(1) (ii) E (iv) (v) (vi) (vii) (viii) (ix) (x) Defining all terms carefully, show the two returns available for the strategies of: Placing

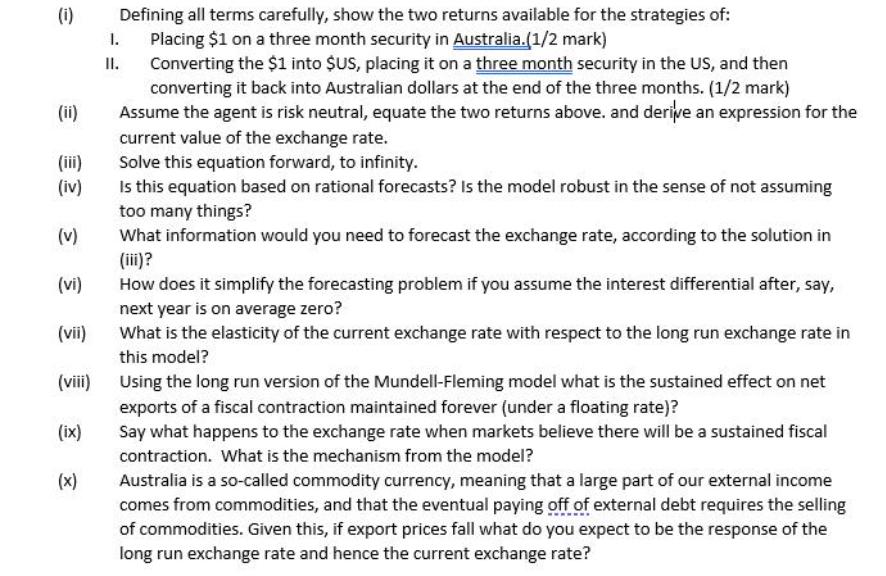

(1) (ii) E (iv) (v) (vi) (vii) (viii) (ix) (x) Defining all terms carefully, show the two returns available for the strategies of: Placing $1 on a three month security in Australia.(1/2 mark) Converting the $1 into $US, placing it on a three month security in the US, and then converting it back into Australian dollars at the end of the three months. (1/2 mark) Assume the agent is risk neutral, equate the two returns above. and derive an expression for the current value of the exchange rate. Solve this equation forward, to infinity. 1. II. Is this equation based on rational forecasts? Is the model robust in the sense of not assuming too many things? What information would you need to forecast the exchange rate, according to the solution in (iii)? How does it simplify the forecasting problem if you assume the interest differential after, say, next year is on average zero? What is the elasticity of the current exchange rate with respect to the long run exchange rate in this model? Using the long run version of the Mundell-Fleming model what is the sustained effect on net exports of a fiscal contraction maintained forever (under a floating rate)? Say what happens to the exchange rate when markets believe there will be a sustained fiscal contraction. What is the mechanism from the model? Australia is a so-called commodity currency, meaning that a large part of our external income comes from commodities, and that the eventual paying off of external debt requires the selling of commodities. Given this, if export prices fall what do you expect to be the response of the long run exchange rate and hence the current exchange rate?

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i The two returns available for the strategies of placing 1 on a three month security in Australia and converting the 1 into US placing it on a three month security in the US and then converting it ba...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started