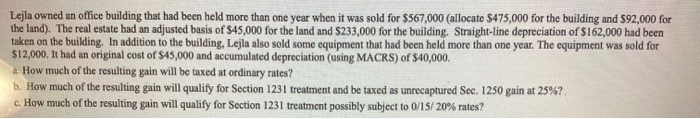

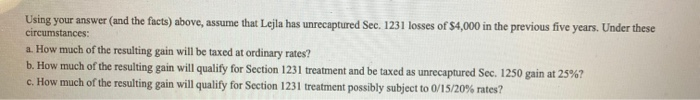

Lejla owned an office building that had been held more than one year when it was sold for $567,000 (allocate $475,000 for the building and $92,000 for the land). The real estate had an adjusted basis of $45,000 for the land and $233,000 for the building. Straight-line depreciation of $162,000 had been taken on the building. In addition to the building, Lejla also sold some equipment that had been held more than one year. The equipment was sold for $12,000. It had an original cost of $45,000 and accumulated depreciation (using MACRS) of $40,000. a. How much of the resulting gain will be taxed at ordinary rates? b. How much of the resulting gain will qualify for Section 1231 treatment and be taxed as unrecaptured Sec. 1250 gain at 25%? c. How much of the resulting gain will qualify for Section 1231 treatment possibly subject to 0/15/20% rates? Using your answer (and the facts) above, assume that Lejla has unrecaptured Sec. 1231 losses of $4,000 in the previous five years. Under these circumstances: a. How much of the resulting gain will be taxed at ordinary rates? b. How much of the resulting gain will qualify for Section 1231 treatment and be taxed as unrecaptured Sec. 1250 gain at 25%? c. How much of the resulting gain will qualify for Section 1231 treatment possibly subject to 0/15/20% rates? Lejla owned an office building that had been held more than one year when it was sold for $567,000 (allocate $475,000 for the building and $92,000 for the land). The real estate had an adjusted basis of $45,000 for the land and $233,000 for the building. Straight-line depreciation of $162,000 had been taken on the building. In addition to the building, Lejla also sold some equipment that had been held more than one year. The equipment was sold for $12,000. It had an original cost of $45,000 and accumulated depreciation (using MACRS) of $40,000. a. How much of the resulting gain will be taxed at ordinary rates? b. How much of the resulting gain will qualify for Section 1231 treatment and be taxed as unrecaptured Sec. 1250 gain at 25%? c. How much of the resulting gain will qualify for Section 1231 treatment possibly subject to 0/15/20% rates? Using your answer (and the facts) above, assume that Lejla has unrecaptured Sec. 1231 losses of $4,000 in the previous five years. Under these circumstances: a. How much of the resulting gain will be taxed at ordinary rates? b. How much of the resulting gain will qualify for Section 1231 treatment and be taxed as unrecaptured Sec. 1250 gain at 25%? c. How much of the resulting gain will qualify for Section 1231 treatment possibly subject to 0/15/20% rates