Question

Leased equipment on January 1, 2007, for 3 years. Lease payments of $100,000 Other expenses (e.g., insurance, taxes, maintenance) are also to be paid =

Leased equipment on January 1, 2007, for 3 years.

Lease payments of $100,000

Other expenses (e.g., insurance, taxes, maintenance) are also to be paid = $2,000 per year.

The lessor did not incur any initial direct costs. The lease contains no purchase or renewal options and the equipment reverts back to Lessor Inc. on the expiration of the lease.

Useful life of the equipment is 4 years.

The fair value of the equipment at lease inception is $265,000.

Lessee has guaranteed $20,000 as the residual value at the end of the lease term.

The salvage value of the equipment is expected to be $2,000 after the end of its economic life.

The lessees incremental borrowing rate is 11 percent.

Lessors implicit rate is 10 percent and is calculable by the lessee from the lease agreement.

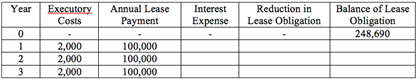

Correct and complete the following amortization schedule for this lease:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started