Answered step by step

Verified Expert Solution

Question

1 Approved Answer

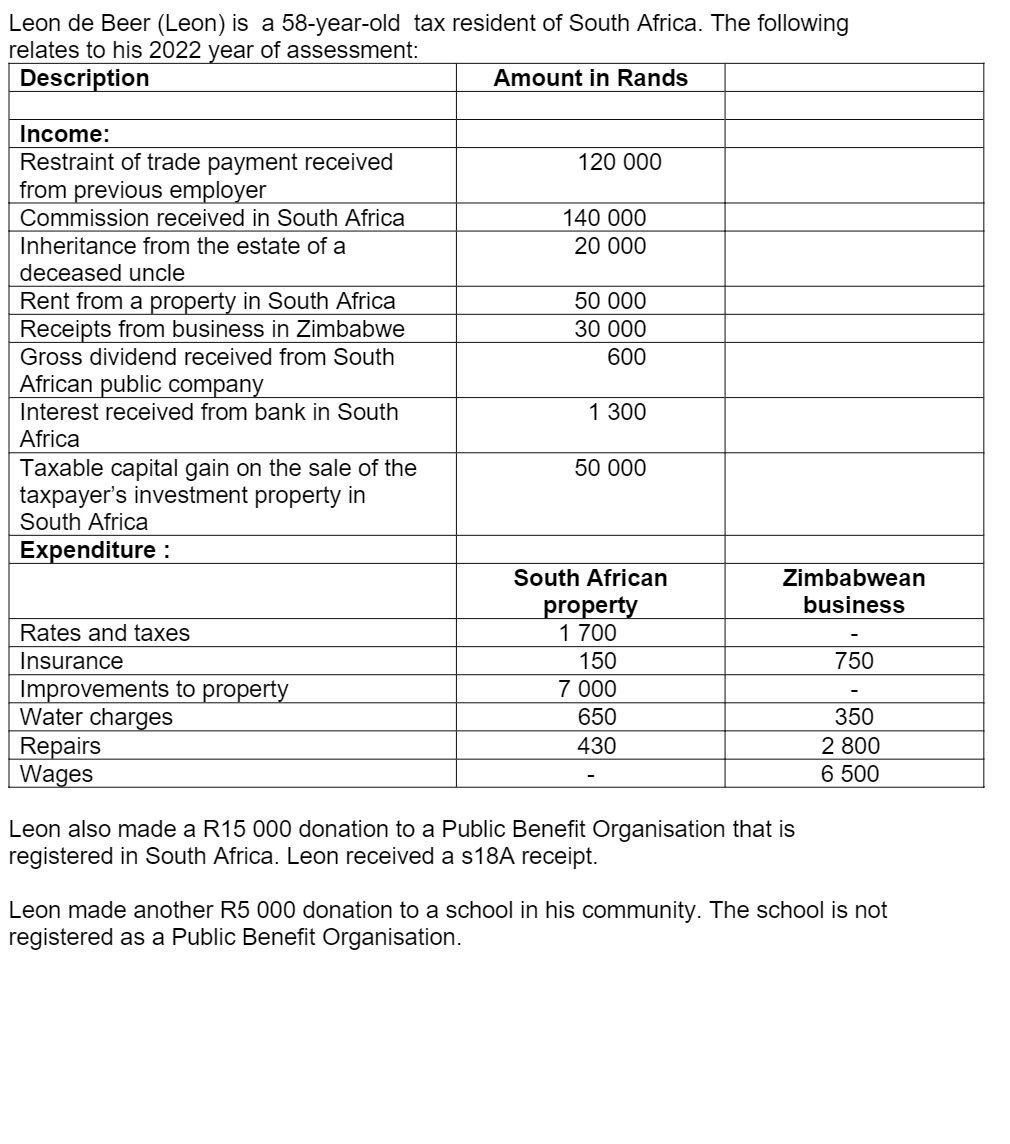

Leon de Beer (Leon) is a 58-year-old tax resident of South Africa. The following relates to his 2022 year of assessment: Description Amount in

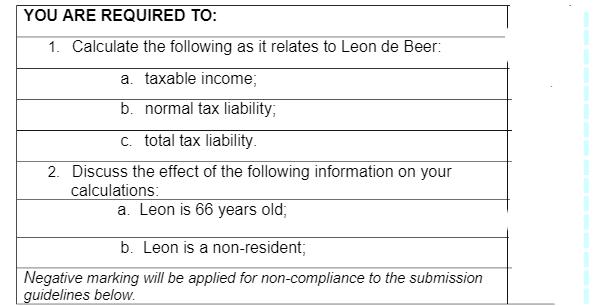

Leon de Beer (Leon) is a 58-year-old tax resident of South Africa. The following relates to his 2022 year of assessment: Description Amount in Rands Income: Restraint of trade payment received from previous employer Commission received in South Africa Inheritance from the estate of a deceased uncle Rent from a property in South Africa Receipts from business in Zimbabwe Gross dividend received from South African public company Interest received from bank in South Africa Taxable capital gain on the sale of the taxpayer's investment property in South Africa Expenditure : Rates and taxes Insurance Improvements to property Water charges Repairs Wages 120 000 140 000 20 000 50 000 30 000 600 1 300 50 000 South African property 1 700 150 7 000 650 430 Zimbabwean business Leon also made a R15 000 donation to a Public Benefit Organisation that is registered in South Africa. Leon received a s18A receipt. 750 350 2 800 6 500 Leon made another R5 000 donation to a school in his community. The school is not registered as a Public Benefit Organisation. YOU ARE REQUIRED TO: 1. Calculate the following as it relates to Leon de Beer: a. taxable income; b. normal tax liability; c. total tax liability. 2. Discuss the effect of the following information on your calculations: a. Leon is 66 years old; b. Leon is a non-resident; Negative marking will be applied for non-compliance to the submission guidelines below.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Leon de Beers tax liability for the 2022 year of assessment a Taxable Income Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started