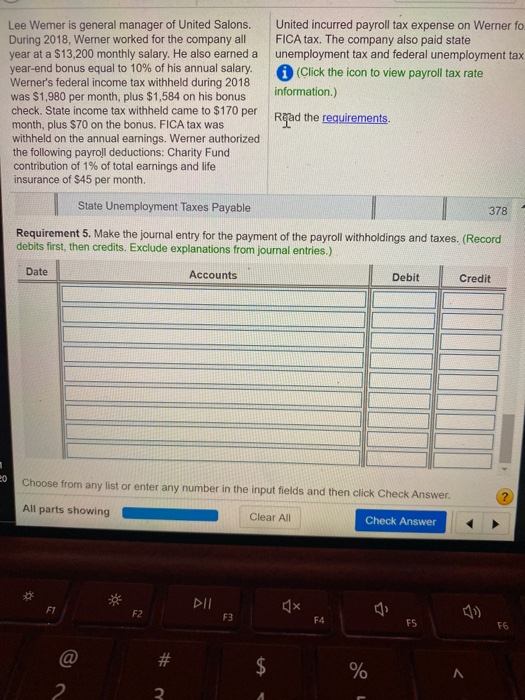

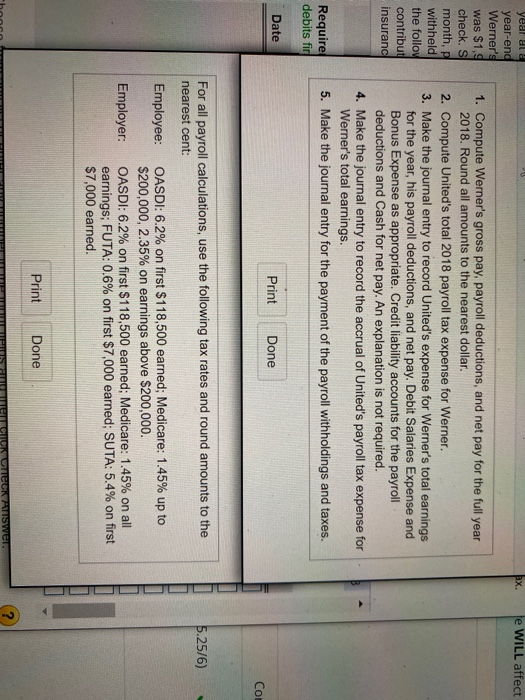

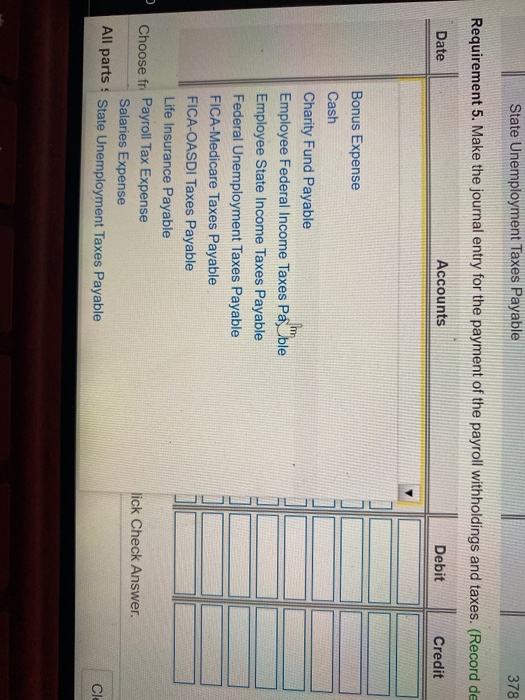

Lee Wemer is general manager of United Salons. During 2018, Werner worked for the company all year at a $13,200 monthly salary. He also earned a year-end bonus equal to 10% of his annual salary. Werner's federal income tax withheld during 2018 was $1,980 per month, plus $1,584 on his bonus check. State income tax withheld came to $170 per month, plus $70 on the bonus. FICA tax was withheld on the annual earnings. Werner authorized the following payroll deductions: Charity Fund contribution of 1% of total earnings and life insurance of $45 per month. United incurred payroll tax expense on Werner fo FICA tax. The company also paid state unemployment tax and federal unemployment tax (Click the icon to view payroll tax rate information.) Read the requirements. State Unemployment Taxes Payable 378 Requirement 5. Make the journal entry for the payment of the payroll withholdings and taxes. (Record debits first, then credits. Exclude explanations from journal entries.) Date Account Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All Check Answer DIL X e WILL affect 1 year al year-end Werner's was $1, 9 check. S month, withheld the follow contribut insuranc . Compute Werner's gross pay, payroll deductions, and net pay for the full year 2018. Round all amounts to the nearest dollar. 2. Compute United's total 2018 payroll tax expense for Werner. 3. Make the journal entry to record United's expense for Werner's total earnings for the year, his payroll deductions, and net pay. Debit Salaries Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required. 4. Make the journal entry to record the accrual of United's payroll tax expense for Werner's total earnings. 5. Make the journal entry for the payment of the payroll withholdings and taxes. Require debits fir Date Print Done Cor ULD For all payroll calculations, use the following tax rates and round amounts to the nearest cent: 5.25/6) Employee: Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Done TP PISATELOR UNECRATISwer. State Unemployment Taxes Payable 378 Requirement 5. Make the journal entry for the payment of the payroll withholdings and taxes. (Record de Date Accounts Debit Credit Bonus Expense Cash Charity Fund Payable Employee Federal Income Taxes Pable Employee State Income Taxes Payable Federal Unemployment Taxes Payable FICA-Medicare Taxes Payable FICA-OASDI Taxes Payable Life Insurance Payable Choose fr Payroll Tax Expense Salaries Expense All parts: State Unemployment Taxes Payable lick Check Answer. Cle