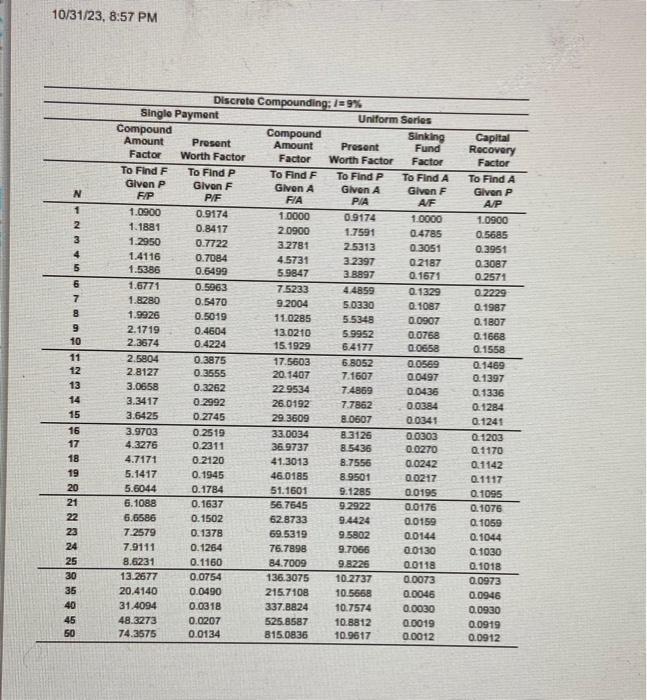

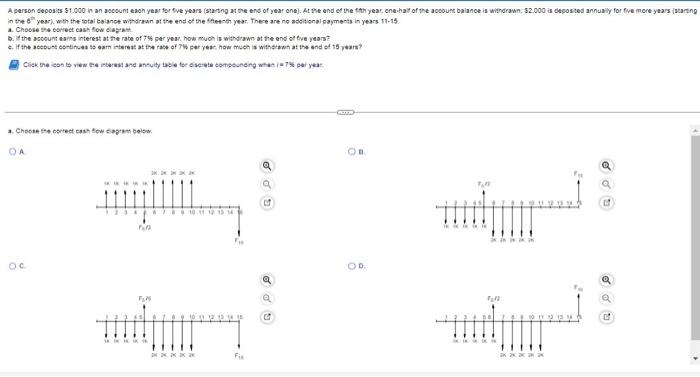

Leon and Heidi decided to invest $3,250 annkally for only the first seven years of their marriage. The first payment was made at age 25 . If the annual interest rate is 9\%, how much accumulated interest and principa! will they have at age 65 ? Click the icon to view the interest and annuity table for discrete compounding when i=9% per year: The accurrulated intorest and principal will oqual ? (Rovind to the nearest dolar) 10/31/23,8:57PM \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Discrete Compounding: I=9%} \\ \hline & \multicolumn{2}{|c|}{ Single Payment } & \multicolumn{4}{|c|}{ Uniform Serles } \\ \hline & \begin{tabular}{c} Compound \\ Amount \\ Factor \end{tabular} & \begin{tabular}{l} Present \\ Worth Factor \end{tabular} & \begin{tabular}{l} Compound \\ Amount \\ Factor \end{tabular} & \begin{tabular}{l} Present \\ Worth Factor \end{tabular} & \begin{tabular}{l} Slinkling \\ Fund \\ Factor \end{tabular} & \begin{tabular}{c} Capital \\ Recovery \\ Factor \end{tabular} \\ \hlineN & \begin{tabular}{c} To Find F \\ Glven P \\ F:P \end{tabular} & \begin{tabular}{c} To Find P \\ Glven F \\ P/F \end{tabular} & \begin{tabular}{c} To Find F \\ Given A \\ F/A \end{tabular} & \begin{tabular}{c} To Flind P \\ Glven A \\ P/A \end{tabular} & \begin{tabular}{c} To Find A \\ Glven F \\ AVF \end{tabular} & \begin{tabular}{c} To Find A \\ Glven P \\ A/P \end{tabular} \\ \hline 1 & 1.0900 & 0.9174 & 1.0000 & 0.9174 & 1.0000 & 1.0900 \\ \hline 2 & 1.1881 & 0.8417 & 20900 & 1.7591 & 0.4785 & 0.5685 \\ \hline 3 & 1.2950 & 0.7722 & 3.2781 & 25313 & 0.3051 & 0.3951 \\ \hline 4 & 1.4116 & 0.7084 & 4.5731 & 3.2397 & 0.2187 & 0.3087 \\ \hline 5 & 1.5386 & 0.6499 & 5.9847 & 3.8997 & 0.1671 & 0.2571 \\ \hline 6 & 1.6771 & 0.5963 & 7.5233 & 4.4859 & 0.1329 & 0.2229 \\ \hline 7 & 1.8280 & 0.5470 & 9.2004 & 5.0330 & 0.1087 & 0.1987 \\ \hline 8 & 1.9926 & 0.5019 & 11.0285 & 5.5348 & 0.0907 & 0.1807 \\ \hline 9 & 2.1719 & 0.4604 & 13.0210 & 5.9952 & 0.0768 & 0.1668 \\ \hline 10 & 2.3674 & 0.4224 & 15.1929 & 6.4177 & 0.0658 & 0.1558 \\ \hline 11 & 2,5904 & 0.3875 & 17.5603 & 6.8052 & 0.0569 & 0.1469 \\ \hline 12 & 2.8127 & 0.3555 & 20.1407 & 7.1607 & 0.0497 & 0.1397 \\ \hline 13 & 3.0658 & 0.3262 & 229534 & 7.4869 & 0.0436 & 0.1336 \\ \hline 14 & 3.3417 & 0.2992 & 26.0192 & 7.7862 & 0.0384 & 0.1284 \\ \hline 15 & 3.6425 & 0.2745 & 29.3609 & 8.0607 & 0.0341 & 0.1241 \\ \hline 16 & 3.9703 & 0.2519 & 33.0034 & 8.3126 & 0.0303 & 0.1203 \\ \hline 17 & 4.3276 & 0.2311 & 36.9737 & 8.5436 & 0.0270 & 0.1170 \\ \hline 18 & 4.7171 & 0.2120 & 41.3013 & 8.7556 & 0.0242 & 0.1142 \\ \hline 19 & 5.1417 & 0.1945 & 46.0185 & 8.9501 & 0.0217 & 0.1117 \\ \hline 20 & 5.6044 & 0.1784 & 51.1601 & 9.1285 & 0.0195 & 0.1095 \\ \hline 21 & 6.1088 & 0.1637 & 56.7645 & 92922 & 0.0176 & 0.1076 \\ \hline 22 & 6.6586 & 0.1502 & 62.8733 & 9.4424 & 0.0159 & 0.1059 \\ \hline 23 & 7.2579 & 0.1378 & 69.5319 & 9.5802 & 0.0144 & 0.1044 \\ \hline 24 & 7.9111 & 0.1264 & 76.7898 & 97066 & 0.0130 & 0.1030 \\ \hline 25 & 8.6231 & 0.1160 & 84.7009 & 98226 & 0.0118 & 0.1018 \\ \hline 30 & 13.2677 & 0.0754 & 136.3075 & 10.2737 & 0.0073 & 0.0973 \\ \hline 35 & 20.4140 & 0.0490 & 215.7108 & 10.5668 & 0.0046 & 0.0946 \\ \hline 40 & 31.4094 & 0.0318 & 337.8824 & 10.7574 & 0.0030 & 0.0930 \\ \hline 45 & 48.3273 & 0.0207 & 525.8587 & 10.8812 & 0.0019 & 0.0919 \\ \hline 50 & 74.3575 & 0.0134 & 815.0836 & 10.9617 & 0.0012 & 0.0912 \\ \hline \end{tabular} a. Choose the eorect eash fow slapar. b. I the acooum eams interest at the rabe of 7 s per yea, how muoh is withdrawn at the end of five years? a. Choses the eprtect eash fow enprem belsw