Answered step by step

Verified Expert Solution

Question

1 Approved Answer

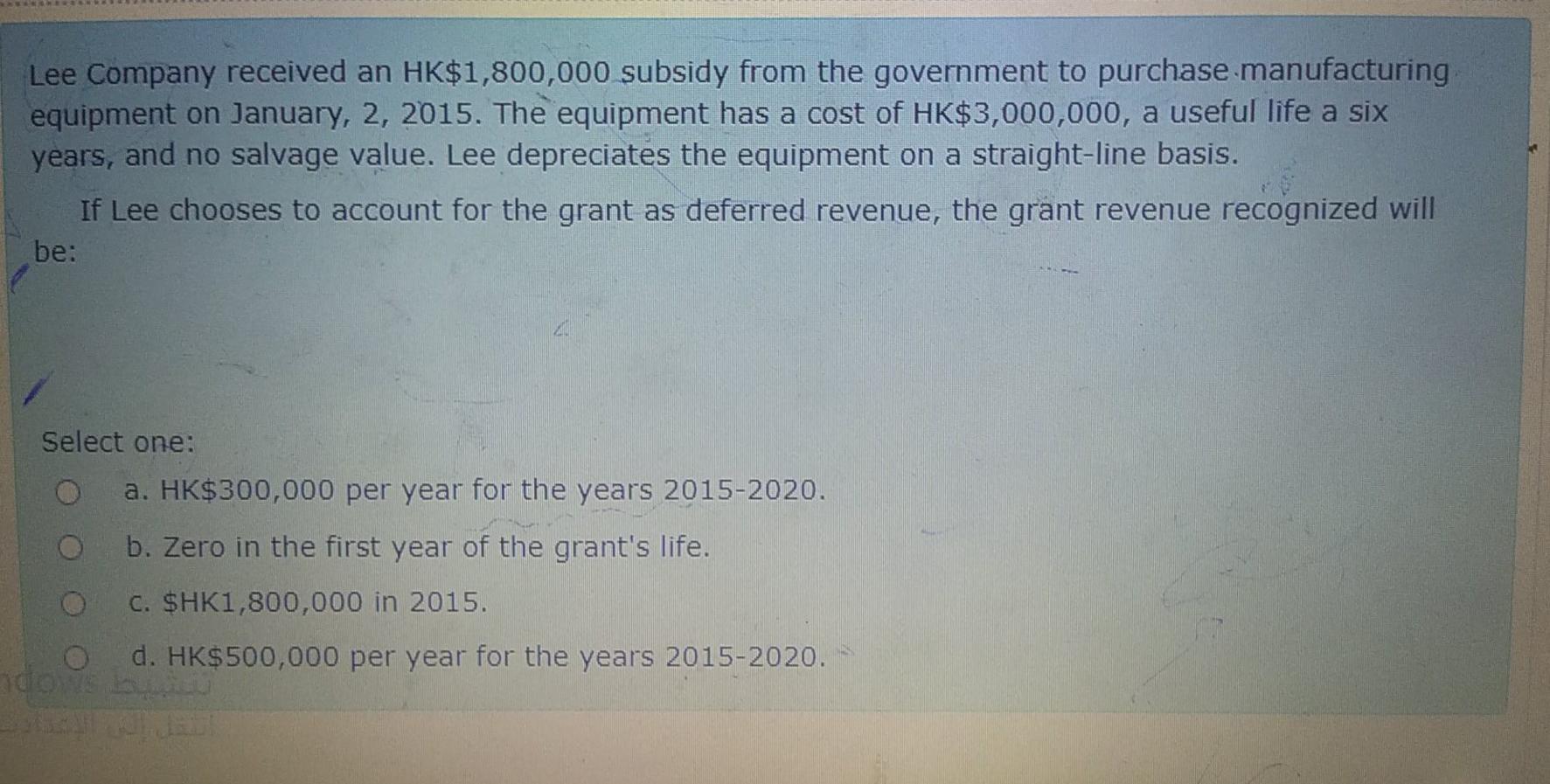

Lee Company received an HK$1,800,000 subsidy from the government to purchase manufacturing equipment on January, 2, 2015. The equipment has a cost of HK$3,000,000, a

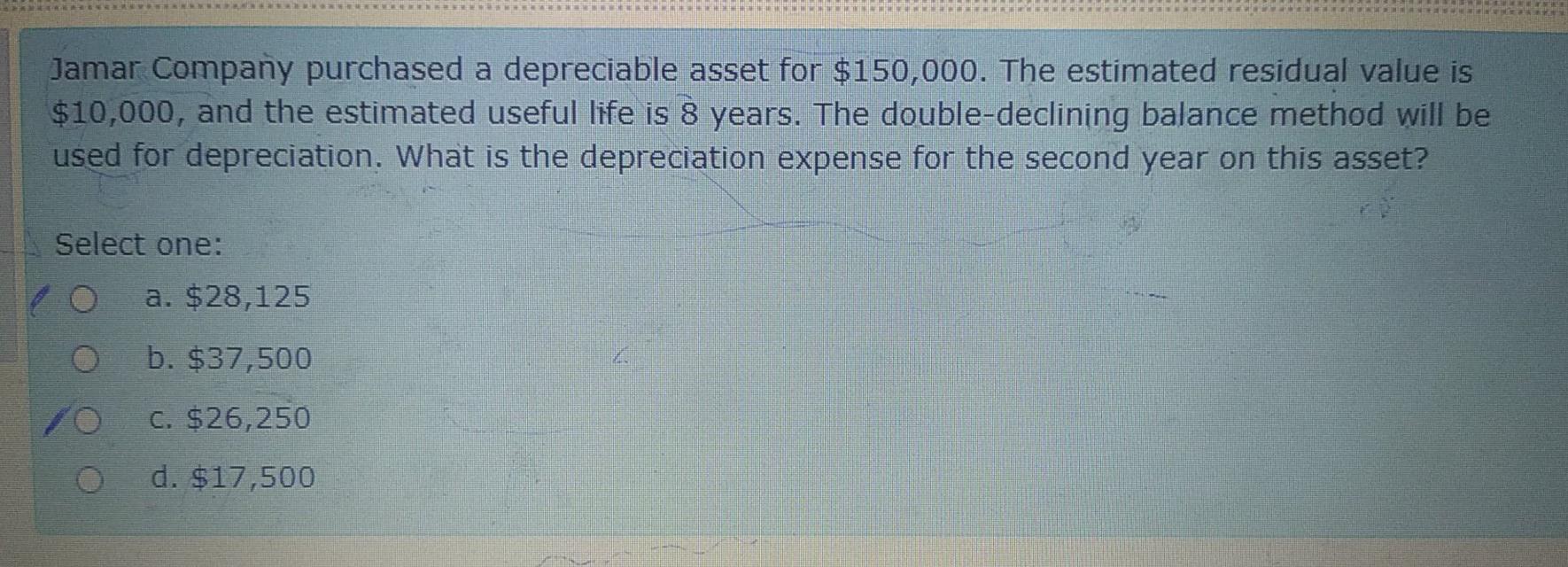

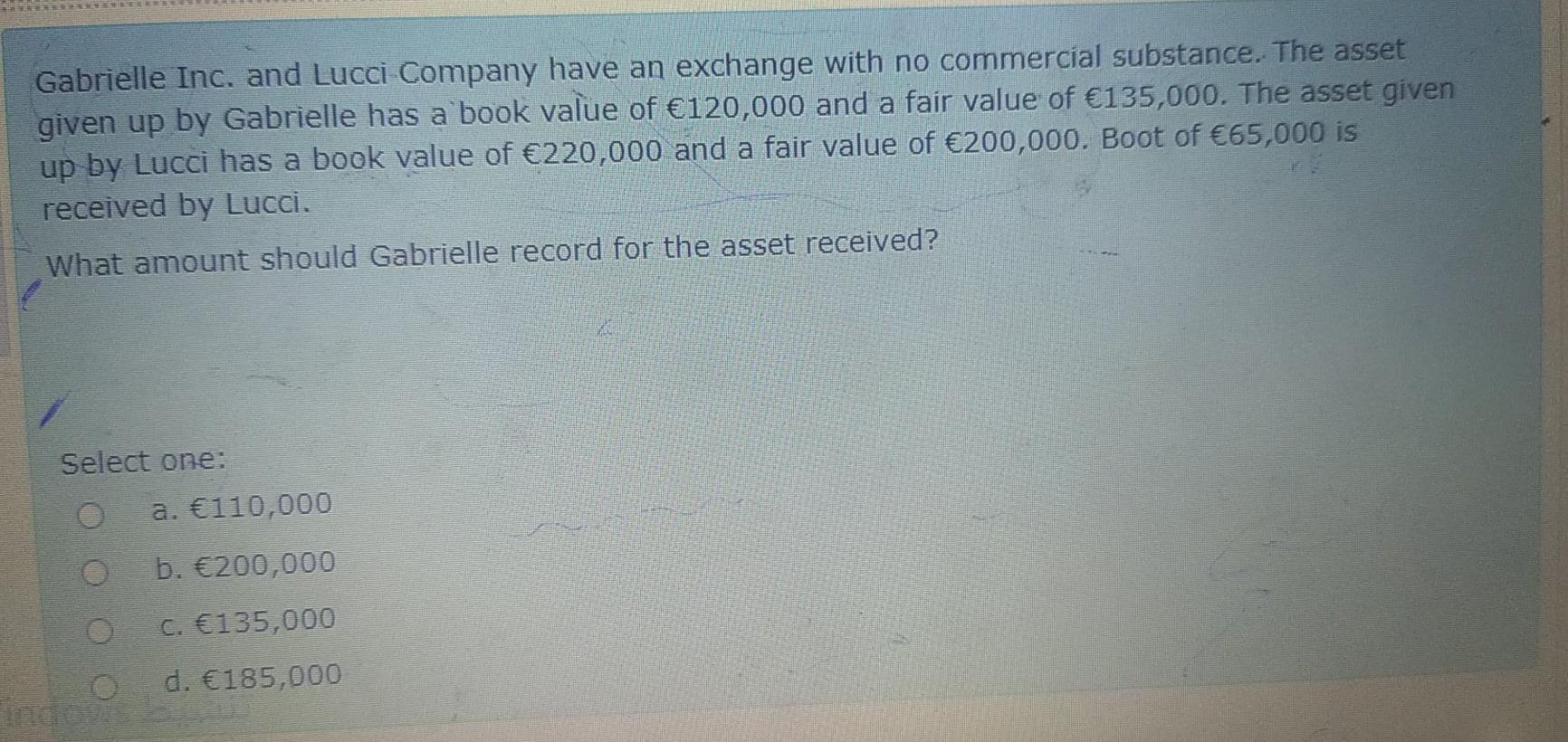

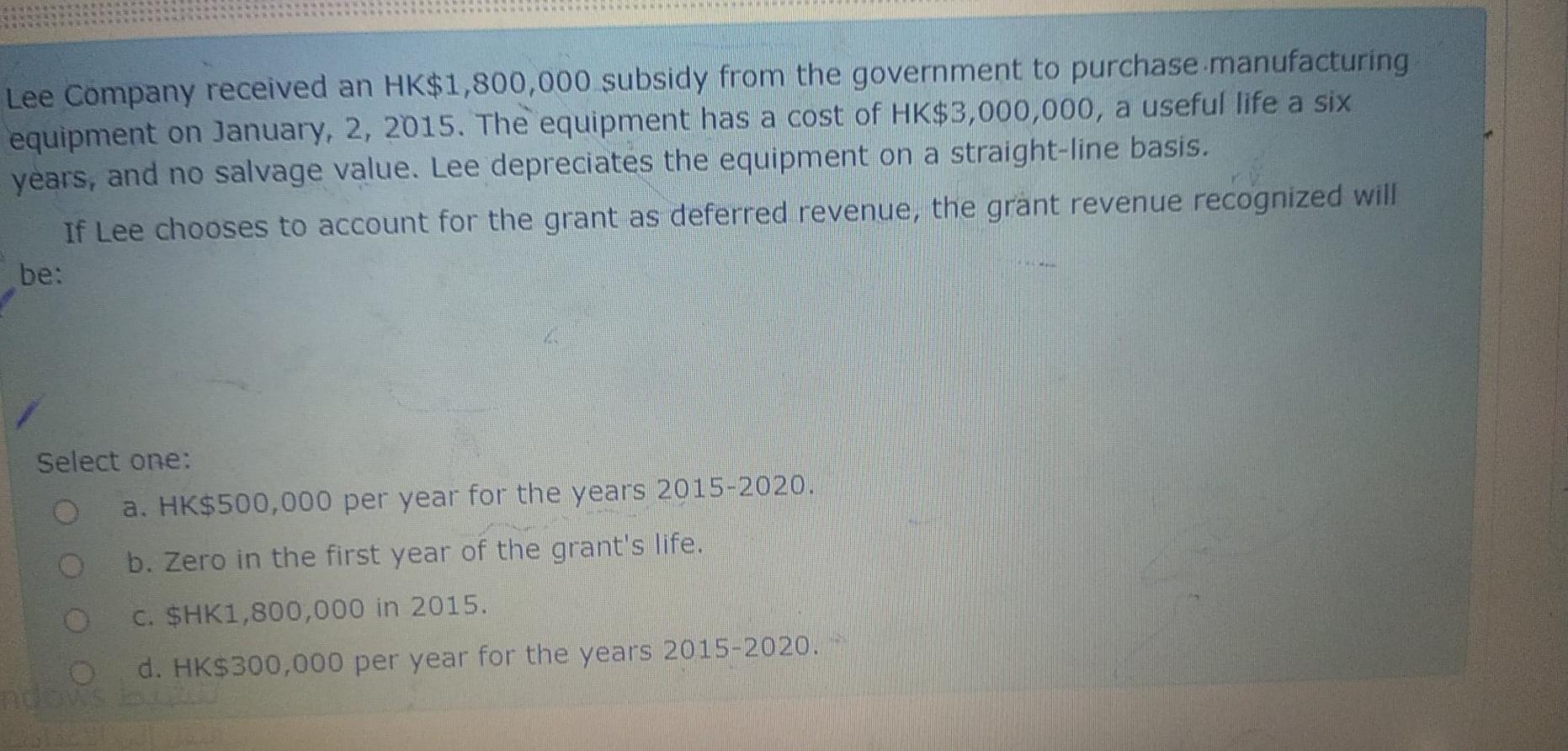

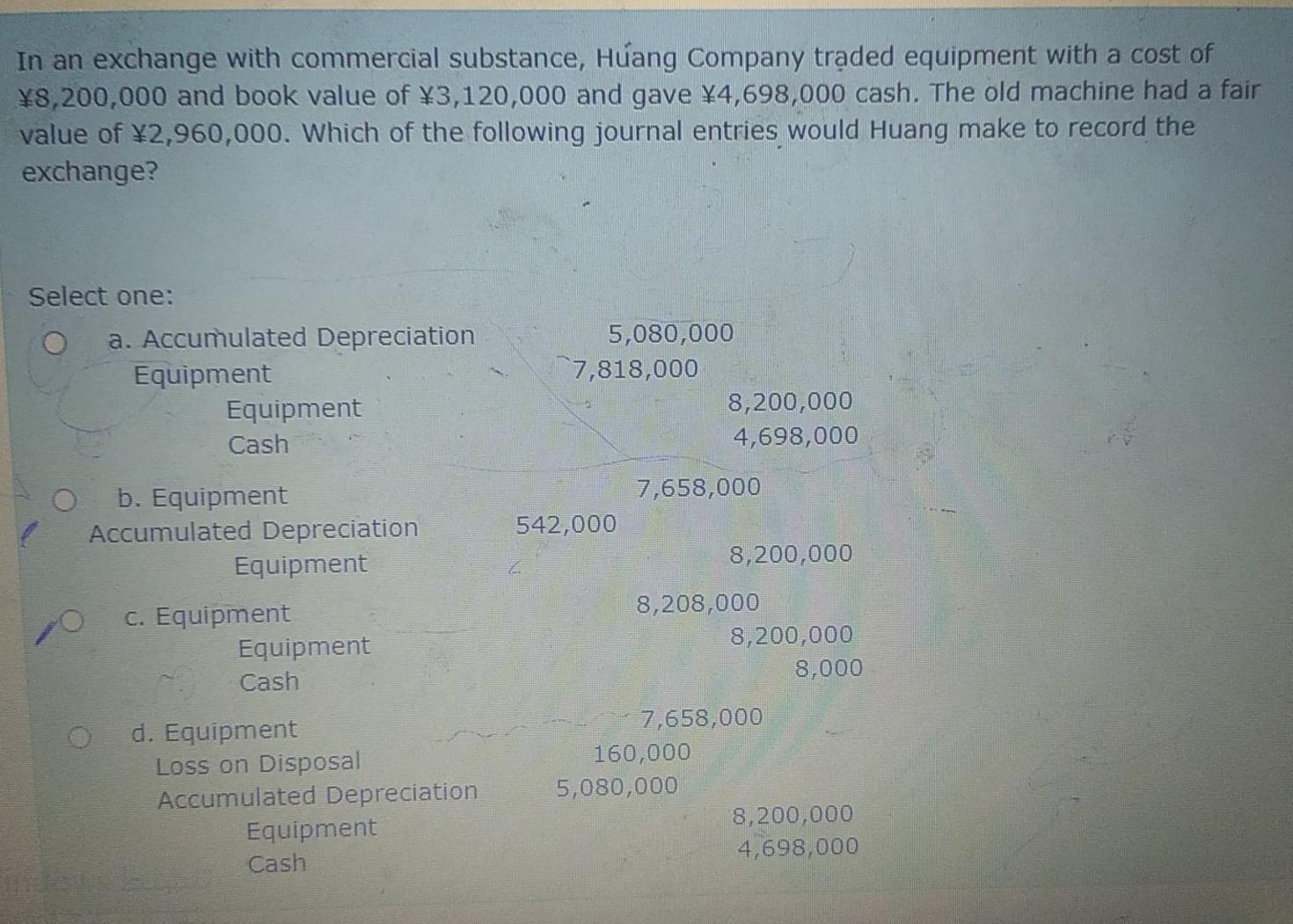

Lee Company received an HK$1,800,000 subsidy from the government to purchase manufacturing equipment on January, 2, 2015. The equipment has a cost of HK$3,000,000, a useful life a six years, and no salvage value. Lee depreciates the equipment on a straight-line basis. If Lee chooses to account for the grant as deferred revenue, the grant revenue recognized will be: Select one: a. HK$300,000 per year for the years 2015-2020. b. Zero in the first year of the grant's life. 0 C. $HK1,800,000 in 2015. O dos d. HK$500,000 per year for the years 2015-2020. Jamar Company purchased a depreciable asset for $150,000. The estimated residual value is $10,000, and the estimated useful life is 8 years. The double-declining balance method will be used for depreciation. What is the depreciation expense for the second year on this asset? Select one: a. $28,125 b. $37,500 O C. $26,250 d. $17,500 Gabrielle Inc. and Lucci Company have an exchange with no commercial substance. The asset given up by Gabrielle has a book value of 120,000 and a fair value of 135,000. The asset given up by Lucci has a book value of 220,000 and a fair value of 200,000. Boot of 65,000 is received by Lucci. What amount should Gabrielle record for the asset received? Select one: a. 110,000 b. 200,000 c. 135,000 d. 185,000 Lee Company received an HK$1,800,000 subsidy from the government to purchase manufacturing equipment on January 2, 2015. The equipment has a cost of HK$3,000,000, a useful life a six years, and no salvage value. Lee depreciates the equipment on a straight-line basis. If Lee chooses to account for the grant as deferred revenue, the grant revenue recognized will be: Select one: a. HK$500,000 per year for the years 2015-2020. b. Zero in the first year of the grant's life. c. $HK1,800,000 in 2015. O d. HK$300,000 per year for the years 2015-2020. In an exchange with commercial substance, Huang Company traded equipment with a cost of 8,200,000 and book value of 3,120,000 and gave 4,698,000 cash. The old machine had a fair value of 2,960,000. Which of the following journal entries would Huang make to record the exchange? Select one: a. Accumulated Depreciation Equipment Equipment Cash 5,080,000 7,818,000 8,200,000 4,698,000 7,658,000 542,000 8,200,000 b. Equipment Accumulated Depreciation Equipment C. Equipment Equipment Cash 8,208,000 8,200,000 8,000 d. Equipment Loss on Disposal Accumulated Depreciation Equipment Cash 7,658,000 160,000 5,080,000 8,200,000 4,698,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started