Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Leasley granted 30 options to 500 of its employees at a fair value of $7 on 1 January 2013. Each option gives its holder

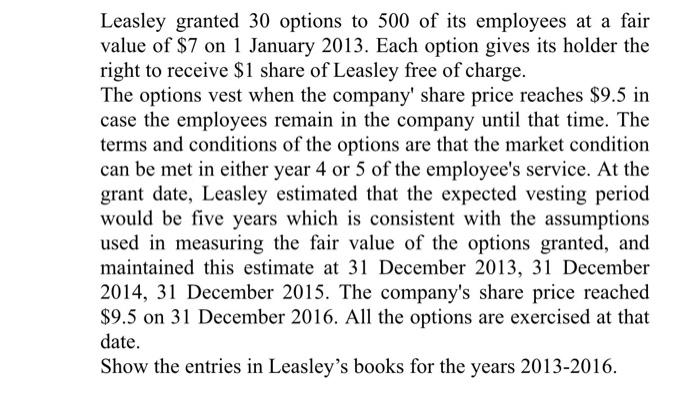

Leasley granted 30 options to 500 of its employees at a fair value of $7 on 1 January 2013. Each option gives its holder the right to receive $1 share of Leasley free of charge. The options vest when the company' share price reaches $9.5 in case the employees remain in the company until that time. The terms and conditions of the options are that the market condition can be met in either year 4 or 5 of the employee's service. At the grant date, Leasley estimated that the expected vesting period would be five years which is consistent with the assumptions used in measuring the fair value of the options granted, and maintained this estimate at 31 December 2013, 31 December 2014, 31 December 2015. The company's share price reached $9.5 on 31 December 2016. All the options are exercised at that date. Show the entries in Leasley's books for the years 2013-2016.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Accounts Title and Explanation Debit Credit 31122013 Employees Compensation Exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started