Question

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $22 per unit. Lehighton uses an actual costing system, which means

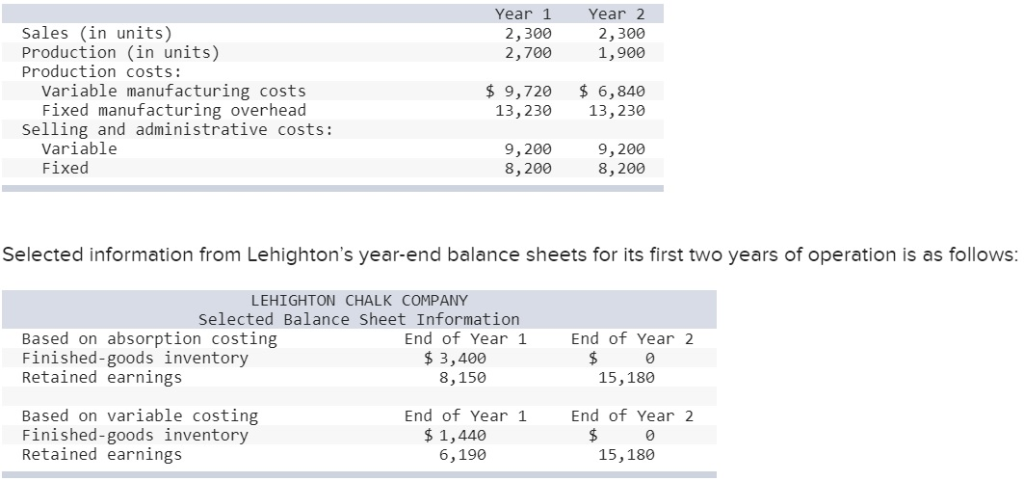

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $22 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehightons first two years of operation is as follows:

-

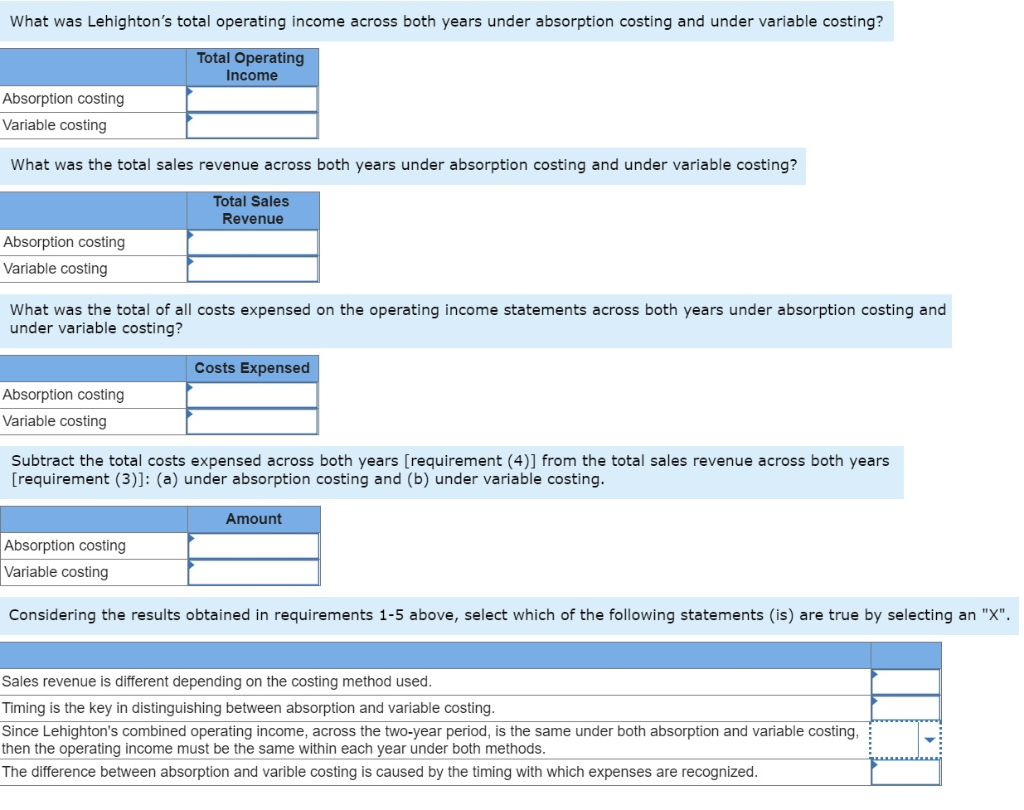

What was Lehightons total operating income across both years under absorption costing and under variable costing?

-

What was the total sales revenue across both years under absorption costing and under variable costing?

-

What was the total of all costs expensed on the operating income statements across both years under absorption costing and under variable costing?

-

Subtract the total costs expensed across both years [requirement (4)] from the total sales revenue across both years [requirement (3)]: (a) under absorption costing and (b) under variable costing.

-

Considering the results obtained in requirements 1-5 above, select which of the following statements (is) are true by selecting an "X".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started