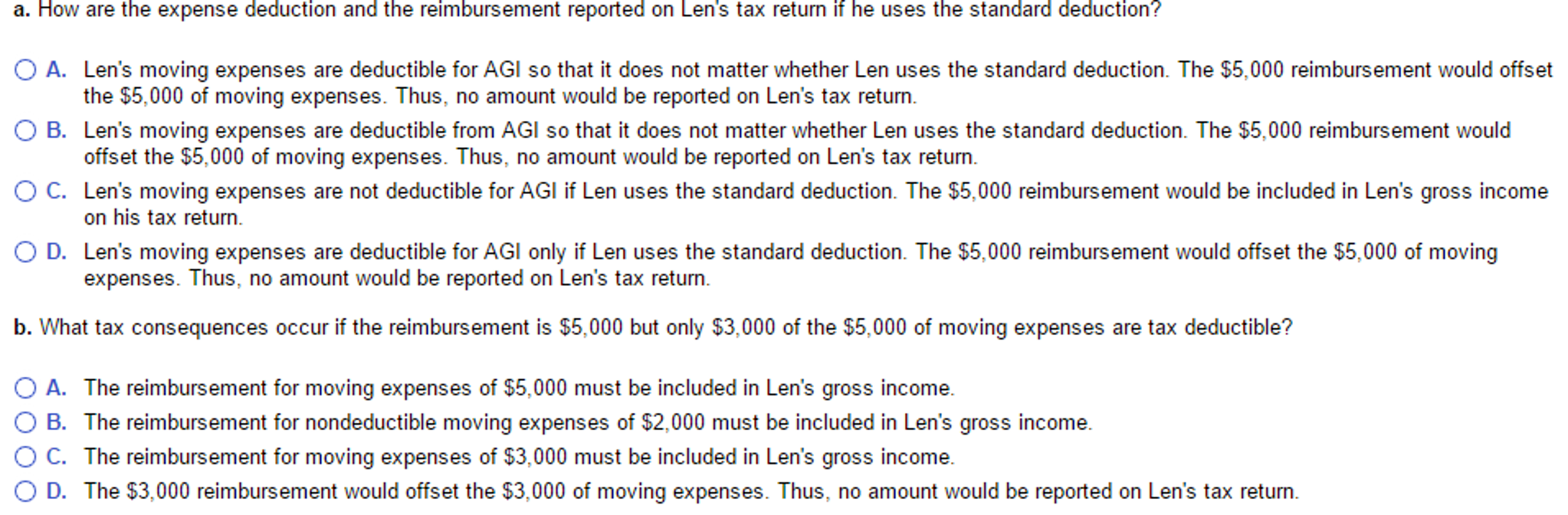

Len incurs $5,000 of deductible moving expenses in the current year and is fully reimbursed by his employer in the same year How are the expense deduction and the reimbursement reported on Len's tax return if he uses the standard deduction? What tax consequences occur if the reimbursement is $5,000 but only $3,000 of the $5,000 of moving expenses are tax deductible? How are the expense deduction and the reimbursement reported on Lens tax return if he uses the standard deductions Lens moving expenses are deductible for AGI so that it does not matter whether Len uses the standard deduction. The $5,000 reimbursement would offset the $5,000 of moving expenses. Thus, no amount would be reported on Len's tax return. Len's moving expenses are deductible from AGI so that it does not matter whether Len uses the standard deduction. The $5,000 reimbursement would offset the $5,000 of moving expenses. Thus, no amount would be reported on Len's tax return. Len's moving expenses are not deductible for AGI if Len uses the standard deduction. The $5,000 reimbursement would be included in Len's gross income on his tax return. Len's moving expenses are deductible for AGI only if Len uses the standard deduction. The $5,000 reimbursement would offset the $5,000 of moving expenses. Thus, no amount would be reported on Len's tax return. What tax consequences occur if the reimbursement is $5,000 but only $3,000 of the $5,000 of moving expenses are tax deductible? The reimbursement for moving expenses of $5,000 must be included in Len's gross income.. The reimbursement for nondeductible moving expenses of $2,000 must be included in Len's gross income. The reimbursement for moving expenses of $3,000 must be included in Len's gross income. The $3,000 reimbursement would offset the $3,000 of moving expenses. Thus, no amount would be reported on Len's tax return. How are the expense deduction and the reimbursement reported on Lens tax return if he uses the standard deductions Lens moving expenses are deductible for AGI so that it does not matter whether Len uses the standard deduction. The $5,000 reimbursement would offset the $5,000 of moving expenses. Thus, no amount would be reported on Len's tax return. Len's moving expenses are deductible from AGI so that it does not matter whether Len uses the standard deduction. The $5,000 reimbursement would offset the $5,000 of moving expenses. Thus, no amount would be reported on Len's tax return. Len's moving expenses are not deductible for AGI if Len uses the standard deduction. The $5,000 reimbursement would be included in Len's gross income on his tax return. Len's moving expenses are deductible for AGI only if Len uses the standard deduction. The $5,000 reimbursement would offset the $5,000 of moving expenses. Thus, no amount would be reported on Len's tax return. What tax consequences occur if the reimbursement is $5,000 but only $3,000 of the $5,000 of moving expenses are tax deductible? The reimbursement for moving expenses of $5,000 must be included in Len's gross income. The reimbursement for nondeductible moving expenses of $2,000 must be included in Len's gross income. The reimbursement for moving expenses of $3,000 must be included in Len's gross income. The $3,000 reimbursement would offset the $3,000 of moving expenses. Thus, no amount would be reported on Len's tax return