Answered step by step

Verified Expert Solution

Question

1 Approved Answer

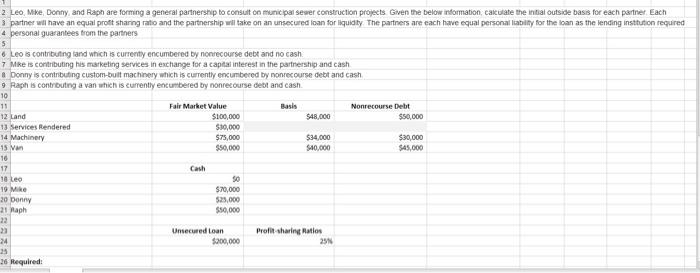

Leo, Mike, Donny, and Raph are forming a general partnership to consult on municipal sewer construction projects. Given the below information, calculate the initial outside

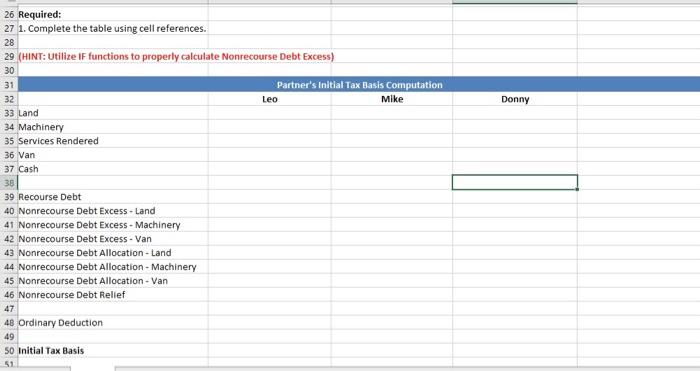

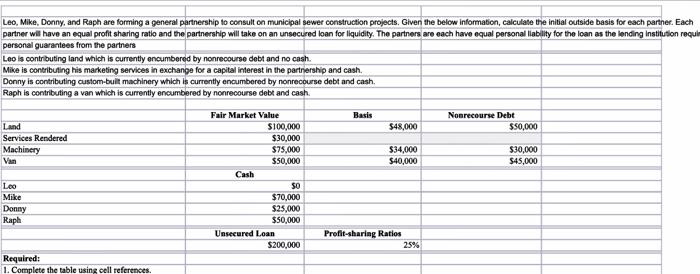

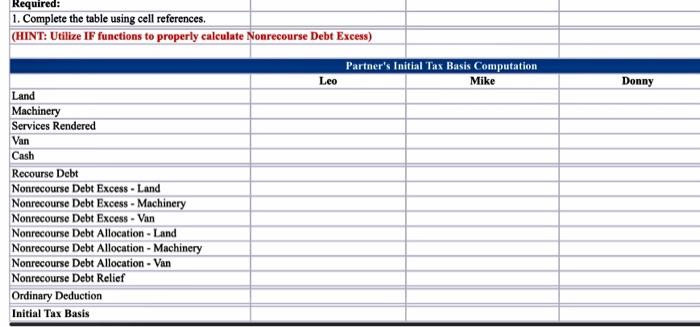

Leo, Mike, Donny, and Raph are forming a general partnership to consult on municipal sewer construction projects. Given the below information, calculate the initial outside basis for each partner. Each partner will have an equal profit sharing ratio and the partnership will take on an unsecured loan for liquidity. The partners are each have equal personal liability for the loan as the lending institution required personal guarantees from the partners

- Leo is contributing land which is currently encumbered by nonrecourse debt and no cash.

- Mike is contributing his marketing services in exchange for a capital interest in the partnership and cash.

- Donny is contributing custom-built machinery which is currently encumbered by nonrecourse debt and cash.

- Raph is contributing a van which is currently encumbered by nonrecourse debt and cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started