Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lecture 3 Mini Case Background Adventure is a company that manufactures and sells gears and equipment for outdoor activities such as hiking, canoeing, camping, kayaking,

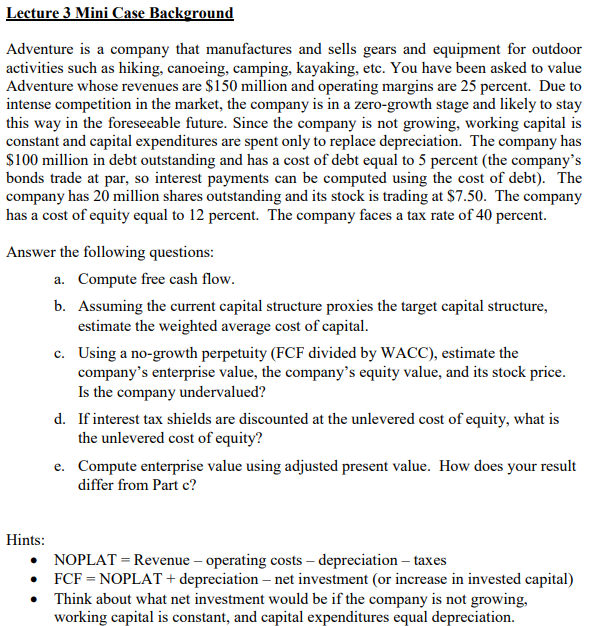

Lecture 3 Mini Case Background Adventure is a company that manufactures and sells gears and equipment for outdoor activities such as hiking, canoeing, camping, kayaking, etc. You have been asked to value Adventure whose revenues are $150 million and operating margins are 25 percent. Due to intense competition in the market, the company is in a zero-growth stage and likely to stay this way in the foreseeable future. Since the company is not growing, working capital is constant and capital expenditures are spent only to replace depreciation. The company has $100 million in debt outstanding and has a cost of debt equal to 5 percent (the company's bonds trade at par, so interest payments can be computed using the cost of debt). The company has 20 million shares outstanding and its stock is trading at $7.50. The company has a cost of equity equal to 12 percent. The company faces a tax rate of 40 percent. Answer the following questions: a. Compute free cash flow. b. Assuming the current capital structure proxies the target capital structure, estimate the weighted average cost of capital. c. Using a no-growth perpetuity (FCF divided by WACC), estimate the company's enterprise value, the company's equity value, and its stock price. Is the company undervalued? d. If interest tax shields are discounted at the unlevered cost of equity, what is the unlevered cost of equity? e. Compute enterprise value using adjusted present value. How does your result differ from Part c? Hints: NOPLAT = Revenue - operating costs - depreciation - taxes FCF = NOPLAT + depreciation - net investment (or increase in invested capital) Think about what net investment would be if the company is not growing, working capital is constant, and capital expenditures equal depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started