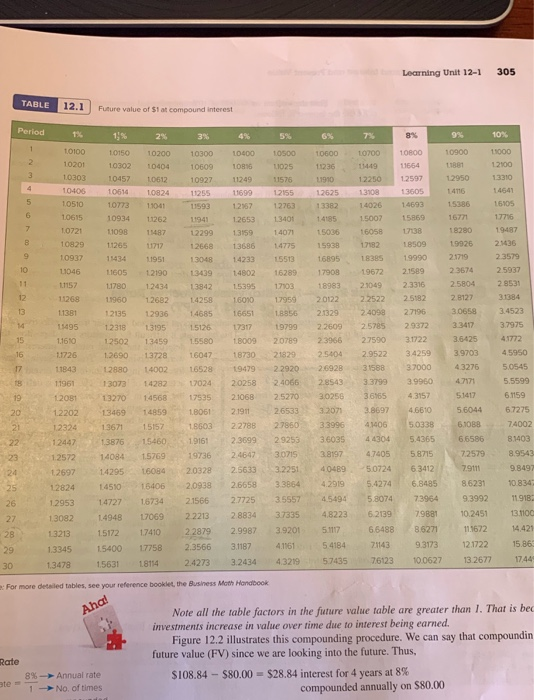

Lee Holmes deposited $16,500 in a new savings account at 12% interest compounded semiannually. At the beginning of year 4, Lee deposits an additional $41,500 at 12% interest compounded semiannually. At the end of 6 years, what is the balance in Lee's account? (Use the Table provided.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Balance 305 Learning Unit 12-1 TABLE 12.1 Future value of $1 at compound interest Period 13% 9 % 10% 1% 8% 2 % 3 % 4 % 5% 6% 7% 1.0100 10900 11000 10150 10200 10500 10700 10800 10300 10400 10600 10201 11881 12100 10302 10404 10816 1I025 11236 11449 11664 10609 1.0303 13310 12597 12950 10457 11249 12250 1.0612 10927 11576 11910 14641 10406 13605 14116 10614 11699 13108 LO824 11255 12155 12625 15386 10510 16105 10773 11593 12763 14026 14693 11041 12167 13382 10615 1.3401 16771 17716 10934 1.5007 15869 11262 14185 11941 1.2653 10721 1.8280 19487 17138 11098 12299 14071 15036 16058 11487 13159 2.1436 10829 1.8509 1.9926 11265 13686 15938 17182 1717 12668 14775 2.3579 21719 10937 1.8385 19990 11434 11951 14233 15513 16895 13048 10 2.3674 2.5937 11046 2.1589 11605 17908 19672 12190 13439 14802 16289 2.853 11 2.3316 2.5804 11157 17103 18983 2.1049 11780 1.2434 13842 1.5395 12 2.2522 31384 2.5182 2.8127 11268 12682 20122 11960 14258 16010 17959 3.4523 18856 3.0658 2.4098 27196 11381 16651 21329 12135 12936 14685 3.7975 2.5785 29372 3.3417 15495 15126 19799 1.2318 17317 2.2609 13195 41772 31722 3.6425 15 20789 23966 27590 11610 12502 13459 15580 1.8009 45950 21829 3.4259 3.9703 2.5404 2.9522 16 1726 1.2690 13728 16047 18730 3 1588 a7000 5.0545 4.3276 26928 17 11843 12880 14002 16528 19479 2 2920 5.5599 24066 3.3799 3.9960 47171 17024 20258 2.8543 1s 14282 11961 13073 19 30256 4.3157 51417 6.1159 2.5270 36165 1208 13270 17535 2.1068 14568 3.2071 67275 13469 3.8697 4.6610 56044 20 2.1911 26533 12202 14859 180611 27860 5.0338 6.1088 74002 21 2.2788 33996 41406 15157 18603 12324 13671 4 4304 66586 81403 15460 29253 36035 nd 5.4365 2.3699 22 1.3876 19161 12447 72579 8.9543 3.0715 3.8197 47405 5.8715 19736 2.4647 14084 15769 23 1.2572 3.2251 5.0724 6.3412 7911 9.8497 2.5633 4.0489 2.0328 14295 16084 24 1,2697 10.834 4.2919 5.4274 6.8485 8.6231 2.0938 2.6658 3.3864 16406 25 12824 14510 35557 11.918 4.5494 5.8074 73964 9.3992 27725 21566 16734 1.2953 14727 26 7.9881 10.2451 13.1100 37335 4.8223 6.2139 2.8834 17069 22213 14948 27 13082 86271 11.1672 14.421 5.1117 66488 2.9987 39201 2.2879 15172 1.7410 13213 28 15.863 9.3173 12.1722 5 4184 71143 3.1187 4.1161 17758 2.3566 15400 29 13345 13.2677 1744 57435 76123 10.0627 4.3219 2.4273 3.2434 1,5631 18114 30 1,3478 For more detailed tables, see your reference booklet, the Business Moth Handbook Note all the table factors in the future value table are greater than 1. That is bec investments increase in value over time due to interest being earned. Figure 12.2 illustrates this compounding procedure. We can say that compoundine Aha! looking into the future. Thus, future value (FV) since we are Rate $28.84 interest for 4 years at 8% compounded annually on $80.00 $108.84 $80.00 8% Annual rate ate No. of times RRARARR