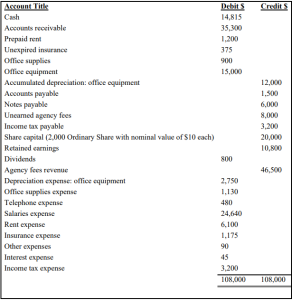

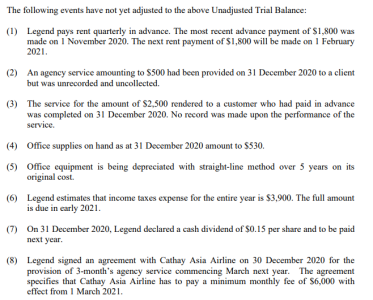

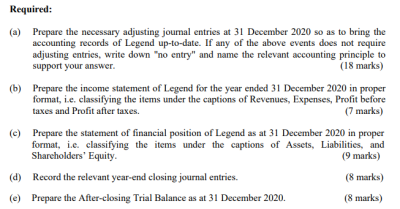

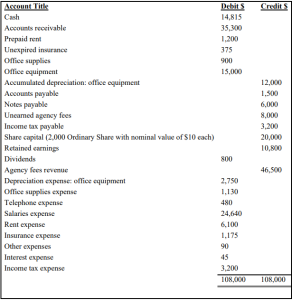

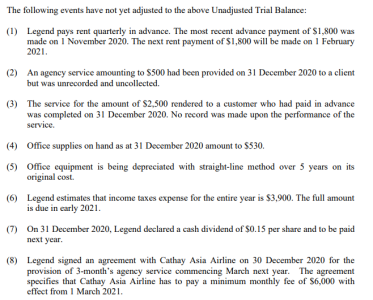

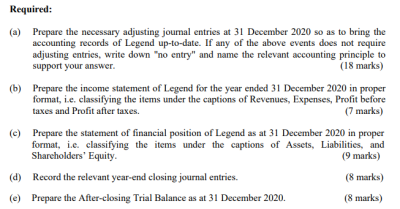

Legend Advertising Limited (Legend) is a communications agency specialized in strengthening brands for their clients through online or offline platforms. Some clients pay in advance for services; others are billed after services have been performed. Advance payments are credited to an account entitled Uneamed Agency Fees. Adjusting entries are performed on a monthly basis. Closing entries are performed annually on 31 December. Below is Legend's Unadjusted Trial Balance at the year ended 31 December 2020. Credits Account Title Cash 14,815 Accounts receivable 35,300 Prepaid rent 1,200 Unexpired insurance 375 Office supplies 900 Office equipment 15,000 Accumulated depreciation office equipment Accounts payable Notes payable Uncamed agency fees Income tax payable Share capital (2.000 Ordinary Share with nominal value of S10 cach) Retained earning Dividends 800 Apmey fees revenue Depreciation expense office equipment 2,750 Office supplies expense 1.130 Telephone expense 480 Salaries expense 24,640 Rent expense 6.100 Insurance expense 1.175 Other expenses 90 Interest expense 45 Income tax expense 3,200 108,000 12,000 1.500 6,000 8,000 3,200 20,000 10.800 46,500 10.000 The following events have not yet adjusted to the above Unadjusted Trial Balance: (1) Legend pays rent quarterly in advance. The most recent advance payment of $1,800 was made on 1 November 2020. The next rent payment of $1,800 will be made on 1 February 2021 (2) An agency service amounting to S500 had been provided on 31 December 2020 to a client but was unrecorded and uncollected. (3) The service for the amount of $2,500 rendered to a customer who had paid in advance was completed on 31 December 2020. No record was made upon the performance of the service. (4) Office supplies on hand as at 31 December 2020 amount to $530, (5) Office equipment is being depreciated with straight-line method over 5 years on its original cost. (6) Legend estimates that income taxes expense for the entire year is $3,900. The full amount is due in early 2021. (7) On 31 December 2020, Legend declared a cash dividend of $0.15 per share and to be paid next year. (8) Legend signed an agreement with Cathay Asia Airline on 30 December 2020 for the provision of 3-month's agency service commencing March next year. The agreement specifies that Cathay Asia Airline has to pay a minimum monthly fee of $6,000 with effect from 1 March 2021. Required: (a) Prepare the necessary adjusting joumal entries at 31 December 2020 so as to bring the accounting records of Legend up-to-date. If any of the above events does not require adjusting entries, write down "no entry" and name the relevant accounting principle to support your answer. (18 marks) (b) Prepare the income statement of Legend for the year ended 31 December 2020 in proper format, i.e. classifying the items under the captions of Revenues, Expenses, Profit before taxes and Profit after taxes. (7 marks) (e) Prepare the statement of financial position of Legend as at 31 December 2020 in proper format, i.e. classifying the items under the captions of Assets, Liabilities, and Shareholders' Equity (9 marks) (d) Record the relevant year-end closing journal entries. (8 marks) @) Prepare the After-closing Trial Balance as at 31 December 2020. (8 marks) (