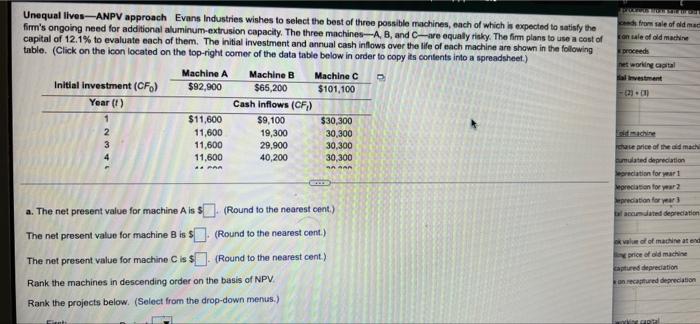

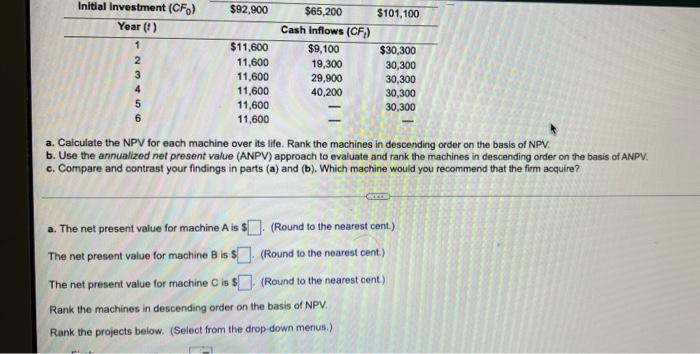

LEILA fror sale of old me one of old machine proceeds networking capital Unequal lives-ANPV approach Evans Industries wishes to select the best of three possible machines, each of which is expected to satisfy the firm's ongoing need for additional aluminum-extrusion capacity. The three machines-A B, and C-re equally risky. The firm plans to use a cost of capital of 12.1% to evaluate each of them. The initial investment and annual cash inflows over the life of each machine are shown in the following table. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Machine A Machine B Machine C Initial Investment (CF) $92,900 $65,200 $101,100 Year (1) Cash Inflows (CF) 1 $11,600 $9,100 $30,300 2 11,600 19,300 30,300 3 11,600 29,900 30,300 11,600 40,200 30,300 1. PAR SAAR cute price of the old mach sumulated depreciation preciation for at preciation for war2 preciation for years andated depreciation a. The net present value for machine Ais $ (Round to the nearest cent) The net present value for machine B is $. (Round to the nearest cont.) The net present value for machine is $(Round to the nearest cent) Rank the machines in descending order on the basis of NPV Rank the projects below. (Select from the drop-down menus.) volume of of machine price of old machine captured depreciation on captured depreciation Initial Investment (CF) $92,900 $65,200 $101,100 Year (1) Cash inflows (CF) $11,600 $9,100 $30,300 2 11,600 19,300 30,300 3 11,600 29,900 30,300 4 11,600 40,200 30,300 5 11,600 30,300 6 11,600 a. Calculate the NPV for each machine over its life. Rank the machines in descending order on the basis of NPV. b. Use the annualized net present value (ANPV) approach to evaluate and rank the machines in descending order on the basis of ANPV. c. Compare and contrast your findings in parts (a) and (b). Which machine would you recommend that the firm acquire? UN CA a. The net present value for machine Ais $. (Round to the nearest cent.) The net present value for machine B is $]. (Round to the nearest cent.) The net present value for machine C is $. (Round to the nearest cent.) Rank the machines in descending order on the basis of NPV. Rank the projects below. (Select from the drop down menus.)