Answered step by step

Verified Expert Solution

Question

1 Approved Answer

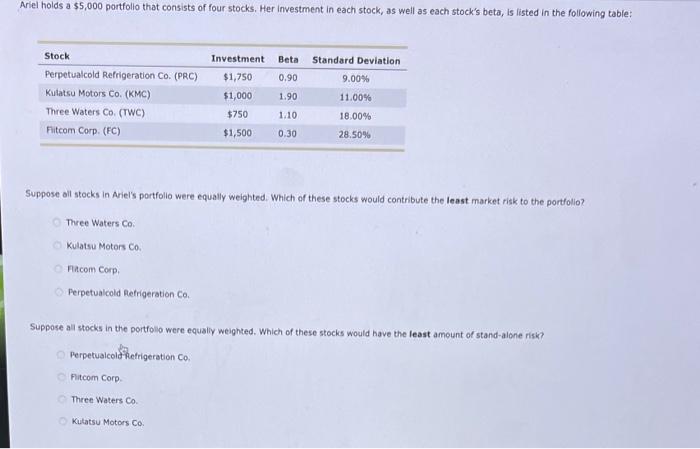

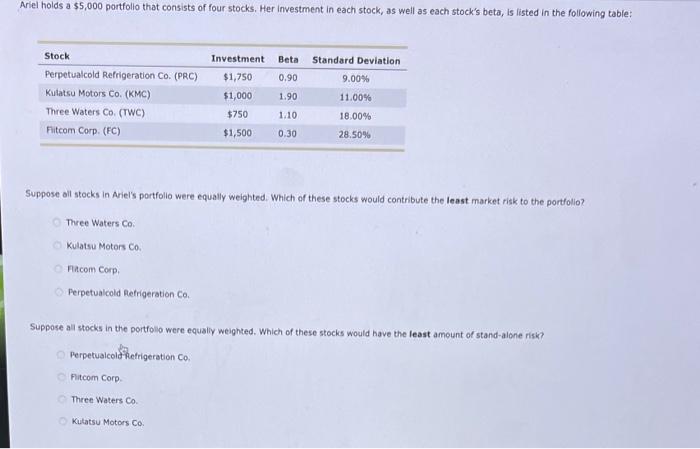

legibility is encouraged Ariel holds a $5,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is

legibility is encouraged

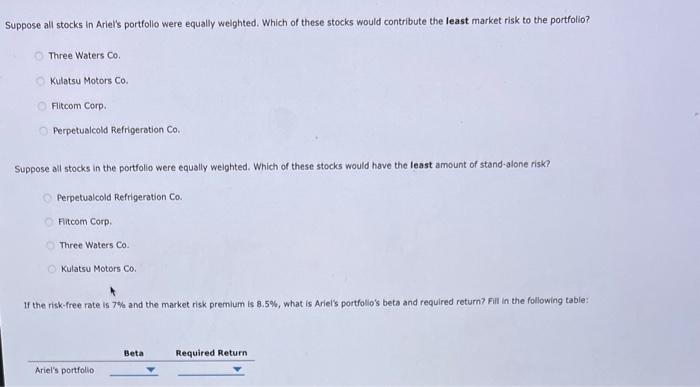

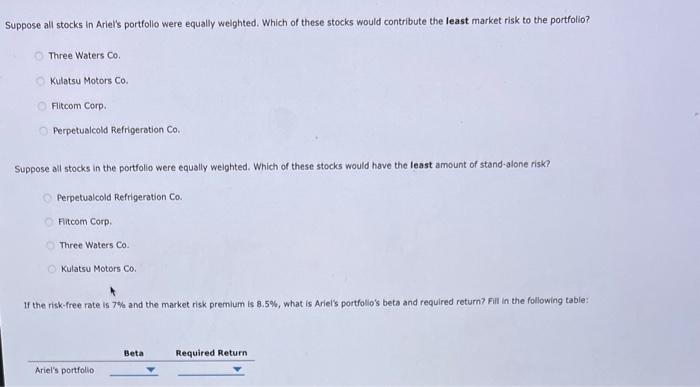

Ariel holds a $5,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Suppose all stocks in Ariel's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfollo? Three Waters Co. Kulatsu Motors Co. Aacom Corp. Perpetualcold Refrigeration Co. Suppose all stocks in the portfollo were equaliy weighted. Which of these stocks would have the least amount of stand-alone risk? Perpetuaicold thetrigeration C. Fitcom Corp. Three Waters Co Kutatsu Motors Co. Suppose all stocks in Ariel's portfollo were equally welghted. Which of these stocks would contribute the least market risk to the portfolio? Three Waters Co. Kulatsu Motors Co. Flitcom Corp. Perpetualcold Refrigeration Co Suppose ail stocks in the portfolio were equally welghted. Which of these stocks would have the least amount of stand-alone risk? Perpetualcold Refrigeration Ca. Fitcom Corp. Three Waters Co. Kulatsu Motors Co. If the risk-free rate is 7% and the market risk premium is 8.5%, what is Arieis portfollo's beta and required return? fill in the following table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started