Answered step by step

Verified Expert Solution

Question

1 Approved Answer

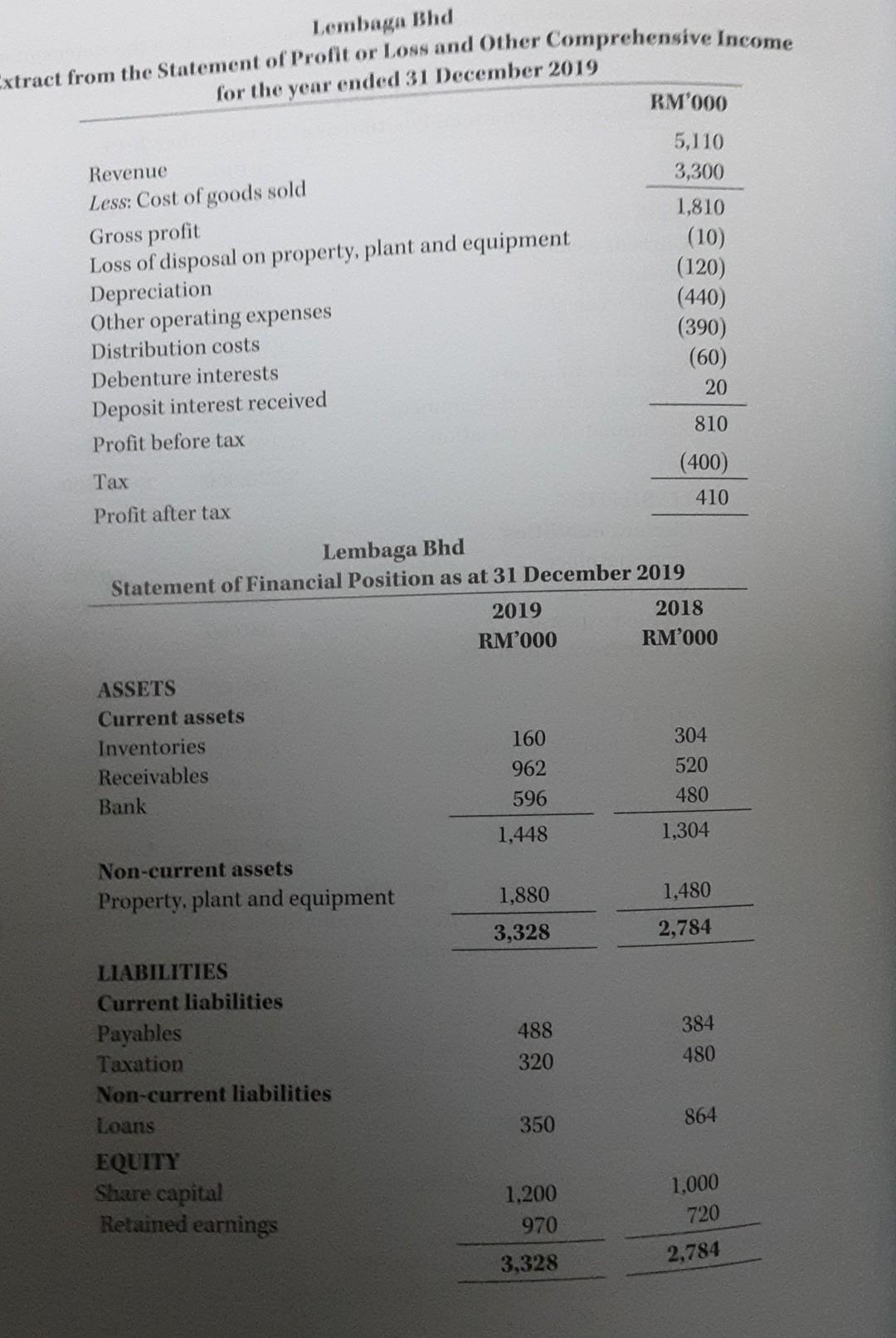

Lembaga Bhd Extract from the Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019 Revenue Less: Cost of

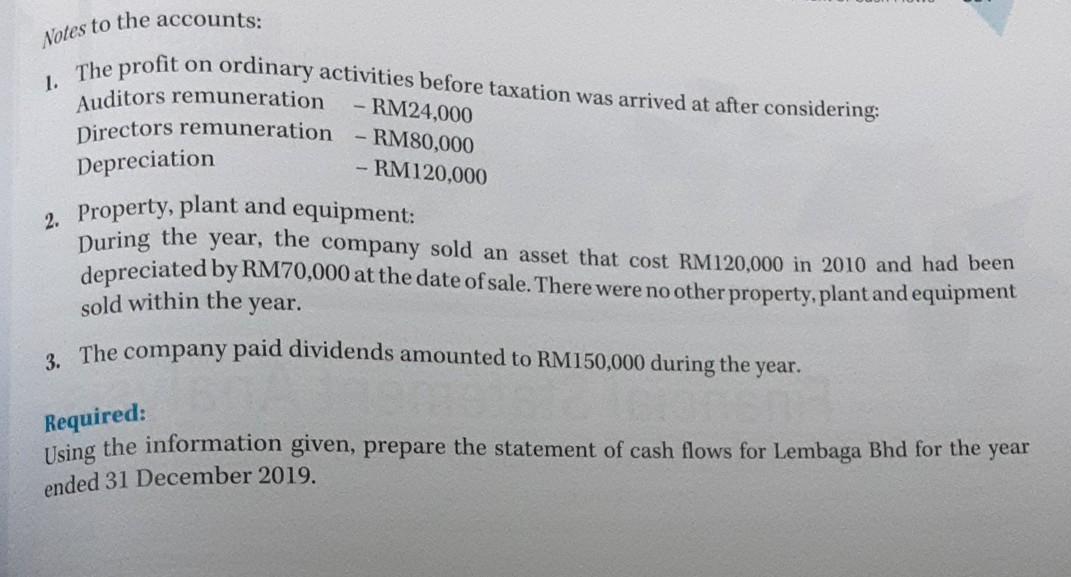

Lembaga Bhd Extract from the Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019 Revenue Less: Cost of goods sold Gross profit Loss of disposal on property, plant and equipment Depreciation Other operating expenses Distribution costs Debenture interests Deposit interest received Profit before tax RM'000 5,110 3,300 1,810 (10) (120) (440) (390) (60) 20 810 (400) Tax 410 Profit after tax Lembaga Bhd Statement of Financial Position as at 31 December 2019 2019 RM'000 2018 RM'000 304 ASSETS Current assets Inventories Receivables Bank 160 962 596 520 480 1,448 1,304 Non-current assets Property, plant and equipment 1,880 1,480 3,328 2,784 488 384 320 480 LIABILITIES Current liabilities Payables Taxation Non-current liabilities Loans EQUITY Share capital Retained earnings 350 864 1.200 970 1,000 720 3,328 2,784 Notes to the accounts: 1 The profit on Auditors remuneration Directors remuneration Depreciation 2. Property, plant and equipment: ordinary activities before taxation was arrived at after considering: - RM24,000 - RM80,000 - RM120,000 During the year, the company sold an asset that cost RM120,000 in 2010 and had been depreciated by RM70,000 at the date of sale. There were no other property, plant and equipment sold within the year. 3. The company paid dividends amounted to RM150,000 during the year. Required: Using the information given, prepare the statement of cash flows for Lembaga Bhd for the year ended 31 December 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started