Answered step by step

Verified Expert Solution

Question

1 Approved Answer

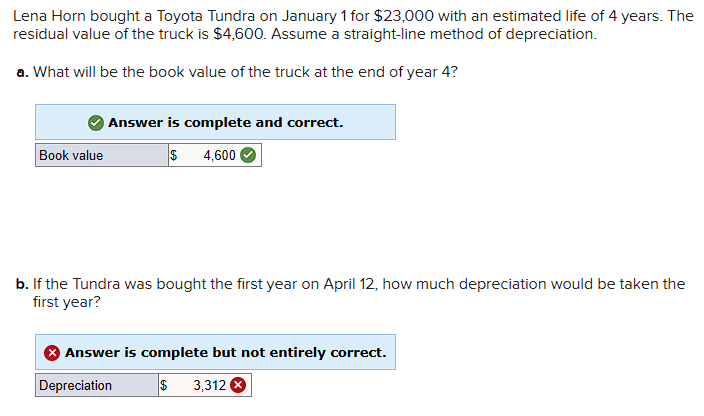

Lena Horn bought a Toyota Tundra on January 1 for $ 2 3 , 0 0 0 with an estimated life of 4 years. The

Lena Horn bought a Toyota Tundra on January for $ with an estimated life of years. The

residual value of the truck is $ Assume a straightline method of depreciation.

a What will be the book value of the truck at the end of year

Answer is complete and correct.

b If the Tundra was bought the first year on April how much depreciation would be taken the

first year?

Answer is complete but not entirely correct.

ROUND DEPRECIATION VALUE TO NEAREST WHOLE NUMBER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started