Leo Timmy Wingull and Julie Angela Wingull are married taxpayers. They do not have children. Below is

their information for 2019:

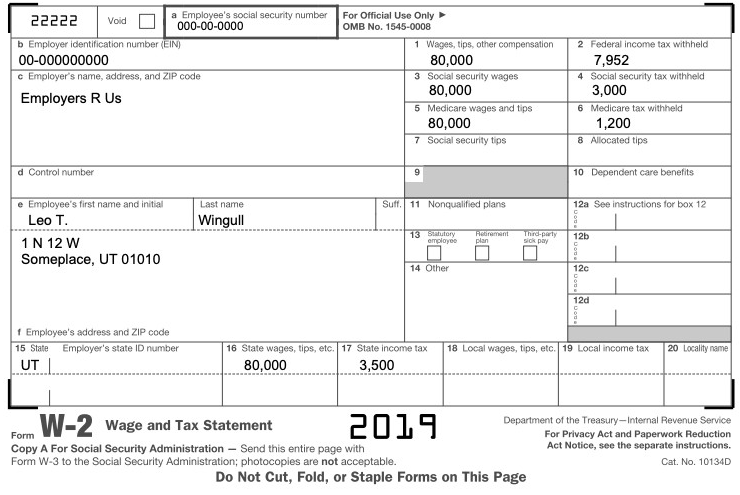

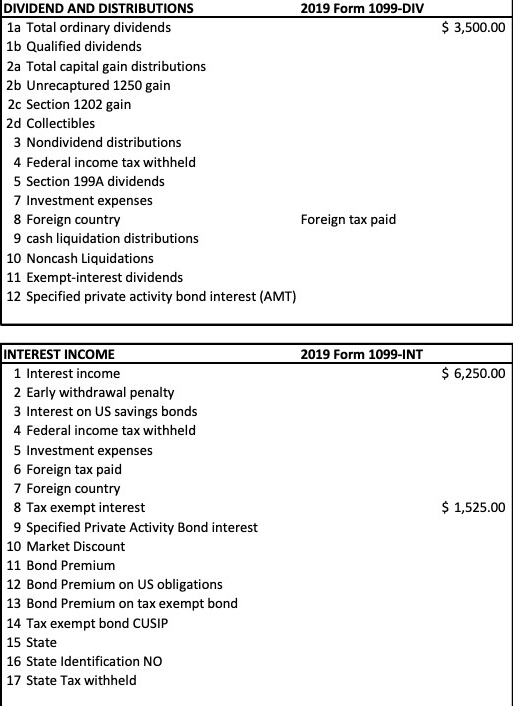

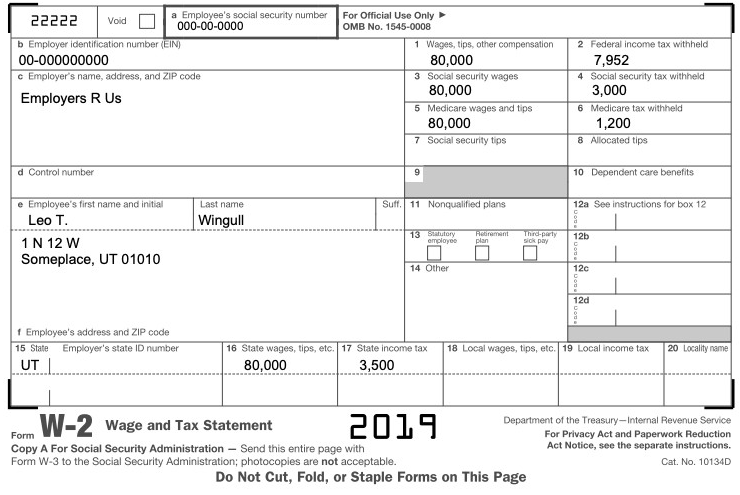

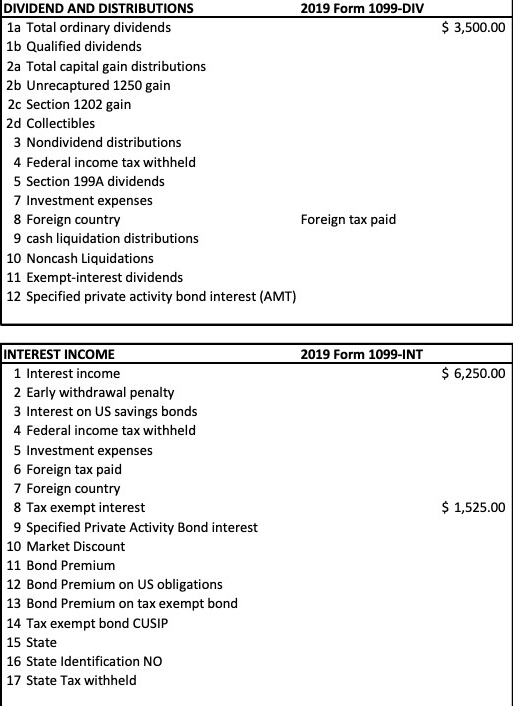

They have wages, dividend, and interest income. Please see the related forms.

Leo pays his ex-wife alimony of $10,000 a year that meets all necessary qualifications.

The divorce decree was finalized in 2011.

Julie received a gift from her cousin of $300.

Please prepare Form 1040 and all related schedules

22222 Da vaid Void U a Employee's social security number I000-00-0000 2 b Employer identification number (EIN) 00-000000000 c Employer's name, address, and ZIP code Employers R Us For Official Use Only OMB No. 1545-0008 1 Wages, tips, other compensation 80,000 3 Social Security wages 80,000 5 Medicare wages and tips 80,000 7 Social security tips Federal income tax withheld 7,952 4 Social security tax withheld 3,000 6 Medicare tax withheld 1,200 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 Wingull 13 Statutory Leo T. 1 N 12 W Someplace, UT 01010 14 Other 1 Employee's address and ZIP code 15 State Employer's state ID number UTI 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 17 State income tax 80,000 3,500 Forn W-2 Wage and Tax Statement 2019 Department of the Treasury-Internal Revenue Service For Privacy Act and Paperwork Reduction Copy A For Social Security Administration - Send this entire page with Act Notice, see the separate instructions. Form W-3 to the Social Security Administration; photocopies are not acceptable. Cat. No. 10134D Do Not Cut, Fold, or Staple Forms on This Page $ 3,500.00 DIVIDEND AND DISTRIBUTIONS 2019 Form 1099-DIV 1a Total ordinary dividends 1b Qualified dividends 2a Total capital gain distributions 2b Unrecaptured 1250 gain 2c Section 1202 gain 2d Collectibles 3 Nondividend distributions 4 Federal income tax withheld 5 Section 199A dividends 7 Investment expenses 8 Foreign country Foreign tax paid 9 cash liquidation distributions 10 Noncash Liquidations 11 Exempt-interest dividends 12 Specified private activity bond interest (AMT) 2019 Form 1099-INT $ 6,250.00 $ 1,525.00 INTEREST INCOME 1 Interest income 2 Early withdrawal penalty 3 Interest on US savings bonds 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country 8 Tax exempt interest 9 Specified Private Activity Bond interest 10 Market Discount 11 Bond Premium 12 Bond Premium on US obligations 13 Bond Premium on tax exempt bond 14 Tax exempt bond CUSIP 15 State 16 State Identification NO 17 State Tax withheld 22222 Da vaid Void U a Employee's social security number I000-00-0000 2 b Employer identification number (EIN) 00-000000000 c Employer's name, address, and ZIP code Employers R Us For Official Use Only OMB No. 1545-0008 1 Wages, tips, other compensation 80,000 3 Social Security wages 80,000 5 Medicare wages and tips 80,000 7 Social security tips Federal income tax withheld 7,952 4 Social security tax withheld 3,000 6 Medicare tax withheld 1,200 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 Wingull 13 Statutory Leo T. 1 N 12 W Someplace, UT 01010 14 Other 1 Employee's address and ZIP code 15 State Employer's state ID number UTI 18 Local wages, tips, etc. 19 Local income tax 20 Locality name 16 State wages, tips, etc. 17 State income tax 80,000 3,500 Forn W-2 Wage and Tax Statement 2019 Department of the Treasury-Internal Revenue Service For Privacy Act and Paperwork Reduction Copy A For Social Security Administration - Send this entire page with Act Notice, see the separate instructions. Form W-3 to the Social Security Administration; photocopies are not acceptable. Cat. No. 10134D Do Not Cut, Fold, or Staple Forms on This Page $ 3,500.00 DIVIDEND AND DISTRIBUTIONS 2019 Form 1099-DIV 1a Total ordinary dividends 1b Qualified dividends 2a Total capital gain distributions 2b Unrecaptured 1250 gain 2c Section 1202 gain 2d Collectibles 3 Nondividend distributions 4 Federal income tax withheld 5 Section 199A dividends 7 Investment expenses 8 Foreign country Foreign tax paid 9 cash liquidation distributions 10 Noncash Liquidations 11 Exempt-interest dividends 12 Specified private activity bond interest (AMT) 2019 Form 1099-INT $ 6,250.00 $ 1,525.00 INTEREST INCOME 1 Interest income 2 Early withdrawal penalty 3 Interest on US savings bonds 4 Federal income tax withheld 5 Investment expenses 6 Foreign tax paid 7 Foreign country 8 Tax exempt interest 9 Specified Private Activity Bond interest 10 Market Discount 11 Bond Premium 12 Bond Premium on US obligations 13 Bond Premium on tax exempt bond 14 Tax exempt bond CUSIP 15 State 16 State Identification NO 17 State Tax withheld