Answered step by step

Verified Expert Solution

Question

1 Approved Answer

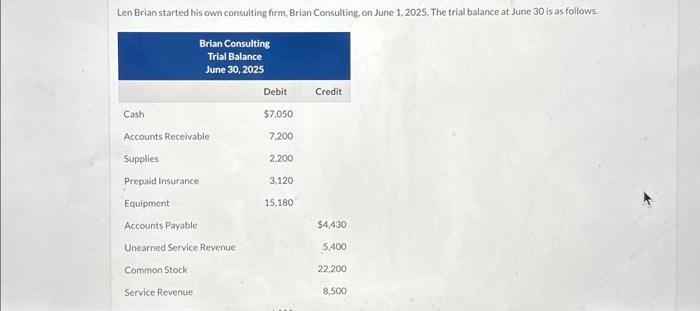

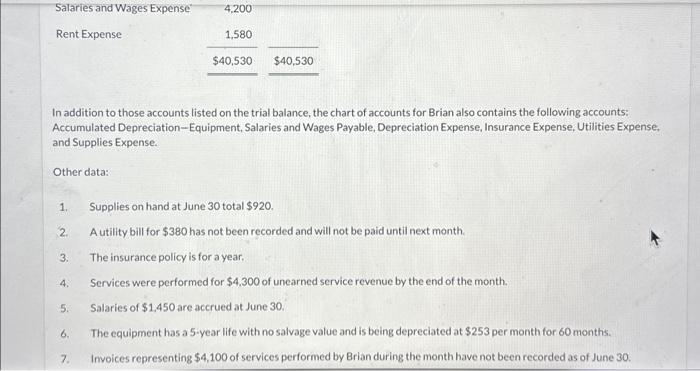

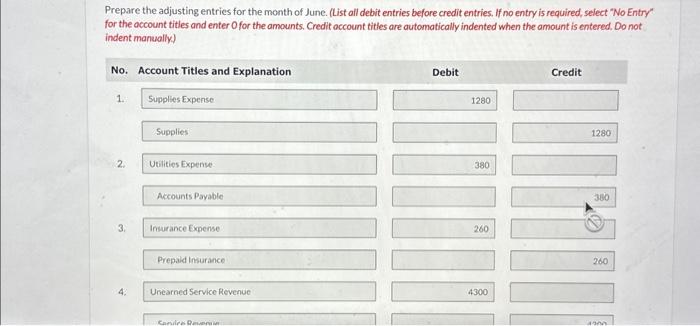

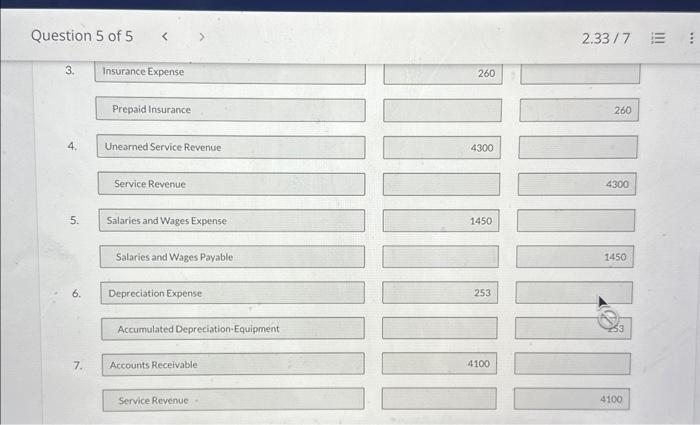

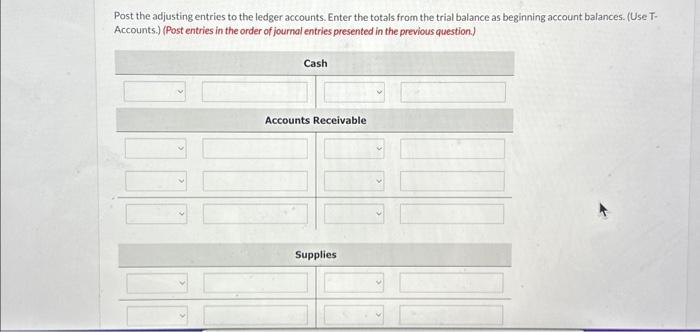

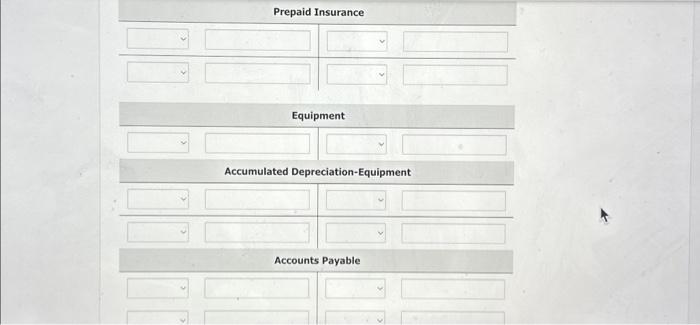

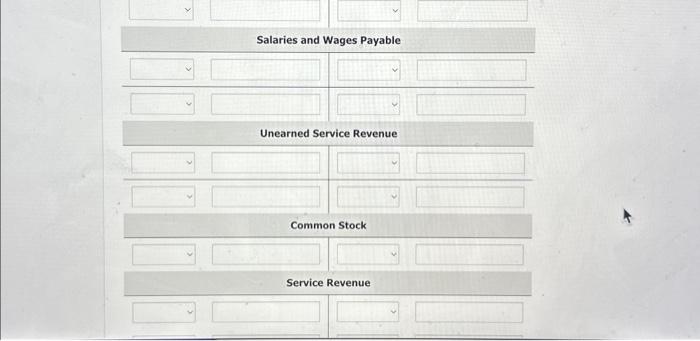

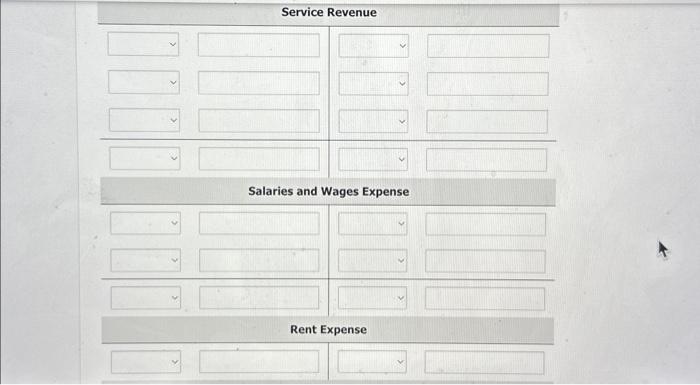

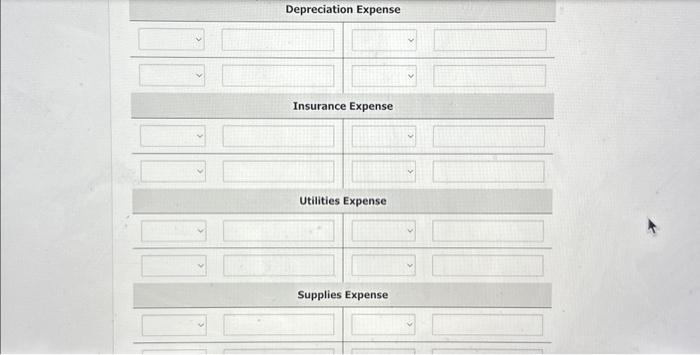

Len Brian started his own consulting firm, Brian Consulting, on June 1, 2025. The trial balance at June 30 is as follows. Prepaid Insurance Equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started