Answered step by step

Verified Expert Solution

Question

1 Approved Answer

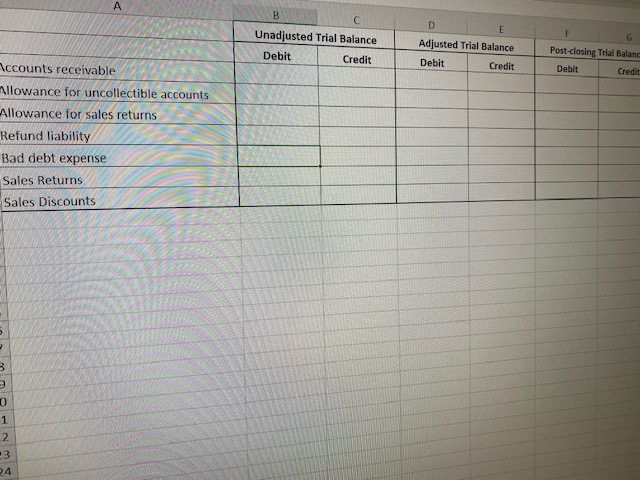

Ledger Accounts: Accounts Receivable, Allowance for Uncollectible Accounts, Allowance for Sales Returns, Refund Liability, Sales Revenue- Repairs, Sales Revenue- Restorations, Sales Returns, Sales Discounts, Bad

Ledger Accounts: Accounts Receivable, Allowance for Uncollectible Accounts, Allowance for Sales Returns, Refund Liability, Sales Revenue- Repairs, Sales Revenue- Restorations, Sales Returns, Sales Discounts, Bad Debt Expense

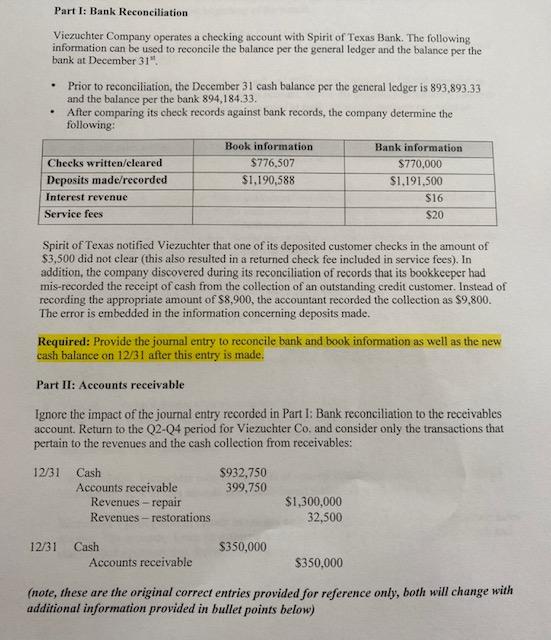

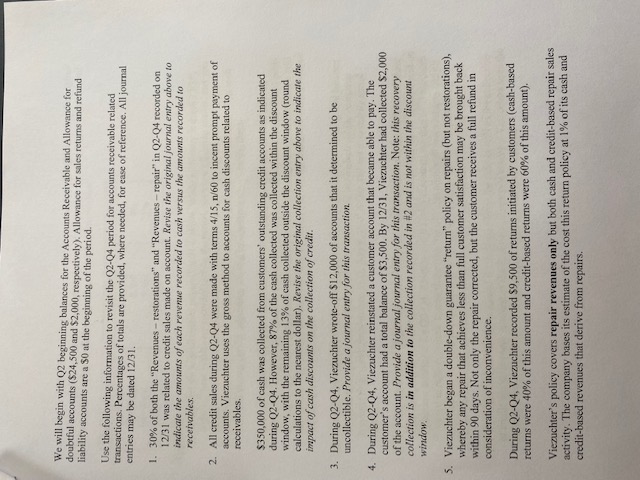

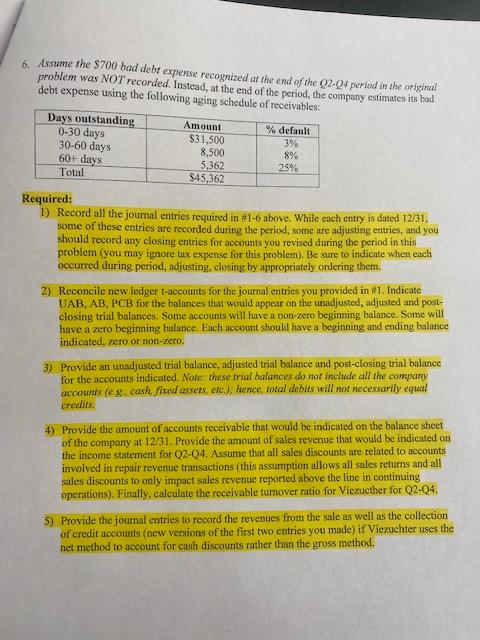

Part I: Bank Reconciliation - Viezuchter Company operates a checking account with Spirit of Texas Bank. The following information can be used to reconcile the balance per the general ledger and the balance per the bank at December 31" Prior to reconciliation, the December 31 cash balance per the general ledger is 893,893,33 and the balance per the bank 894,184.33. After comparing its check records against bank records, the company determine the following: Book information Bank information Checks written/cleared $776,507 $770,000 Deposits made/recorded $1,190,588 $1,191,500 Interest revenue $16 Service fees $20 Spirit of Texas notified Viezuchter that one of its deposited customer checks in the amount of $3,500 did not clear this also resulted in a returned check fee included in service fees). In addition, the company discovered during its reconciliation of records that its bookkeeper had mis-recorded the receipt of cash from the collection of an outstanding credit customer. Instead of recording the appropriate amount of $8,900, the accountant recorded the collection as $9.800. The error is embedded in the information concerning deposits made. Required: Provide the journal entry to reconcile bank and book information as well as the new cash balance on 12/31 after this entry is made Part II: Accounts receivable Ignore the impact of the journal entry recorded in Part I: Bank reconciliation to the receivables account . Return to the Q2-04 period for Viezuchter Co. and consider only the transactions that pertain to the revenues and the cash collection from receivables: 12/31 $932,750 399,750 Cash Accounts receivable Revenues-repair Revenues- restorations $1,300,000 32,500 12/31 Cash Accounts receivable $350,000 $350,000 (note, these are the original correct entries provided for reference only, both will change with additional information provided in bullet points below) We will begin with Q2 beginning balances for the Accounts Receivable and Allowance for doubtful accounts ($24,500 and $2,000, respectively). Allowance for sales returns and refund liability accounts are a 50 at the beginning of the period. Use the following information to revisit the Q2-04 period for accounts receivable related transactions. Percentages of totals are provided, where needed, for ease of reference. All journal entries may be dated 12/31. 1. 30% of both the "Revenues - restorations" and "Revenues-repair" in Q2-04 recorded on 12/31 was related to credit sales made on account. Revise the original journal entry above to indicate the amounts of each revenue recorded to cash versus the amounts recorded to receivables. 2. All credit sales during Q2-04 were made with terms 4/15, n/60 to incent prompt payment of accounts. Viezuchter uses the gross method to accounts for cash discounts related to receivables $350,000 of cash was collected from customers' outstanding credit accounts as indicated during Q2-04. However, 87% of the cash collected was collected within the discount window, with the remaining 13% of cash collected outside the discount window (round calculations to the nearest dollar). Revise the original collection entry above to indicate the impact of cash discounts on the collection of credit. 3. During Q2-04, Viezuchter wrote-off $12,000 of accounts that it determined to be uncollectible. Provide a journal entry for this transaction. 4. During Q2-04, Viezuchter reinstated a customer account that became able to pay. The customer's account had a total balance of $3,500. By 12/31, Viezuchter had collected $2,000 of the account. Provide a journal journal entry for this transaction. Note: this recovery collection is in addition to the collection recorded in #2 and is not within the discount window. 5. Viezuchter began a double-down guarantee "return" policy on repairs (but not restorations), whereby any repair that achieves less than full customer satisfaction may be brought back within 90 days. Not only the repair corrected, but the customer receives a full refund in consideration of inconvenience. During Q2-04, Viezuchter recorded $9,500 of returns initiated by customers (cash-based returns were 40% of this amount and credit-based returns were 60% of this amount). Viezuchter's policy covers repair revenues only but both cash and credit-based repair sales activity. The company bases its estimate of the cost this return policy at 1% of its cash and credit-based revenues that derive from repairs. 6. Assume the $700 bad debt expense recognized at the end of the 02-04 period in the original problem was NOT recorded. Instead, at the end of the period, the company estimates its bad debt expense using the following aging schedule of receivables: Days outstanding Amount % default 0-30 days $31,500 3% 30-60 days 8,500 8% 60+ days 5,362 25% Total $45,362 Required: 1) Record all the journal entries required in #1-6 above. While each entry is dated 12/31 some of these entries are recorded during the period, some are adjusting entries, and you should record any closing entries for accounts you revised during the period in this problem (you may ignore tax expense for this problem). Be sure to indicate when each occurred during period, adjusting, closing by appropriately ordering them. 2) Reconcile new ledger t-accounts for the journal entries you provided in #1. Indicate UAB, AB, PCB for the balances that would appear on the unadjusted, adjusted and post- closing trial balances. Some accounts will have a non-zero beginning balance. Some will have a zero beginning balance. Each account should have a beginning and ending balance indicated, zero or non-zero. 3) Provide an unadjusted trial balance, adjusted trial balance and post-closing trial balance for the accounts indicated. Note: these trial balances do not include all the company accounts (eg, cash, fixed assets, etc.); hence total debits will not necessarily equal credits. 4) Provide the amount of accounts receivable that would be indicated on the balance sheet of the company at 12/31. Provide the amount of sales revenue that would be indicated on the income statement for Q2-04. Assume that all sales discounts are related to accounts involved in repair revenue transactions (this assumption allows all sales returns and all sales discounts to only impact sales revenue reported above the line in continuing operations). Finally, calculate the receivable turnover ratio for Viezuether for Q2-04 5) Provide the journal entries to record the revenues from the sale as well as the collection of credit accounts (new versions of the first two entries you made) if Viezuchter uses the net method to account for cash discounts rather than the gross method. A B Unadjusted Trial Balance Debit Credit F G D E Adjusted Trial Balance Debit Credit Post-closing Trial Balanc Debit Credit Accounts receivable Allowance for uncollectible accounts Allowance for sales returns Refund liability Bad debt expense Sales Returns Sales Discounts - 3 3 0 1 2 3 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started