Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lee and Marta Howard are in their early 70s. Recently they have grown concerned about probate and estate taxes. They calculated that this year they

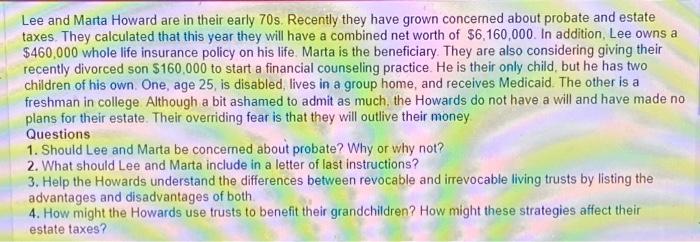

Lee and Marta Howard are in their early 70s. Recently they have grown concerned about probate and estate taxes. They calculated that this year they will have a combined net worth of $6,160,000. In addition, Lee owns a $460,000 whole life insurance policy on his life. Marta is the beneficiary. They are also considering giving their recently divorced son $160,000 to start a financial counseling practice. He is their only child, but he has two children of his own. One, age 25, is disabled, lives in a group home, and receives Medicaid. The other is a freshman in college. Although a bit ashamed to admit as much, the Howards do not have a will and have made no plans for their estate. Their overriding fear is that they will outlive their money. Questions 1. Should Lee and Marta be concerned about probate? Why or why not? 2. What should Lee and Marta include in a letter of last instructions? 3. Help the Howards understand the differences between revocable and irrevocable living trusts by listing the advantages and disadvantages of both. 4. How might the Howards use trusts to benefit their grandchildren? How might these strategies affect their estate taxes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started