% loan requiring annual end-0 year payments of S28.469 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-year recovery period. Seefor he applicable depreciation percentages. The firm will pay $2400 per year for a ser ce contract that covers all maintenance costs Insurance and other costs will be borne by the firm. The firm plans to keep the equipment and use it beyond its 3-year recovery periad. entage by recovery yea Recovery3 years 5 years 7 years 14% 25% 18% 12% 10 years 10% 18% 14% 12% 9% year 45% 15% 32% 19% 12% 12% 5% 4 9% 49% 6% 6% 6% 10 Totals 100% 100% 100% 100% a. Calculate the after-tax cash outflows associated with each altemative. (Hint: Because insurance and other costs are bome by the firm under both alternatives, those costs can be ignored here.) b. Calculate the present value of each cash outflow stream, using the after-tax cost of debt. c. Which alternative lease or purchase-would you recommend? Why