Answered step by step

Verified Expert Solution

Question

1 Approved Answer

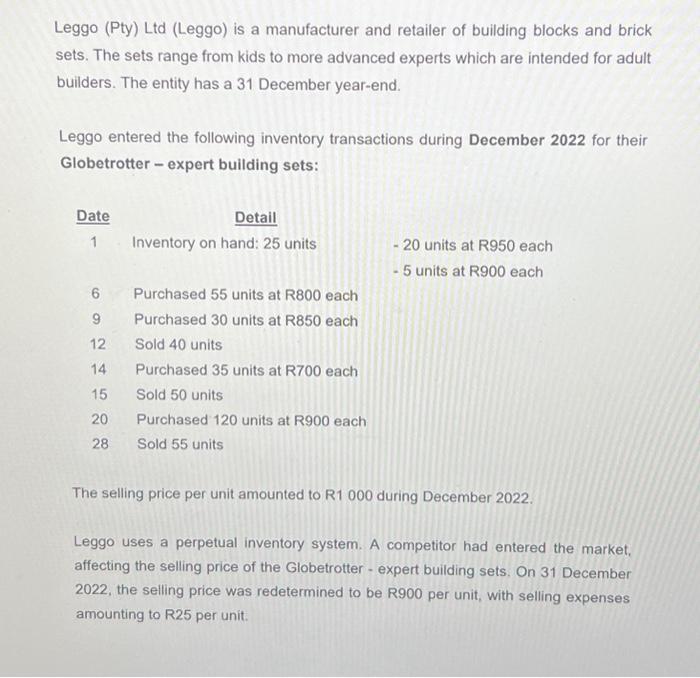

Leggo (Pty) Ltd (Leggo) is a manufacturer and retailer of building blocks and brick sets. The sets range from kids to more advanced experts

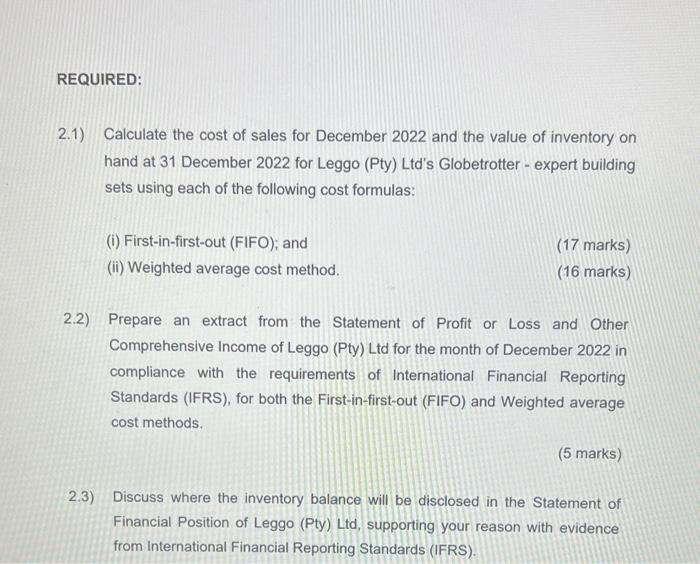

Leggo (Pty) Ltd (Leggo) is a manufacturer and retailer of building blocks and brick sets. The sets range from kids to more advanced experts which are intended for adult builders. The entity has a 31 December year-end. Leggo entered the following inventory transactions during December 2022 for their Globetrotter-expert building sets: Date 1 6 9 12 14 15 20 28 Detail Inventory on hand: 25 units Purchased 55 units at R800 each Purchased 30 units at R850 each Sold 40 units Purchased 35 units at R700 each Sold 50 units Purchased 120 units at R900 each Sold 55 units - 20 units at R950 each - 5 units at R900 each The selling price per unit amounted to R1 000 during December 2022. Leggo uses a perpetual inventory system. A competitor had entered the market, affecting the selling price of the Globetrotter expert building sets. On 31 December 2022, the selling price was redetermined to be R900 per unit, with selling expenses amounting to R25 per unit. REQUIRED: 2.1) Calculate the cost of sales for December 2022 and the value of inventory on hand at 31 December 2022 for Leggo (Pty) Ltd's Globetrotter - expert building sets using each of the following cost formulas: (i) First-in-first-out (FIFO); and (ii) Weighted average cost method. (17 marks) (16 marks) 2.2) Prepare an extract from the Statement of Profit or Loss and Other Comprehensive Income of Leggo (Pty) Ltd for the month of December 2022 in compliance with the requirements of International Financial Reporting Standards (IFRS), for both the First-in-first-out (FIFO) and Weighted average cost methods. (5 marks) 2.3) Discuss where the inventory balance will be disclosed in the Statement of Financial Position of Leggo (Pty) Ltd, supporting your reason with evidence from International Financial Reporting Standards (IFRS).

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

21 Cost of Sales and Inventory Valuation Firstinfirstout FIFO Method Calculation of Cost of Sales 40 units sold at R950 each from the initial inventory 40 R950 R38000 15 units sold at R800 each from t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started