Answered step by step

Verified Expert Solution

Question

1 Approved Answer

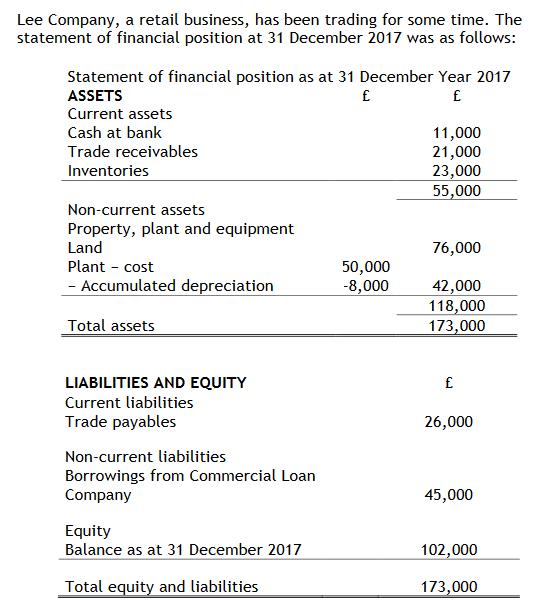

Lee Company, a retail business, has been trading for some time. The statement of financial position at 31 December 2017 was as follows: Statement

![(a) State the impact of each transaction (1)-(10) on the relevant items in balance sheet and income statement. [30 marks] (b)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/07/60eab30ad1c11_1625993994456.jpg)

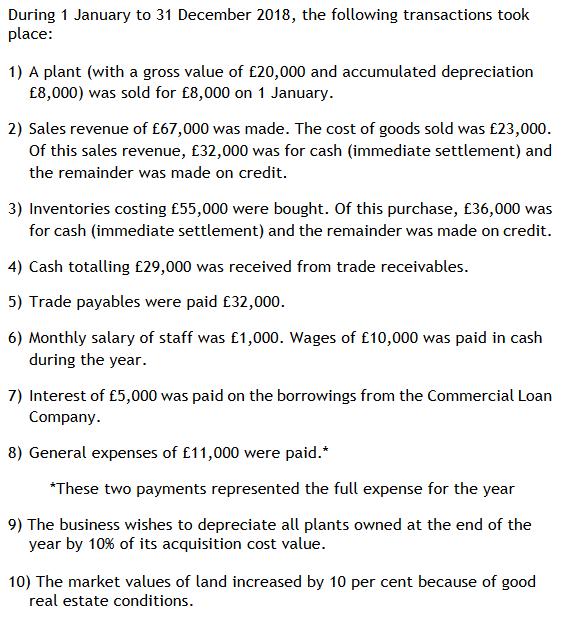

Lee Company, a retail business, has been trading for some time. The statement of financial position at 31 December 2017 was as follows: Statement of financial position as at 31 December Year 2017 ASSETS Current assets Cash at bank 11,000 21,000 23,000 55,000 Trade receivables Inventories Non-current assets Property, plant and equipment Land 76,000 Plant - cost - Accumulated depreciation 50,000 -8,000 42,000 118,000 173,000 Total assets LIABILITIES AND EQUITY Current liabilities Trade payables 26,000 Non-current liabilities Borrowings from Commercial Loan Company 45,000 Equity Balance as at 31 December 2017 102,000 Total equity and liabilities 173,000 During 1 January to 31 December 2018, the following transactions took place: 1) A plant (with a gross value of 20,000 and accumulated depreciation 8,000) was sold for 8,000 on 1 January. 2) Sales revenue of 67,000 was made. The cost of goods sold was 23,000. Of this sales revenue, 32,000 was for cash (immediate settlement) and the remainder was made on credit. 3) Inventories costing 55,000 were bought. Of this purchase, 36,000 was for cash (immediate settlement) and the remainder was made on credit. 4) Cash totalling 29,000 was received from trade receivables. 5) Trade payables were paid 32,000. 6) Monthly salary of staff was 1,000. Wages of 10,000 was paid in cash during the year. 7) Interest of 5,000 was paid on the borrowings from the Commercial Loan Company. 8) General expenses of 11,000 were paid.* *These two payments represented the full expense for the year 9) The business wishes to depreciate all plants owned at the end of the year by 10% of its acquisition cost value. 10) The market values of land increased by 10 per cent because of good real estate conditions. (a) State the impact of each transaction (1)-(10) on the relevant items in balance sheet and income statement. [30 marks] (b) Prepare an income statement for the financial year 2017. Ignore corporate income taxation. [10 marks] (c) Sara Lee, the owner of Lee Company, won 50,000 in a casino during the year and held a celebration party with employees. She paid for the expense 4,000 by herself. In a speech during the party, Sara Lee emphasised human capital as a valuable asset of the company and the party successfully boosted employees' morale. Discuss in detail the impact of the events (i.e. casino winning, payment of celebration party expense, and the speech about human capital) in part (c) on the financial position of Lee Company by referring to certain accounting principle(s). [10 marks]

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

solution a 1the real value of plant is 12000 pounds and it is sold for 8000 pounds means there is a loss of 4000 pounds which should be reflected and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635fe44983c41_232652.pdf

180 KBs PDF File

635fe44983c41_232652.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started